- HYPE dipped 1% Tuesday after a strong Monday rally, as Binance US gears up to list the token on its spot market—fueling fresh interest.

- Open Interest surged to a record $1.43B, alongside a rising funding rate, signaling growing bullish sentiment and new capital inflows.

- Technically, HYPE is eyeing a breakout above $39 with a possible run to $50, but a reversal could drag it down to key support at $31.26.

Hyperliquid’s HYPE token dipped just over 1% on Tuesday, easing off after Monday’s 6.7% pop. Despite the red candle, bullish sentiment is still very much in play—especially with Open Interest (OI) blasting to a fresh all-time high. The excitement kicked off after Binance US announced plans to list HYPE on its spot market. That’s a big deal, and it’s not just hype… well, maybe a little hype.

At the moment, Binance is only offering HYPE in the form of perpetual futures, with around $17.3 million in open positions on their platform alone. But with Binance pushing over $14 billion in daily spot volume and $65 billion in derivatives, the upcoming spot listing on its US arm could bring some serious eyeballs—and liquidity.

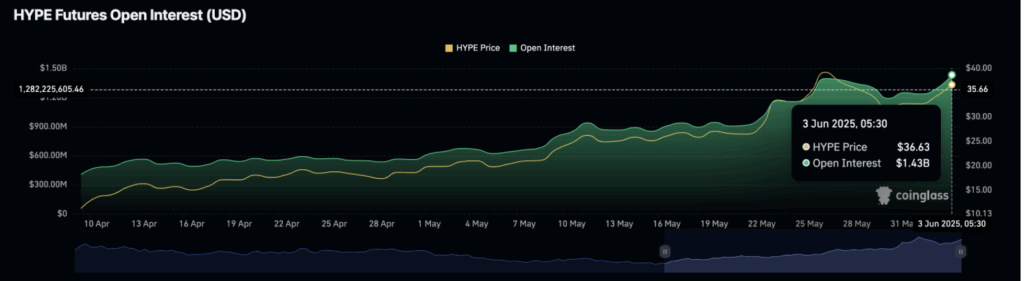

Open Interest Surge Signals Strong Demand

According to CoinGlass, HYPE’s total Open Interest has soared to $1.43 billion, with $140 million added in just 24 hours. That kind of spike usually means one thing—fresh capital flooding in, often tied to bullish bets. More funds = more fuel for the rally, at least in theory.

The funding rate is also climbing. It’s now sitting at 0.0368%, and yeah, that may sound small, but in the derivatives world it says a lot. A rising funding rate shows that long traders (buyers) are willing to pay more to keep their positions open. Basically, bullish conviction is growing, even if the price took a breather.

Technical Setup Still Favors the Bulls

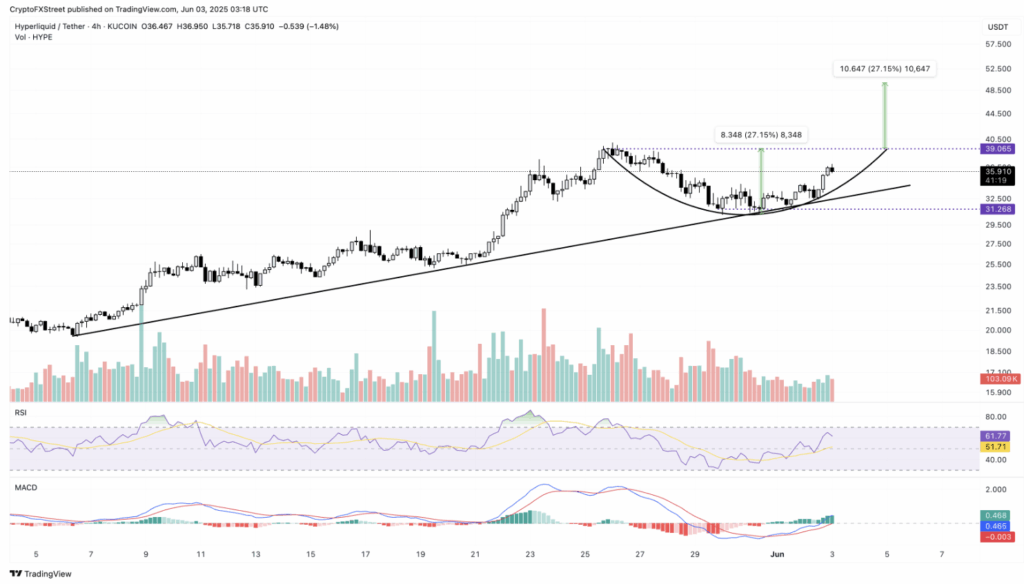

May was a wild ride—HYPE ran up 63% to hit a new all-time high of $40 before pulling back to $30. But June’s off to a strong start, already gaining over 9%. The price bounced cleanly off a support trendline built from a bunch of May swing lows. That support seems to be holding for now.

Chart-wise, there’s a potential rounding bottom formation playing out, with the neckline hanging around $39. If HYPE clears that level, the pattern hints at a breakout target near $50—about 27% higher from that point. That’s based on the depth of the formation added to the breakout zone, a pretty common way to map these things.

Momentum Builds, But Watch the Support Line

Momentum indicators are lining up nicely too. The MACD just flashed a bullish crossover, climbing above the zero line. RSI is at 60, coming up from oversold levels and pointing north. Together, these show that buyers are stepping in again.

Still, it’s not a done deal. If the price gets rejected again and drops, the next key support to watch is $31.26. A breakdown below that could shift things bearish in a hurry. So, yeah—HYPE’s setup looks strong, but the bulls still need to push it over the finish line.