- Hyperliquid had its best month ever in May, with trading volume hitting $242 billion and its HYPE token soaring over 327% to nearly $40. The platform’s market cap jumped to $10.9 billion, making it a serious contender among top crypto exchanges.

- It outperformed major DeFi protocols in fee generation, pulling in $69 million—more than Ethereum, Raydium, and BSC Chain. This surge was fueled by renewed crypto market energy, with Bitcoin reaching $111K and total market cap surpassing $3.5 trillion.

- The token’s chart formed a bullish cup-and-handle pattern, and while HYPE has pulled back slightly, traders expect a break-and-retest at the $28 level before potentially resuming the rally.

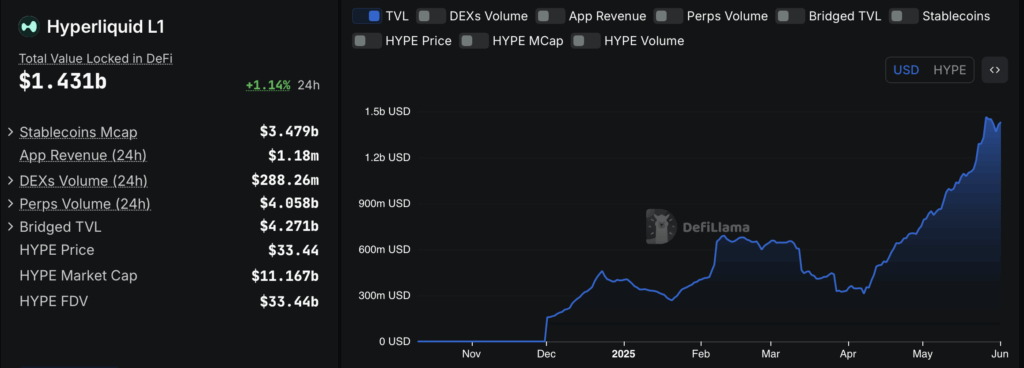

Hyperliquid had an absolutely massive May—its biggest month to date. The decentralized perpetual futures giant saw its HYPE token spike to $39.92 on May 26, shooting up more than 327% since early April. That jump pushed the platform’s market cap beyond $10.9 billion, with a fully diluted value topping $35 billion. And the volume? Unreal. Hyperliquid clocked over $242 billion in trading activity last month, dwarfing competitors like Jupiter ($19.78B) and others that didn’t even break $10 billion. For context, that’s way up from April’s $187B and March’s $175B.

All-time, Hyperliquid has now handled more than $1.6 trillion worth of tokens. It’s closing in on centralized exchange big dogs—Binance, Bybit, and Bitget—in daily trading volume, having managed over $4 billion in the last 24 hours alone. Binance still dominates with $41.27B, but Hyperliquid’s rise is impressive. Even more jaw-dropping: it pulled in over $69 million in fees last month. That’s more than Ethereum, BSC, and Raydium managed in the same stretch.

Technical Patterns Flash Bullish Signals

Technically speaking, HYPE’s rally was no fluke. The chart shows a clean “cup and handle” formation—a super bullish signal in trader speak. The cup’s rim formed around $28.40 before the token ripped upward to nearly $40. But after that explosive move, it started to cool off a bit as the broader crypto market stumbled. Analysts think this could lead to a “break-and-retest” pattern, where HYPE dips back to that $28 zone and then, if support holds, takes off again.

Bullish Market Energy Fuels the Fire

Part of this whole surge was thanks to the crypto market flipping bullish overall. Bitcoin shot past $111K, and total market cap crossed $3.5 trillion. That renewed energy definitely bled into Hyperliquid’s numbers. With volume booming and fees flowing in like crazy, it’s positioned not just as a top DeFi project—but as a real threat to some centralized powerhouses. Whether the uptrend keeps rolling depends on a few key levels, but May showed what this platform’s capable of when the stars align.