- GameStop upsized its note offering to $2.25B, with potential for $2.68B total proceeds if the $450M option is exercised.

- Funds will support general operations and bitcoin acquisitions under the firm’s updated investment strategy.

- GME stock dropped sharply after the news, closing down 22.5% amid investor concerns over dilution and revenue weakness.

GameStop has announced a significant expansion of its private offering of zero-coupon convertible senior notes, raising the deal size from $1.75 billion to $2.25 billion. These unsecured notes carry no interest and do not accrue value, but they offer investors the option to convert them into GameStop stock at a premium as they approach maturity in June 2032. The structure also includes protective clauses like a 2028 buyback option.

Additional $450 Million Purchase Option Available

The company has also granted initial purchasers a 13-day window to acquire up to an additional $450 million in notes. The sale is expected to close by June 17, 2025, contingent on standard closing conditions. If the full allotment is exercised, GameStop could raise up to $2.68 billion in net proceeds after expenses.

Bitcoin Strategy Continues Despite Revenue Drop

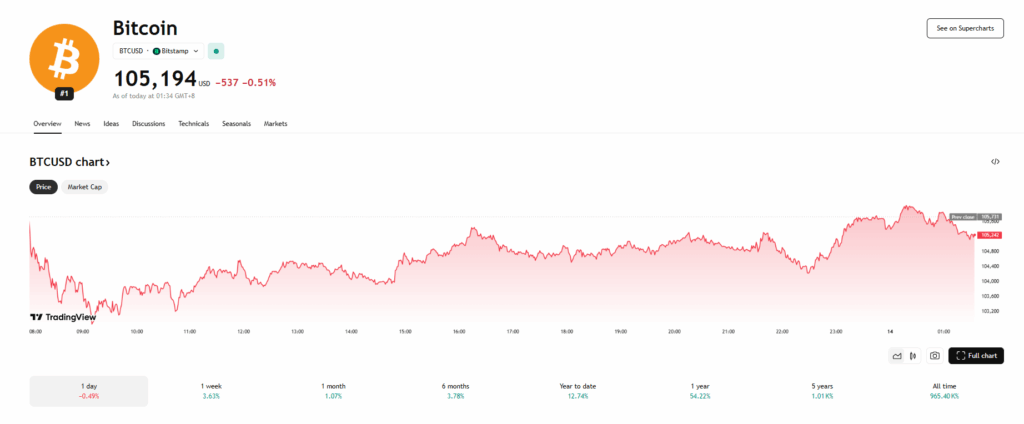

Proceeds will be used for general corporate purposes, including acquisitions aligned with GameStop’s investment policy, which now includes bitcoin. The company previously raised $1.5 billion and purchased 4,710 BTC, now valued at about $495 million. This comes amid a sharp 17% year-over-year revenue drop in Q1 and ongoing stock volatility.

Stock Dips Amid Investor Concerns

GameStop’s stock plunged by 25% during Thursday trading, closing down 22.5% after news of the initial $1.75 billion offering. The announcement of the upsized deal followed shortly thereafter. GME shares are down more than 30% year-to-date and slipped another 0.3% in pre-market trading Friday.