- Ethereum is trading above $1,700 and testing a key resistance level at $1,750, with analysts noting a potential market structure shift if bulls can flip this zone into solid support.

- Despite lingering macroeconomic risks like U.S.-China trade tensions, bullish momentum is building, helped by Ethereum’s 32% recovery from its recent $1,383 low.

- Holding above $1,700 and reclaiming $2,000 are critical next steps; success could trigger a larger rally and bring sidelined buyers back into the market.

Ethereum (ETH) is back trading above $1,700 after a rollercoaster couple of weeks, and bulls are making a serious push to flip resistance into support.

Despite the usual macro headaches — think U.S.-China trade drama and general market jitters — optimism is creeping back in. Investors seem to be pricing in hopes of progress on the global stage, and risk assets like ETH are starting to reflect it.

Key Level in Play: $1,750

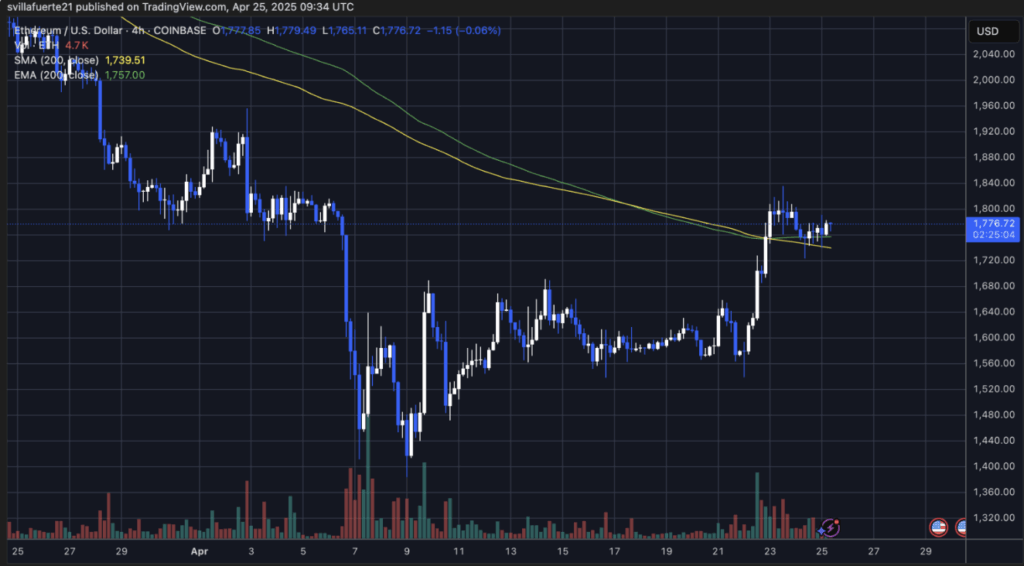

Top analyst Daan shared his thoughts over on X, pointing out that Ethereum is now testing a major horizontal level around $1,750 — a spot that used to be strong support before bears smashed through it months ago.

If ETH can actually reclaim this zone and stick the landing?

It would be the first real sign in months that bulls are flipping the script — turning resistance back into support instead of setting lower lows.

Everyone’s watching it. A clean breakout could open the floodgates for a bigger move across the altcoin space too.

Ethereum’s Comeback So Far

Since bottoming out near $1,383, Ethereum has clawed its way back up over 32% — not bad at all considering the broader uncertainty.

Now, holding above these current levels is crucial. A solid daily close over $1,750 would send a strong signal that Ethereum’s ready to shift its market structure — maybe even start a proper trend reversal after months of pain.

Macro Risks Still Hanging Overhead

That said, it’s not all blue skies yet.

Trade tensions between the U.S. and China are still simmering, with new tariff threats popping up like clockwork. Another escalation could squash risk appetite real quick — and yeah, crypto wouldn’t be immune.

On the flip side?

A diplomatic breakthrough could light a fire under assets like Bitcoin, Ethereum, and everything in between.

So yeah, macro still matters — big time.

ETH Holding Strong at $1,770

At the time of writing, Ethereum is hovering around $1,770, holding steady above its 4-hour 200 EMA — a key short-term trend line that’s acted like both a trampoline and a trapdoor in the past.

Right now?

Bulls are defending it pretty well, hinting that momentum could be building.

What’s Next for Ethereum?

- Hold $1,700 → critical to avoid a deeper dump

- Reclaim $2,000 → the next big psychological and technical hurdle

If Ethereum can punch through $2K and turn it into a new floor?

Expect sidelined buyers — and maybe even some big money — to start piling back in.

But for now, it’s all about daily closes above $1,750. Watch that zone like a hawk.

Final Thoughts

ETH’s showing real fight, bulls are trying to flip the script, but macro risks still loom large.

Hold $1,700… reclaim $2K… and this market could finally start heating up for real.