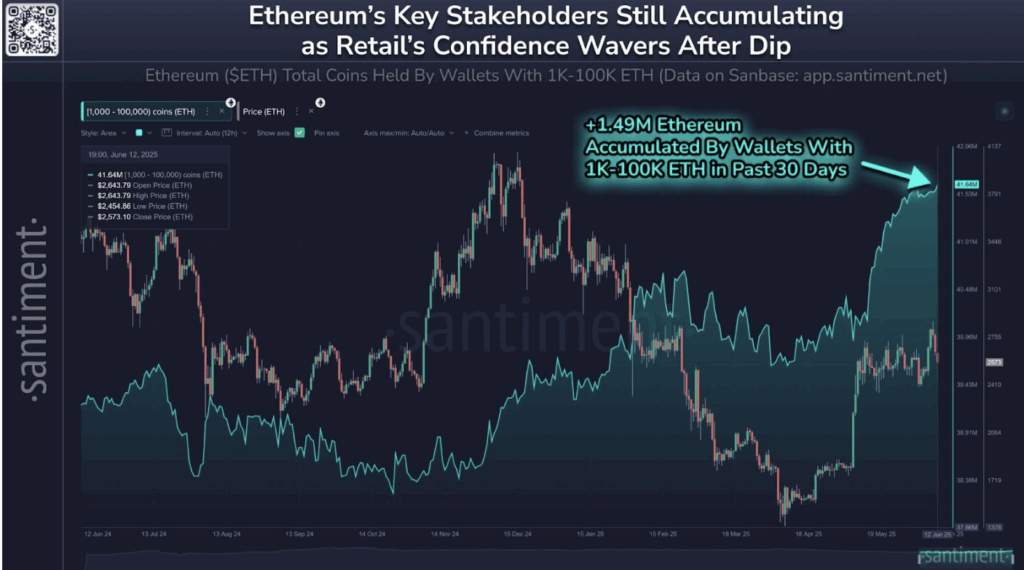

- Ethereum whales and sharks added 1.49M ETH in 30 days, while retail sold off.

- DeFi activity and Layer 2 usage are spiking, even as ETH’s price stays pretty flat.

- ETH ETFs saw a record 19-day inflow streak before a brief pullback, while SharpLink stock cratered amid ETH treasury confusion.

Looks like the big fish are back at it. While Ethereum’s been pretty flat price-wise lately, major holders—yep, the whales and sharks—have quietly been stacking ETH like it’s on sale. Meanwhile, retail traders? A lot of them are cashing out, taking profits as things drift sideways.

According to data shared by Santiment on June 13, wallets holding between 1,000 and 100,000 ETH have scooped up 1.49 million Ether in just 30 days. That’s around $3.79 billion worth, give or take. It’s a 3.72% jump in holdings for that group, which now controls over 41.6 million ETH—roughly 27% of the total supply. That’s… a pretty serious chunk.

Whales Dive Deeper Into Ethereum’s DeFi Scene

But they’re not just hoarding coins. These wallets are also getting more active in Ethereum’s DeFi ecosystem. According to another Santiment post, Ethereum Name Service (ENS) saw whale transaction activity jump 313.5% last week. Right behind it? An ETH lending protocol with a 203.8% spike.

And over in Layer 2 land, things are heating up too. The Virtual Protocol, plus USDC transfers on Arbitrum and Optimism, have also seen big surges. So while ETH’s price hasn’t done much lately—up just 1.8% in 14 days and 3.8% in the past month—under the hood, the network’s buzzing.

ETH ETF Inflows Hit Pause After Long Run

On the institutional side, interest hasn’t slowed too much either. ETH spot ETFs in the U.S. had a wild 19-day run of inflows before finally snapping on Friday. That day saw a modest outflow of $2.1 million, ending what was the longest streak since these ETFs launched in July 2024.

During that stretch? A massive $1.37 billion flowed in—mostly into BlackRock’s iShares Ethereum Trust. So yeah, despite the pause, the appetite’s still there.

Sharplink Stumbles After ETH Treasury Hype

One sour note, though: sports betting company SharpLink Gaming saw its stock nosedive—like, 73% in after-hours trading. Why? They filed to register a bunch of shares for resale, which spooked investors. And that’s after they hyped up an Ether treasury strategy.

But wait—Joseph Lubin, chairman of SharpLink and head of Consensys, says people totally misread the filing. According to him, the plan to sell up to $1 billion in common stock (filed May 30) is still centered around using the cash to buy ETH. So maybe the market jumped the gun.