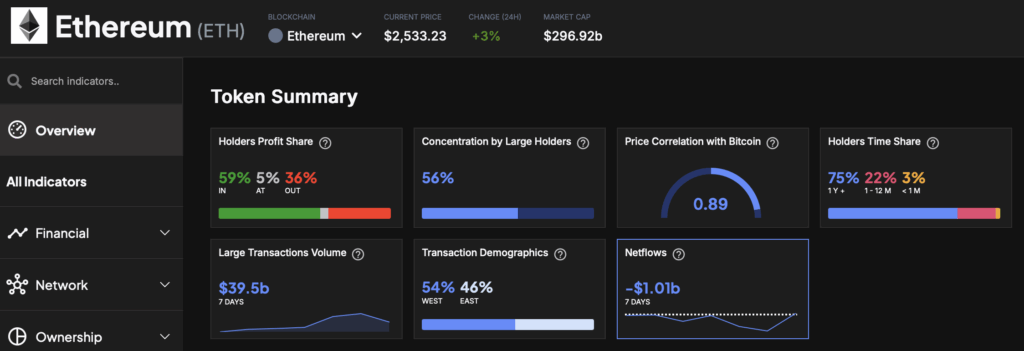

- Ethereum Holders in Profit: With ETH holding at $2,459, on-chain data shows 59% of holders are in profit, while 36% are in loss and 5% are at break-even, indicating growing investor confidence amid broader market strength.

- Key On-Chain Metrics – Mixed Signals: Despite a $1 billion net outflow over the past week, Ethereum’s overall metrics are leaning bullish, with large transaction volume hitting $39.5 billion and 75% of addresses holding for over a year.

- Sentiment Remains Mostly Bullish: Investor sentiment is labeled as “Mostly Bullish,” driven by network growth and a solid base of long-term holders, though Ethereum’s 0.89 correlation with Bitcoin suggests any BTC volatility could impact ETH’s trajectory.

Ethereum is holding steady at the $2,459 mark, and on-chain data reveals a pretty interesting picture. Nearly 59% of all Ethereum holders are currently in profit, a sign of growing investor confidence as the broader crypto market sees some bullish momentum.

On-Chain Snapshot — Who’s Winning, Who’s Losing?

Here’s how the numbers break down:

- Holders in Profit: 59%

- At the Money (Break-Even): 5%

- Out of the Money (Loss): 36%

So, almost 6 out of 10 ETH wallets are seeing gains right now, while just over a third are sitting on losses. The “at the money” crowd — those who bought near the current price — only make up 5%, hinting that fewer recent buyers are holding at break-even levels.

Key On-Chain Metrics – Mixed Signals

- Market Cap: $296.92 billion

- Large Transactions Volume (7D): $39.5 billion

- Netflows (7D): -$1.01 billion

- Concentration by Large Holders: 56%

- Holder Time Share: 75% of addresses have held for over a year

- Price Correlation with Bitcoin: 0.89 (strong correlation)

Despite a $1 billion net outflow over the past week — often seen as a bearish sign — Ethereum’s overall on-chain data is skewing bullish. The summary indicator currently shows 3 bullish signals and 1 neutral, with zero bearish signals flashing right now.

Investor Sentiment – Mostly Bullish

The overall sentiment around ETH is labeled as “Mostly Bullish.” Here’s what’s driving that optimism:

- Net Network Growth (0.36%) — Neutral

- In the Money (6.51%) — Bullish

- Large Transactions (0.45%) — Bullish

Interestingly, while there are no immediate exchange or derivatives signals for Ethereum at the moment, the on-chain data suggests that most investors are still holding onto their coins — and they’re not just recent buyers either. A solid 75% of ETH addresses have been holding for over a year, signaling a strong long-term base of holders.

What’s Next for ETH?

For now, Ethereum remains in a pretty comfortable spot, with the majority of holders in profit and key metrics leaning bullish. But with a strong correlation to Bitcoin (0.89), any major move by BTC could easily drag ETH along for the ride. Stay tuned — this one’s far from over.