- GameStop is raising $1.75B via convertible notes to further its Bitcoin treasury strategy, with an option for $250M more.

- The company previously raised $1.3B and bought 4,710 BTC in May using those funds.

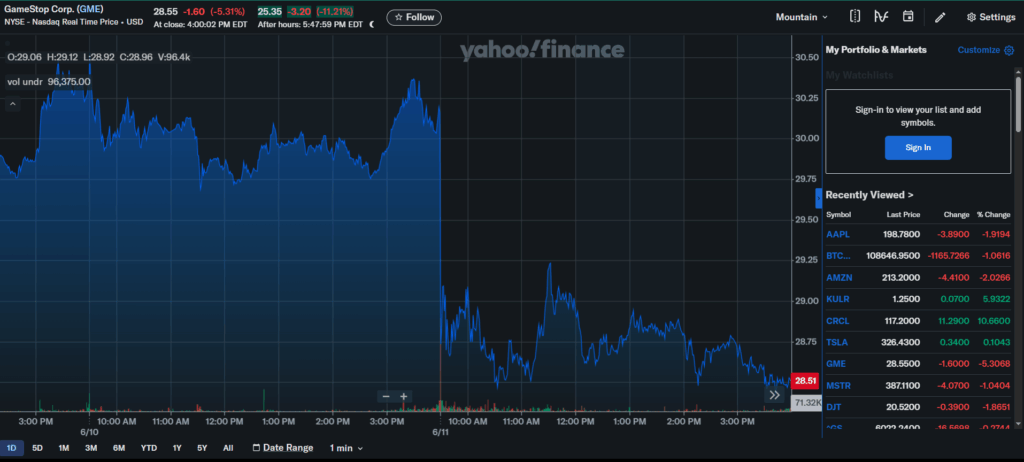

- GME stock dropped 10% after hours as investors react to the bold crypto-focused move.

GameStop (GME) is doubling down on its crypto pivot. The company announced on Wednesday it will raise $1.75 billion through a convertible senior note offering, with the option to add another $250 million within two weeks. According to GameStop’s press release, proceeds will go toward investments aligned with its official Investment Policy—a policy that includes holding Bitcoin as a treasury reserve asset, first disclosed back in March.

This marks GameStop’s second major raise for its crypto treasury strategy. In May, the meme stock darling used funds from a $1.3 billion convertible note offering to scoop up 4,710 BTC, worth around $500 million at the time.

Today’s notes won’t carry any regular interest and are due in June 2032, unless converted or repurchased early. The offering is open exclusively to qualified institutional buyers, reflecting a growing appetite for long-term speculative exposure tied to both GameStop and Bitcoin.

Still, not everyone is buying the hype. GME shares fell 10% in after-hours trading, with some investors likely unsettled by the continued pivot away from core retail operations.