- Price Drop With a Twist: Fartcoin fell 13% in 24 hours, nearly erasing its monthly gains. However, data shows significant accumulation during this dip, suggesting some traders see it as a buying opportunity.

- Support Zone Holds Promise: The price has returned to a previously active accumulation zone between $1.01 and $1.20, which could act as a springboard for a future rally—if buyers hold strong.

- Mixed Market Sentiment: While the derivatives market still shows some bullish bias with a positive funding rate, the spot market sentiment is shaky, with more traders leaning short and investors growing cautious.

Well, Fartcoin isn’t having the best week—dropping a steep 13% in the last 24 hours, wiping out nearly every bit of gain it had made this month. Now, it’s wobbling around with a -0.75% drawdown on the monthly chart. Pretty rough. But oddly enough, there might still be something brewing under the surface.

Liquidity Flooding In… Even While Price Slips

Despite the dip, some folks out there are clearly buying the blood. A new Nansen report showed that Fartcoin actually had the highest positive netflow across all tracked tokens during the same 24-hour window. Yep, about $178K worth of FARTCOIN moved into exchanges. So, either someone’s making a big bet—or the crowd’s quietly building bags at discount prices. Sometimes when these quiet buys stack up, they lead to a sharp reversal. Not always… but it’s happened before.

Back to the Old Accumulation Zone

If you check out the charts, the coin has basically slid right back into a familiar pocket—somewhere between $1.01 and $1.20. That range last saw action between late April and early May, right before the last rally. Now that it’s parked there again, some buyers might get interested, maybe even start scooping more up. Thing is, prices could hang out in this box for a while before deciding on a direction. Doesn’t mean a pump is coming—just that the base might be forming again.

Bulls Still Hopeful, But Bears Aren’t Gone Yet

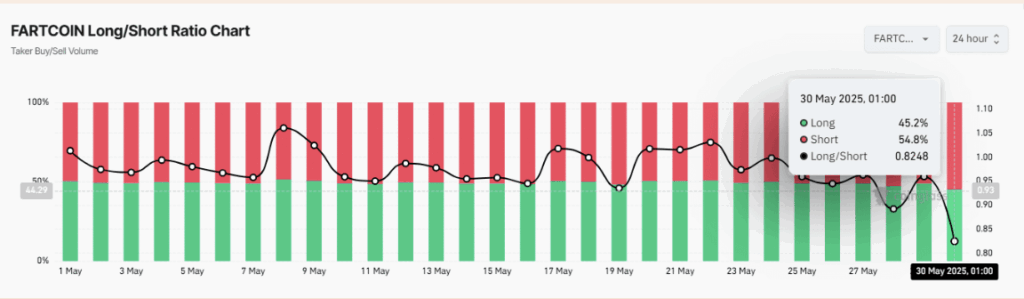

Zooming out to the derivatives side, things get a bit messy. The Long/Short ratio as of May 30 shows 54.8% of volume is from sellers, which tells you—short-term, people are still betting against it. But curiously, the funding rate is holding up in positive territory and slowly climbing. That typically means bullish contracts are leading, even if there’s pressure from the other side.

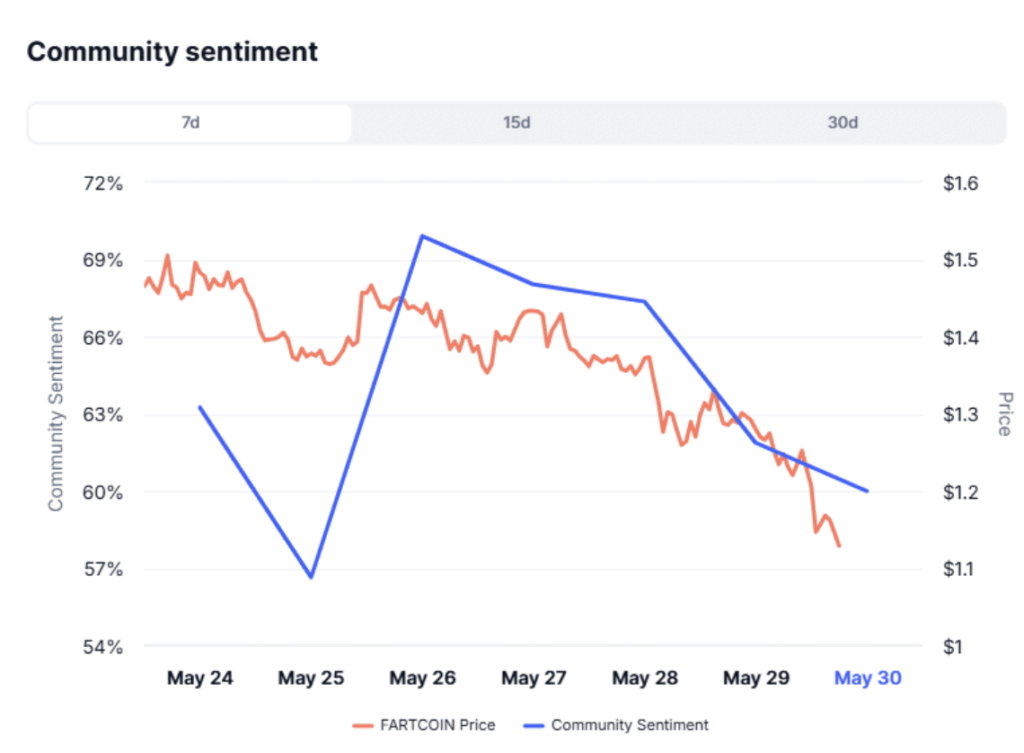

One thing to keep an eye on, though, is how the spot market is feeling. And right now, it’s… well, kinda grim. Sentiment’s taken a nosedive. If things drop any lower, we might see even more holders give up and hit the exit. So yeah, momentum’s building—but the crowd still seems nervous.