- Ethereum surged 15% to reclaim $2,000 after a US-UK trade deal boosted market sentiment and institutional buying.

- Abraxas Capital purchased 49,644 ETH as exchange reserves dropped by 132,000 ETH, signaling mounting buying pressure.

- Analysts eye the $2,100–$2,250 range as key resistance, but overbought signals suggest a potential short-term pullback.

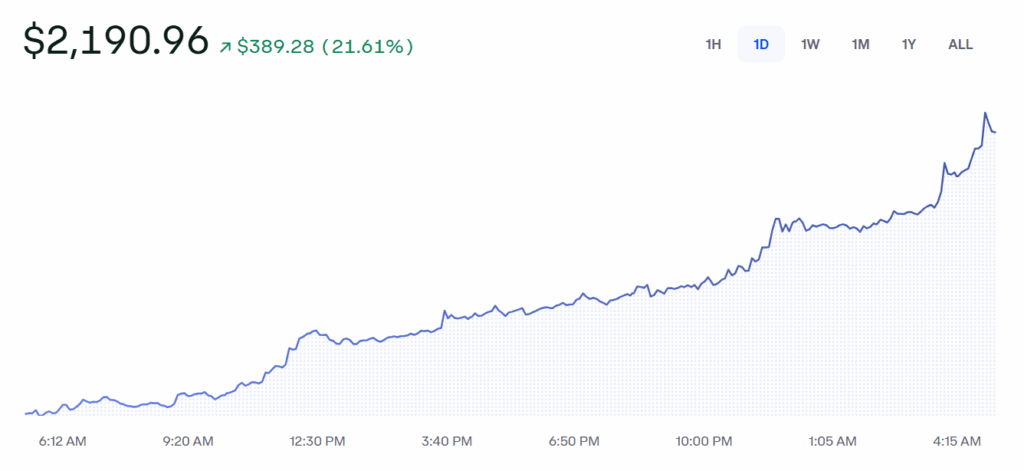

Ethereum surged 15% on Thursday, reclaiming the $2,000 mark after news broke of a “full and comprehensive” trade agreement between the US and UK. The deal includes a reduced baseline tariff of 10% and removes levies on aluminum and steel, fueling optimism across global markets.

ETH’s recovery follows a rough Q1, where tariffs and trade tensions dragged it down. Now, on-chain data shows institutional buyers are piling in. Abraxas Capital snapped up 49,644 ETH on Binance and Kraken, according to Lookonchain. Meanwhile, Ethereum’s exchange reserves dropped by 132,000 ETH in four days — a sign of mounting buying pressure.

Bullish Signs in Derivatives and Institutional Buying

The bullish vibe extends to the derivatives market, too. Ethereum’s open interest (OI) hit 12.08 million ETH ($25.04 billion), suggesting a surge in unsettled contracts as traders position for more upside. Meanwhile, Bitcoin’s rally to $100,000 — its first time above that level since February — has also buoyed sentiment across the crypto space.

Adding to the momentum, the Ethereum Foundation just awarded $32.64 million in grants to ecosystem projects aimed at protocol growth, cryptography, and zero-knowledge proofs. This comes days after the successful Pectra upgrade, with the next upgrade, Fusaka, already in the pipeline for late 2025.

What’s Next? ETH Eyes Key Resistance

With ETH reclaiming $2,000, analysts are eyeing the 100-day SMA range between $2,100 and $2,250 as the next key resistance. If bulls can push through, a full-blown recovery could be in the cards.

However, the RSI and Stochastic Oscillator are both flashing overbought signals, hinting at a possible short-term pullback. Over $188 million in ETH futures were liquidated in the past 24 hours, with most of it coming from short positions — a sign that some traders are still betting against the rally.