- Trump and Musk chaos shake markets: Trump’s attacks on Fed Chair Powell and Musk’s Epstein accusations spark political and financial turmoil, while the Trump Organization flip-flops on the $TRUMP memecoin, confusing investors.

- Crypto regulation and IPO shocks: California passes a bill allowing seizure of inactive crypto accounts, while Circle’s blockbuster IPO signals Wall Street’s growing embrace of stablecoins.

- Ethereum steals the spotlight: ETH surges 46% in a month, beating Bitcoin and pulling institutional inflows, with analysts predicting prices could top $8,500 by 2025.

Trump’s calling out the Fed and hinting at firing Jerome Powell, Elon Musk is dragging Trump into Epstein conspiracies, California just made a major move on crypto exchanges, and institutions are quietly scooping up Ethereum like crazy. If you thought things were heating up before, well, buckle up—because this week, it’s absolute chaos.

Welcome back to JRNY TV, your trusted source for making sense of the wildest headlines in finance, crypto, and politics. Today, we’re covering all the massive stories unfolding right now that you can’t afford to miss. From Trump’s relentless attacks on interest rates and Fed Chair Powell, to his organization’s shocking 180-degree turn on the $TRUMP memecoin, things are getting seriously unpredictable. And speaking of drama, Elon Musk is publicly feuding with Trump again, linking him to Epstein and calling for impeachment. Yeah—this isn’t your average news cycle.

But that’s not all: California just passed a groundbreaking law that could let them seize crypto assets directly from exchanges. USDC issuer Circle has officially announced its IPO, marking another huge milestone for crypto legitimacy. Plus, Ethereum is suddenly on fire, outperforming Bitcoin by a solid 30% last month as institutions load up—does this mean ETH season is officially here?

In today’s video, we’re going deep on every single one of these stories. We’ll give you the facts, the impacts, and exactly what you need to watch out for next.

So, let’s jump straight into it—starting first with Trump’s explosive attacks on the Federal Reserve and Chairman Jerome Powell. Is a shakeup at the Fed imminent? Let’s find out.

Trump Unleashes on the Fed—Will Powell Get the Axe?

Trump isn’t exactly known for keeping his opinions quiet—and right now, Jerome Powell and the Federal Reserve are firmly in his crosshairs. In a dramatic escalation this week, Trump took to social media, aggressively criticizing Powell for what he calls a stubborn refusal to slash interest rates. He’s demanding immediate action, specifically calling for a massive full percentage point rate cut, arguing that the U.S. is being left behind economically because of Powell’s cautious approach. His exact words? “Europe has had 10 rate cuts, we have had none. Despite Powell, our country is doing great. Go for a full point.” It doesn’t get clearer than that.

This isn’t the first time Trump’s clashed with the Fed Chair, but things are clearly hitting a boiling point. He’s gone even further, publicly labeling Powell a “fool” and stating that Powell’s termination “cannot come fast enough.” With these harsh criticisms, investors and economists are seriously questioning whether Trump is setting the stage to replace Powell entirely. The implications could be massive—interest rates directly impact everything from the stock market to crypto prices and mortgage rates, meaning a change in leadership could shake markets hard.

If Trump pushes Powell out and installs someone more aligned with aggressive rate cuts, markets could see immediate volatility. Crypto investors, in particular, are watching closely—lower rates often mean higher asset prices, potentially pushing crypto markets into another rally. On the flip side, uncertainty around the Fed could create instability in the short term, sending investors running for safer assets until the dust settles.

Bottom line? Trump’s latest move is making markets nervous, and everyone—from crypto traders to major institutional investors—is keeping their eyes glued to Washington. A major shakeup at the Federal Reserve isn’t just political noise; it could redefine the financial landscape for months, if not years.

Trump Organization’s Memecoin Flip-Flop—Cease and Desist, then All-In?

Imagine this: one day, the Trump Organization is sending legal threats to a memecoin project using the Trump name without authorization. The next, they’re announcing a significant investment in that very same coin. Sounds like a plot twist, right? Well, that’s exactly what’s unfolding in the world of $TRUMP memecoin.

Initially, the Trump family, through their crypto venture World Liberty Financial (WLF), issued a cease-and-desist letter to Fight Fight Fight LLC and NFT marketplace Magic Eden. These entities had launched a crypto wallet branded as the “official $TRUMP wallet,” claiming affiliation with the Trump family. Donald Trump Jr. and Eric Trump publicly denied any involvement, warning against unauthorized use of their family’s name.

But the narrative took a surprising turn. Shortly after the legal action, Eric Trump announced that WLF plans to acquire a substantial position in the $TRUMP memecoin for their long-term treasury. This move signaled a shift from legal opposition to active investment, leaving many in the crypto community puzzled.

This flip-flop raises questions about the internal dynamics of Trump’s crypto ventures, as well as red flags. The initial legal action suggested a desire to control the use of the Trump brand in the crypto space. However, the subsequent investment indicates a recognition of the coin’s potential profitability. It’s a classic case of brand management colliding with market opportunity.

Pump.fun’s $1B Token Launch—A Game-Changer or a Red Flag?

Imagine a platform that lets anyone create a meme coin in seconds, now planning to raise $1 billion through its own token sale. That’s exactly what’s happening with Pump.fun, and it’s sending shockwaves through the crypto community.

Pump.fun, the Solana-based memecoin launchpad, is reportedly preparing a token sale aiming to raise $1 billion at a $4 billion valuation. The sale is expected to include both public and private investors, with a potential launch in the next two weeks.

Since its launch in early 2024, Pump.fun has enabled users to create nearly 11 million tokens, generating over $700 million in cumulative revenue. The platform’s success has been attributed to its user-friendly interface and the viral nature of meme coins.

However, the proposed token sale has sparked debate. Critics argue that introducing a native token could lead to liquidity issues and increased volatility in the Solana ecosystem. Some fear it may divert attention and resources from more sustainable projects.

On the other hand, supporters believe the token could enhance Pump.fun’s ecosystem by introducing staking mechanisms, creator rewards, and governance features. This could potentially attract more users and solidify its position in the market. This has potential to be one of the BIGGEST liquidity events of 2025, for better, or for worst.

Elon vs. Trump—The Feud That Shook the Internet

Imagine two of the most influential figures in the world, once allies, now locked in a public feud that’s sending shockwaves through politics, business, and social media. That’s exactly what’s happening between Elon Musk and President Donald Trump.

The fallout began when Musk criticized Trump’s “One Big Beautiful Bill,” labeling it a “disgusting abomination” due to its potential to increase the national debt and cut electric vehicle subsidies. In response, Trump dismissed Musk’s concerns, suggesting he was acting out of personal interest. The situation escalated when Musk endorsed a social media post calling for Trump’s impeachment and claimed, without evidence, that Trump was named in sealed Jeffrey Epstein files.

Trump retaliated by threatening to cancel federal contracts with Musk’s companies, including SpaceX, which has received substantial government funding. Musk countered by threatening to decommission SpaceX’s Dragon spacecraft, a critical component of NASA’s operations.

The feud has had tangible effects on the market. Tesla’s stock price dropped significantly, and Trump’s media company also saw a decline. The public spat has divided their shared political base, with supporters taking sides in the #TeamTrump vs. #TeamMusk debate. There is a good chance this field is far from over

California’s Crypto Custody Law—What You Need to Know

Imagine waking up to find that your dormant crypto assets held on an exchange have been transferred to state custody. That’s the reality California residents might face under a new bill passed by the State Assembly.

Assembly Bill 1052 (AB 1052) allows the state to take custody of unclaimed cryptocurrency assets held on exchanges after three years of inactivity. The bill, which passed unanimously in the Assembly, now moves to the Senate for further consideration.

Under AB 1052, if a crypto account shows no activity—such as transactions or logins—for three years, the assets are considered unclaimed property. The state would then hold these assets in their original form, without liquidation, allowing owners to reclaim them later.

While proponents argue that the bill modernizes unclaimed property laws to include digital assets, critics express concerns about privacy and state overreach. The legislation primarily targets custodial accounts on exchanges, not self-custodied wallets, highlighting the importance of active account management.

As the bill progresses through the legislative process, crypto holders in California should stay informed and consider reviewing their account activity to ensure compliance and maintain control over their digital assets.

Circle’s Blockbuster IPO—A New Era for Stablecoins

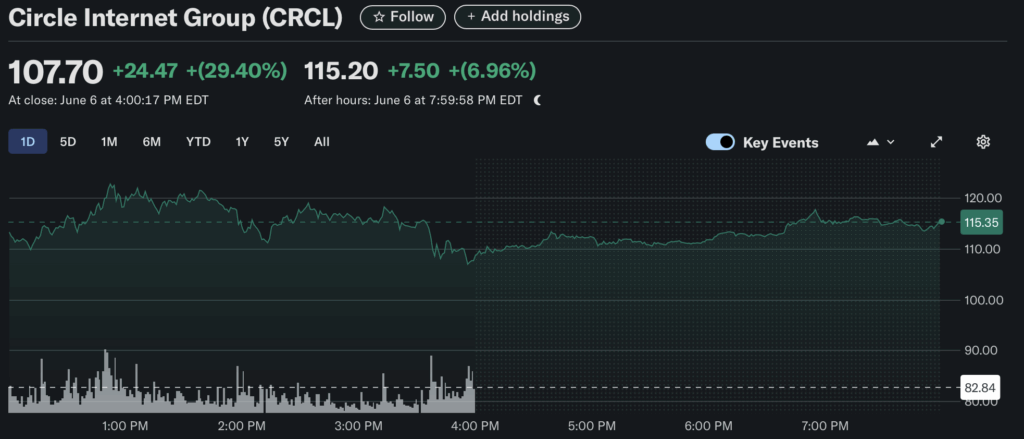

It finally happened. After years of speculation, delays, and market chaos, Circle—the company behind USDC—just hit the stock market, and it exploded out of the gate. We’re talking one of the biggest crypto IPOs ever, and yeah, Wall Street actually showed up for this one.

Circle didn’t just slide onto the public markets… it launched like a damn rocket. The IPO was priced at $31 a share, but by the end of day one, it was trading above $83. That’s a 168% rip, and it put Circle’s valuation above $18 billion almost instantly. That kind of performance sends a very clear message: stablecoins are no longer just a crypto niche—they’re becoming Wall Street darlings.

But hold up—it’s not all hype and headlines. Circle makes most of its money off the interest from USDC reserves. So if the Fed actually cuts rates like everyone’s expecting, that could eat into their profits fast. Some analysts say every 25 bps cut could shave off $100 million in earnings. That’s a huge deal for a business that’s now playing in the big leagues.

Still, this IPO is a game-changer. It shows traditional finance is ready—maybe even eager—to bet big on stablecoins. And with Circle leading the charge, don’t be surprised if other crypto firms start filing their paperwork next.

Ethereum’s Surge—Outperforming Bitcoin and Attracting Institutional Interest

Ethereum is making headlines with its recent performance, outpacing Bitcoin and drawing significant attention from institutional investors. Over the past month, Ether (ETH) has surged by 46%, while the ETH/BTC trading pair has increased by 30%, indicating a strong demand for Ethereum over Bitcoin.

This impressive rally is attributed to several factors. Notably, Ethereum has seen twelve consecutive days of net inflows into spot Ethereum ETFs, reflecting growing institutional confidence. Additionally, the recent Pectra upgrade has enhanced Ethereum’s scalability and efficiency, further solidifying its position in the crypto market.

Analysts are optimistic about Ethereum’s future. VanEck predicts that Ethereum’s price could surpass $6,000 by the end of 2025, while JPMorgan forecasts it reaching $8,500, driven by increased institutional adoption and the growth of decentralized finance (DeFi).

The surge in Ethereum’s performance has also sparked discussions about the potential onset of an “altseason,” where alternative cryptocurrencies outperform Bitcoin. Historically, such periods have led to significant gains across the crypto market.

Stay Ahead of the Curve

And there you have it—another wild week in crypto. From Trump drama and token bans to Circle’s IPO and Ethereum flipping the script on Bitcoin, one thing’s clear: this market never sleeps.

If you’re feeling overwhelmed, don’t stress—it just means you’re paying attention. The smartest thing you can do right now is stay informed, stay strategic, and surround yourself with the right community. Whether it’s meme coins, macro policy, or altseason alpha… we’ve got you covered.

If you learned something new today, hit that like button, drop a comment on what surprised you most, and subscribe to JRNY TV so you don’t miss what’s coming next. We’re here to help you navigate the noise and make sense of the madness.

Thanks for watching—Catch you in the next one.