- BlackRock and Fidelity offloaded $180M in Bitcoin on June 2, rotating into Ethereum with nearly 30,000 ETH scooped up—likely anticipating ETH staking approval.

- Trader sentiment is strongly bullish on ETH, with a 3:1 bullish-to-bearish post ratio, far outpacing Bitcoin’s more cautious 1.3:1.

- A major ETH whale, despite $15M in losses, recently moved 10,000 ETH to Binance—signaling strategic repositioning rather than panic selling.

Ethereum’s having a bit of a moment—and Wall Street’s paying attention. Big names like BlackRock and Fidelity are making quiet moves behind the scenes, pulling capital out of Bitcoin and funneling it straight into ETH. On June 2 alone, the two dumped around $180 million worth of BTC, according to fresh ETF data. Where’d it go? Straight into Ethereum, apparently.

Roughly 30,000 ETH—worth about $78 million—got scooped up right after, and it’s not hard to guess why. The market’s buzzing with talk of ETH staking approvals finally getting the green light, and institutions are trying to front-run that wave. It’s not just retail sentiment shifting anymore—this is big money positioning itself early.

Ethereum Becomes the Talk of the Town

Social sentiment is leaning heavily in ETH’s favor. Data from Santiment shows that for every bearish mention of Ethereum, there are three bullish ones. That’s a strong signal of where trader psychology is heading. For comparison, Bitcoin’s bullish-to-bearish ratio is only 1.3 to 1—still positive, but way more reserved.

So what’s this mean? Confidence is clearly flowing toward Ethereum right now. The ETH crowd is fired up, especially with staking approval rumors flying around. Whether it’s hype or something more real remains to be seen, but the growing gap in sentiment between ETH and BTC is becoming hard to ignore.

Even Underwater Whales Are Playing the Long Game

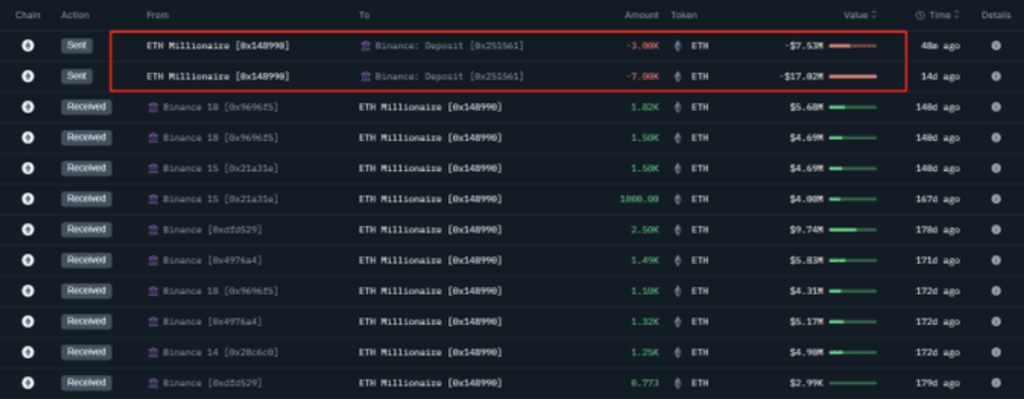

And then there’s the whale activity. One massive Ethereum holder, who bought over 13,000 ETH between December and January, is making moves. They just sent 10,000 ETH—worth around $24.5 million—to Binance in the past two weeks. That’s not small.

Thing is, they’re still sitting on about 3,478 ETH. And even though they’re down about $15.6 million overall, the sell-off looks more like strategic rebalancing than panic dumping. Whales don’t always win, but their timing’s usually no accident. This one seems to be clearing the decks for what could come next.

All Eyes on ETH as Market Mood Shifts

So yeah, Ethereum’s looking hot right now. Institutional players are rotating in, social sentiment is soaring, and even major holders are adjusting their strategies ahead of potential staking news. Nothing’s guaranteed, obviously—but the signs? They’re getting louder.