- Ethereum whales, led by Galaxy Digital, have been aggressively offloading ETH, pushing heavy sell pressure into the $1.4k–$1.6k zone, while realized losses across the network continue to pile up.

- Recovery looks tough unless ETH breaks above $1,982, the average realized price—this would require a 20%+ price jump just to stop most holders from bleeding.

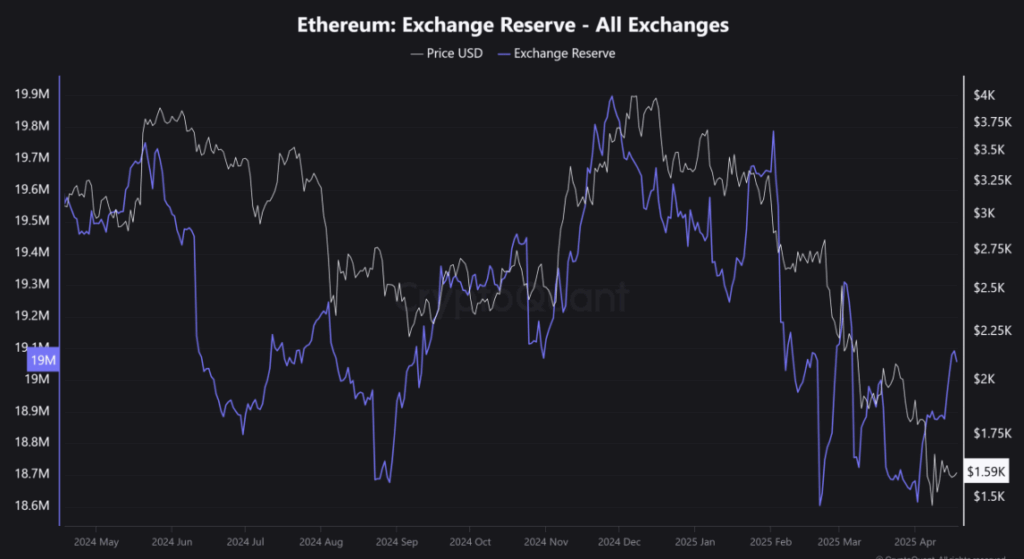

- Exchange inflows remain high, suggesting more sell pressure is coming unless buyer demand kicks in fast, meaning Ethereum is still stuck in a risky, bearish zone.

Ethereum’s been under some serious pressure lately. Big-time whales are offloading tons of ETH, and most of that sell-side liquidity is clustering between the $1.4k–$1.6k range. Not great news for bulls—at least not yet.

Galaxy Digital Leads the Sell Parade

One name that really stands out in this wave of dumping? Galaxy Digital. Over the last six trading sessions, they’ve dumped 62,181 ETH—worth just shy of $100 million—at an average transfer price of $1,599. Yikes.

Basically, whales are in full distribution mode. And unless demand picks up in that $1.4k–$1.6k zone, we’re probably going to stay stuck in this sluggish, sideways price action. Or worse, slide further.

Is Market Exhaustion the Missing Piece?

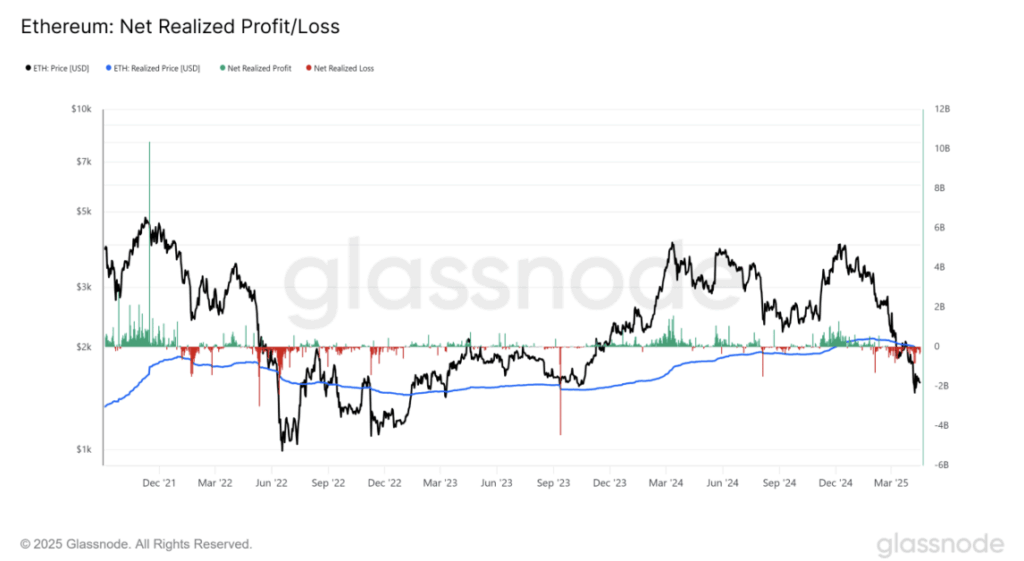

Let’s rewind a bit. The last time Ethereum faced this kind of intense sell pressure was back in the 2022 bear market. Same vibes, really—net realized profit/loss (PnL) in the red, holders bailing out, and a whole lot of panic.

Since mid-February, when ETH was chillin’ around $2.7k–$3k, things turned sour fast. The price tanked more than 50%, and realized losses skyrocketed. Until we see a shift back into the green on that PnL chart, it’s tough to say we’ve hit a true bottom.

Long story short: we need buyers to step in big time and start absorbing this sell pressure. Without that, we’re just in rinse-repeat mode with more pain on the horizon.

Key Price to Watch: $1,982

Right now, ETH is trading around $1,583. But here’s the kicker—roughly 300 million ETH are sitting at a loss, based on a realized price of $1,982. If the market wants a real comeback? We need a solid 20% rally just to break even for most holders.

And even then, we’ve got another problem brewing. Since April 2nd, about 40 million ETH have been moved to exchanges. That’s a ton of supply that could flood the market if things don’t pick up soon.

Final Thoughts

Until we see that demand side really show up—and until ETH reclaims that ~$1,982 level—we’re probably not out of the woods. Exchange inflows are still high, sentiment is shaky, and whales aren’t done distributing. So yeah… things are dicey.

But if volume kicks in and price flips key resistance? We might just be gearing up for one of those sneaky ETH comebacks.