- The Ethereum Foundation borrowed $2 million in GHO from Aave, marking deeper DeFi engagement.

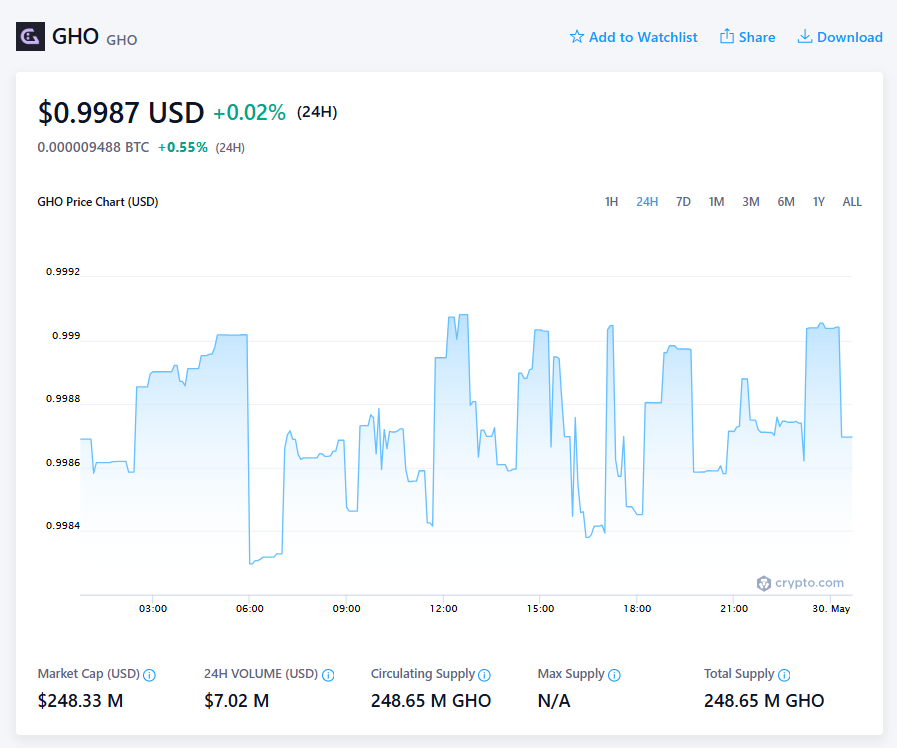

- GHO is a decentralized stablecoin governed by Aave’s DAO, not a centralized issuer.

- This move follows a previous $120M ETH deployment into DeFi, signaling a shift in treasury strategy.

Well, this just made a few DeFi purists smile. The Ethereum Foundation (EF) has officially borrowed $2 million worth of GHO—the decentralized stablecoin developed by Aave—in a move that signals it’s getting more hands-on with DeFi treasury tools. The news dropped via Aave founder Stani Kulechov on X, who seemed pretty jazzed about it, calling it “the full DeFi circle” since EF’s also supplying ETH to Aave while now borrowing from it too.

GHO isn’t your average stablecoin. It’s overcollateralized and governed by Aave’s DAO, meaning all decisions—from interest rates to which protocols get to mint GHO—are made collectively by token holders. No centralized black boxes here. So yeah, EF borrowing from this setup kinda screams, “We’re doing this the decentralized way.”

Not EF’s First DeFi Rodeo

To be clear, this ain’t their first step into the DeFi pond. Back in February, the Ethereum Foundation dropped 45,000 ETH (worth around $120M at the time) into a bunch of DeFi protocols like Aave, Spark, and Compound. That was their biggest DeFi allocation to date—and now, this GHO move just adds another layer to that strategy.

Stani was hyped then too, saying stuff like “DeFi will win” as the EF started pumping liquidity into these ecosystems. And honestly? The DeFi crowd loved it. Community replies were mostly cheers and encouragements to “keep it up,” with a few users pointing out that this is exactly how large crypto treasuries should operate: leverage, not liquidate.

Community Once Criticized ETH Selling

Not long ago, some ETH folks were raising their eyebrows at the Foundation for selling ETH to fund operations. There were questions about why they weren’t using DeFi tools to make their treasury work smarter, not smaller. Eric Conner, who co-wrote EIP-1559, straight-up called ETH sales “insane,” and others—including The Daily Gwei’s Anthony Sassano—were suggesting staking and borrowing stablecoins instead of offloading ETH outright.

Now it looks like the EF’s been listening. This new GHO loan shows a shift from just holding ETH or selling it, toward managing it with a little more finesse—think yield farming, collateralized loans, and other on-chain money Lego magic.

Final Thoughts: EF Is Practicing What Ethereum Preaches

This whole move feels like a flex. Like, if you’re building the future of decentralized finance, you should probably be using it too, right? By borrowing GHO, EF is showing it’s not just preaching DeFi—it’s actually using it. And that could nudge other big players (foundations, DAOs, treasuries, etc.) to rethink how they manage crypto holdings.

It’s still early, and yeah, borrowing $2M might not move mountains on its own. But if the EF keeps stacking moves like this, it might just set the tone for how Web3 organizations run their finances in the years to come.