- GameStop’s stock dropped over 16% in two days after revealing a $512M Bitcoin purchase.

- Investors appear cautious despite the firm following Strategy’s Bitcoin treasury playbook.

- CEO Ryan Cohen said future BTC moves won’t be telegraphed, leaving investors guessing.

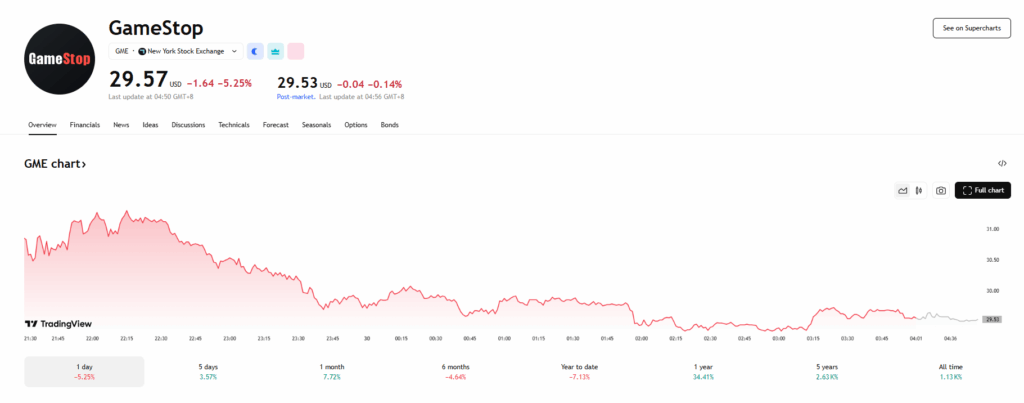

GameStop just made its biggest crypto move yet—dropping over half a billion dollars into Bitcoin. But instead of rallying behind the bold play, the stock’s tanked for the second day in a row. On Thursday, GME slid more than 5% to close at $29.57, tacking on to Wednesday’s 11% drop. Whatever excitement was there at the open—when the stock touched nearly $36—vanished pretty fast.

It’s not the first time GameStop’s seen this kind of rollercoaster around Bitcoin news. Back in March, GME spiked after it first teased the idea of a BTC treasury. Then it dropped just as quickly when the company said it would raise $1.5 billion to fund it—rather than using cash on hand. That raised eyebrows. Now, with the purchase finalized—4,710 BTC for around $512 million—investors seem… unimpressed.

The Market’s Moving, Just Not With GameStop

While GME slid, the broader market was looking better. The Nasdaq and S&P 500 both closed up about 0.4%, as traders chewed on news of a trade court delay on Trump-era tariffs and a weaker-than-expected GDP reading. So it’s not like GameStop was sinking with the ship—the market, in general, was doing fine.

Meanwhile, Bitcoin itself isn’t exactly soaring either. After setting a fresh all-time high at $111,814 on May 22, it’s drifted downward, now sitting just under $106K. Not terrible, but not helping GME’s narrative either. Other major cryptos like Solana, XRP, and Dogecoin are down harder over the past week, while Ethereum’s been holding up relatively well.

Ryan Cohen’s Not Giving Away the Playbook

Speaking at the Bitcoin 2025 conference on Wednesday, GameStop CEO Ryan Cohen kept things vague. He said the company isn’t going to “call our shots in advance” regarding any future BTC purchases. That might be smart strategy—but it’s not giving investors much to hold onto.

GameStop’s move mirrors what firms like Strategy (formerly MicroStrategy) have done—go all-in on Bitcoin as a corporate treasury asset. Strategy’s approach has pushed its stock to new highs and inspired plenty of copycats. But for now, GameStop’s version of the playbook isn’t getting the same reaction.

It’s still early. But if GME’s hoping its crypto pivot will reignite meme-stock magic, this week’s market response suggests it’s got some convincing to do.