- Bitcoin broke past its 2025 downtrend line, sparking renewed market hype—but Peter Brandt isn’t impressed.

- Brandt dismissed trendlines as “least significant” and warned amateur chartists not to mistake it for a real trend shift.

- He says meaningful price zones—not simple lines—are what really matter when gauging Bitcoin’s next move.

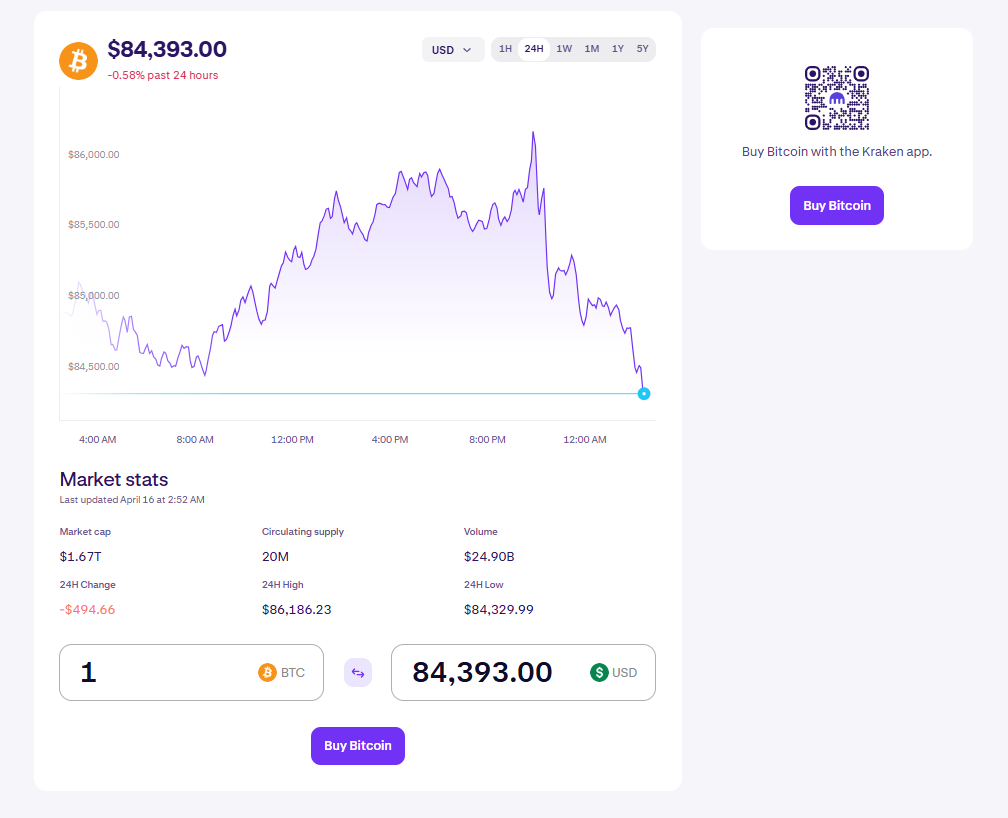

Bitcoin just made its biggest move of the year—finally busting through a stubborn downward trendline that had been capping price action since the start of 2025. After spending January, February, and most of March in a slow grind, BTC broke free. And right on cue, the bulls are back.

The vibes have completely flipped. Just a week ago, people were panicking at $75K—now? We’re back to the “number go up” chants. It’s classic crypto behavior. But not everyone’s buying the hype. In fact, legendary trader Peter Brandt? He’s shrugging it off entirely.

Peter Brandt, who’s been charting markets since disco was still cool, says this breakout isn’t all that impressive. In his latest commentary, he flat-out downplays trendlines, calling them the least important charting tool. Oof.

He even takes a cheeky jab at what he calls “amateur chartists” clinging to trendlines like gospel. For him, this breakout doesn’t signal anything significant. “Sorry,” he ends his breakdown—dry, maybe a little savage, but vintage Brandt.

That said, he does give props to something more meaningful than trendlines: dynamic range boundaries. These zones—where price repeatedly bounces or gets rejected—actually carry weight, unlike a simple line drawn from two points on a chart.

Still, Bitcoin is back in the spotlight. Whether you’re a degen trader or a Wall Street suit watching from the sidelines, eyes are locked on where this move might lead next. Will BTC rocket higher or fake everyone out again? The jury’s out—but hey, at least it’s exciting.