- Trump Jr. says the family turned to crypto out of necessity after being cut off by traditional banks.

- He believes stablecoins like USD1 can actually strengthen the U.S. dollar, not threaten it.

- The Trumps have heavily invested in crypto projects, signaling long-term commitment beyond politics.

Donald Trump Jr. didn’t sugarcoat it—his family’s move into crypto wasn’t about riding the hype wave. According to him, it all started when they got iced out by the traditional banking system after Trump Sr. took office. Banks that once rolled out red carpets suddenly ghosted them. So, turning to crypto wasn’t a gimmick—it was a lifeline. He made it clear: they leaned into Bitcoin and stablecoins because the old system slammed the door in their faces.

Real Problems, Real Solutions

Trump Jr. said crypto offered not just an escape route but an upgrade. As a real estate developer, he saw how blockchain could cut costs and time on stuff like title insurance. He didn’t just want in—he saw inefficiencies and wanted them fixed. While distancing himself from the TRUMP meme coin, he still defended it as proof the public’s tired of financial gatekeeping. And when pressed about shady use cases, he pointed out the anonymity of crypto actually makes tracing political corruption harder—not easier.

Crypto, the Dollar, and a Big Bet

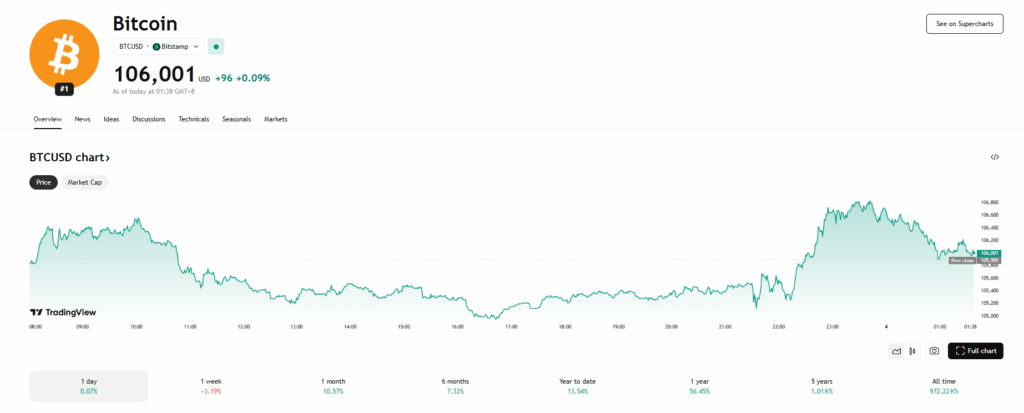

He wrapped things up by flipping the “crypto will kill the dollar” argument on its head. Instead, he sees stablecoins like USD1 as keeping the dollar afloat, maybe even boosting its global power. The Trump crew hasn’t just dabbled—they’ve launched coins, backed mining ops, and dropped billions into DeFi. From World Liberty Financial’s $550M raise to a $2.5B Bitcoin treasury, their actions scream conviction. Trump Jr. says crypto is bipartisan, disruptive, and here to stay—and for them, it’s not just politics. It’s personal.

Trust, Tech, and the Bigger Picture

At the core of Trump Jr.’s message is a growing distrust in traditional systems—a feeling shared by many in the crypto space. He argues that blockchain and decentralized finance aren’t just tech buzzwords; they represent a shift toward transparency and autonomy. With the family’s influence and resources now deeply rooted in the crypto world, their involvement could shape public sentiment and regulatory approaches in the coming years. Whether you agree with their politics or not, their crypto playbook is turning heads—and possibly rewriting the rules.