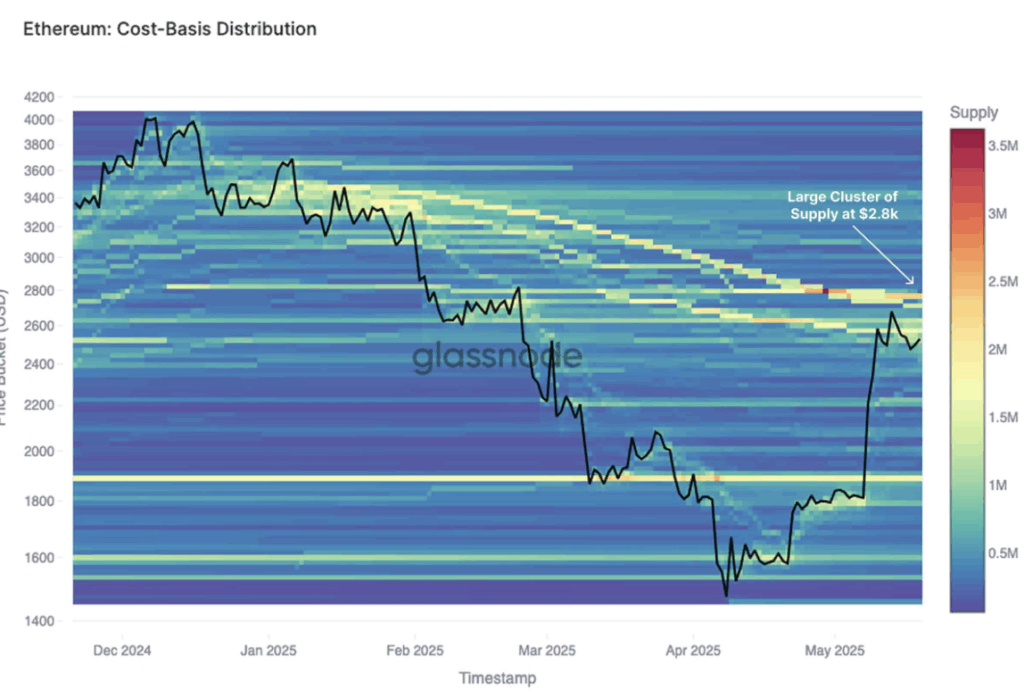

- Ethereum is facing strong resistance at $2,800, a level where many holders are likely to sell at breakeven, creating serious pressure on the current rally.

- Whales are moving ETH back to exchanges, and open interest is falling, suggesting cautious sentiment even as retail traders remain overly bullish and heavily long.

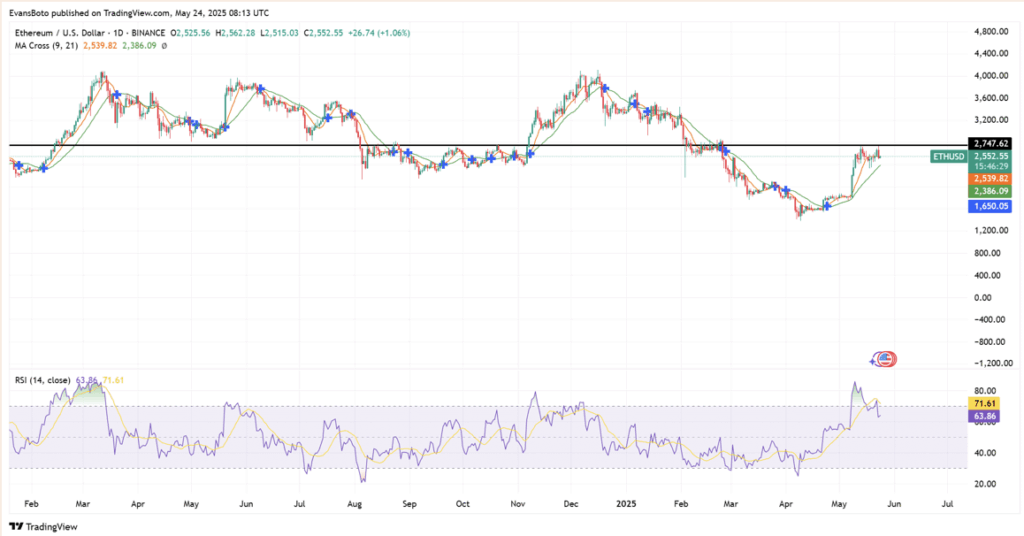

- Momentum is fading, with RSI dipping and ETH consolidating below resistance—if bulls can’t push through soon, a price correction could be on the table.

Ethereum’s been on a bit of a tear lately—but now it’s bumping up against a big, chunky resistance zone right around $2,800. That level, according to Glassnode, is where a whole bunch of investors bought in… meaning a lot of folks might be looking to dump and break even if we get close.

Right now, ETH’s floating around $2,549.98—down about 4.5% in the past 24 hours. The climb over the past couple of weeks was strong, no doubt. But now? It’s showing signs of fatigue.

Signs of a Tired Rally

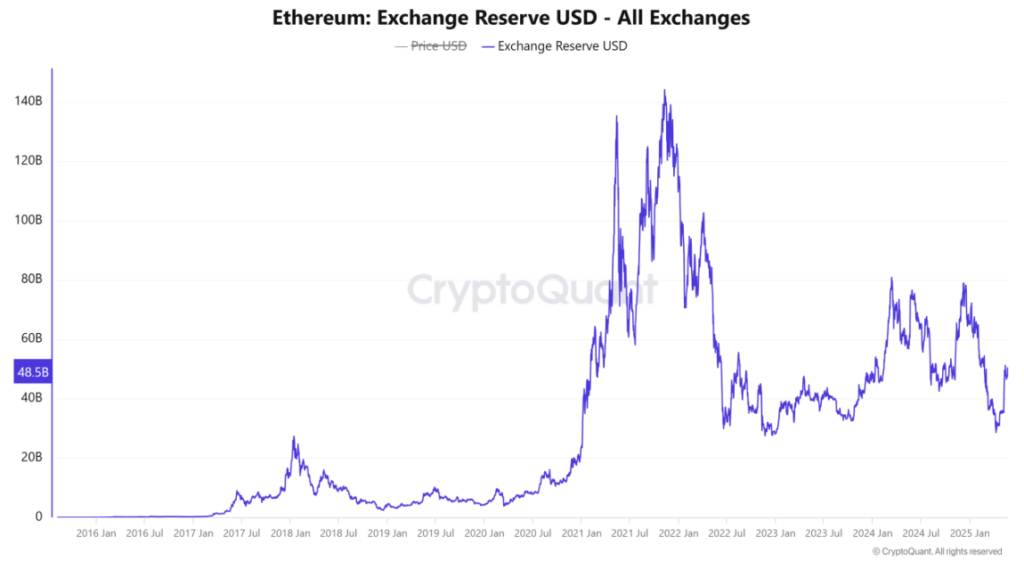

The Exchange Reserve’s dropped 3.66% to $48.18B. Usually that’s bullish—it suggests people are pulling coins off exchanges, not ready to sell. But on the flip side, Open Interest is down too—falling 4.32% to $16.61B. That’s a bit of a mixed bag.

Could mean traders are playing it safe, maybe taking profits or hedging as we approach that scary $2.8k mark. And with OI dipping while price bounces around? Yeah, that’s a sign folks are getting a bit cautious.

Whales Are Quietly Making Moves

IntoTheBlock dropped a stat that’s hard to ignore: the Large Holder-to-Exchange Netflow Ratio fell a wild 193.84% in the past week. Translation? Big wallets are moving ETH back to exchanges—probably thinking about selling soon.

Now, zooming out, the 30-day netflow is still way up (450%+), so whales did load up recently. But this shift in behavior hints they might be looking to unload some of that stash soon.

Retail Traders Go All-In… Maybe Too Hard?

On Binance, ETH longs make up a massive 84.28% of open positions. That’s super lopsided—almost no one is shorting right now. The Long/Short Ratio’s sitting up at 5.36, which usually screams “overconfident.”

If ETH can’t bust through resistance soon, this over-leveraged crowd could get wiped out quick. And when that unwind starts, it tends to get messy fast.

Momentum Fading, Support Still Strong

ETH got smacked back after touching $2,747 and has been chilling near $2,550 since. Still above its 9-day and 21-day EMAs, but the RSI slipping from 71 to around 63 shows momentum’s definitely cooling.

Unless bulls get their act together and send ETH flying above $2,800 with some serious volume, we could be looking at a bit of a pullback. Key support levels at $2,540 and $2,386 could hold the line if it does dip.

What’s Next?

This $2,800 area’s shaping up to be a make-or-break moment. If ETH smashes through, expect fireworks. But if the resistance holds, whales might dump, retail might panic, and the price could roll over.

Eyes on volume, whale flows, and that key resistance zone. It’s about to get interesting.