- ETH Struggles at $2,800 Resistance: Ethereum remains stuck under the $2,800 level despite earlier bullish momentum. Repeated rejections raise doubts about buyer strength at these highs.

- Mixed Technical Signals: While ETH holds above key moving averages and forms an ascending triangle, bearish patterns could emerge if it drops below $2,500. A breakout above $2,800 would signal renewed bullish action.

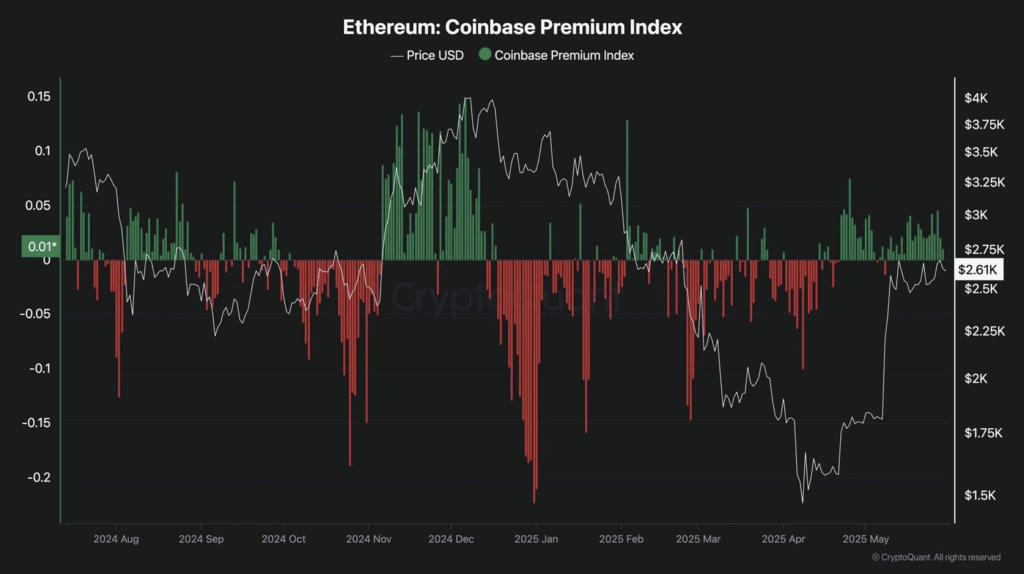

- Sentiment is Neutral: The Coinbase Premium Index is slightly positive, hinting at some U.S. spot demand. But fading interest could trigger a correction if buyers don’t step in soon.

Ethereum’s been kinda stuck lately, hanging out under that $2,800 line like it’s glued there. After a pretty solid run-up earlier in May, the momentum’s cooled, and bulls just can’t seem to push past that ceiling.

Yeah, higher lows are still in play, which sounds good. But let’s be real—getting rejected at the same spot over and over kinda makes you wonder if buyers are just out of steam here.

A Look at the Bigger Picture

So on the daily chart, ETH’s chilling just under the $2,800 resistance, which also happens to match up with that big-deal 200-day moving average. Momentum’s slowed, and the RSI dipped under 70—not exactly flashing warning signs, but definitely not screaming “rally incoming” either.

Still, we’re above the 100-day MA and haven’t dropped back into that $2,200 breakout zone. Translation? Structure’s still bullish… for now. If ETH can bust through that $2.8K wall cleanly, it could run toward the $3,400 to $3,600 range. But if it doesn’t? Well, we could be revisiting that $2,200 level sooner than you think.

Zooming In: The 4H Frame

In the short term, there’s this ascending triangle forming between $2,500 and $2,800. Classic setup. Kinda looks like a distribution phase though—especially after those big buys below $1,850 a few weeks ago. ETH is grinding higher, but the rejections up top are starting to drag.

The RSI’s chillin’ around 47, which is super neutral. If we lose $2,500, that triangle pattern breaks down and we might see ETH drift toward $2,100. But hey, if it punches through $2,800? That whole bearish setup gets tossed.

Sentiment’s… Lukewarm

Coinbase Premium Index? Slightly above zero—not bad, not great. It shows there’s still some U.S. interest, but it’s not like folks are tripping over themselves to grab ETH at a markup. Usually when this index starts climbing, it means some serious buyers are loading up.

Right now, though, that premium’s kinda just… there. If it starts climbing as ETH tests resistance again, that could be a bullish sign. But if it drops off or flips negative? That’s your cue that demand’s drying up and a pullback’s likely.

So yeah, we’re in a bit of a wait-and-see zone. ETH’s trying to break free, but until it does, there’s always the chance it slides back down. Keep your eyes on that $2.8K level—it’s the key to what comes next.