- Whale transactions in Dogecoin (DOGE) have surged massively, with $1M–$10M transfers up 540% and $10M+ transfers skyrocketing 8060%, signaling strong accumulation during price consolidation.

- Despite a 1.45% dip and a 43% drop in trading volume, trader sentiment remains bullish, with 68.28% of top Binance traders holding long positions, according to Coinglass data.

- DOGE is consolidating between $0.175 and $0.185, and a breakout above $0.185 could trigger a 10% rally to $0.205, while a breakdown could send it 7.5% lower to $0.162.

Dogecoin (DOGE) has been on everyone’s radar lately. Thanks to its strong upside momentum, the memecoin’s not just catching retail buzz — whales and big-money investors are swarming in too.

Over the past few days, DOGE even broke out of a descending trendline on the charts — a pretty bullish signal if you ask most traders.

At the time of writing though? The price is just… kinda chilling, consolidating.

Whale Activity Spikes — A Bullish Sign?

Even though the price is moving sideways, behind the scenes, some major whale action is heating up.

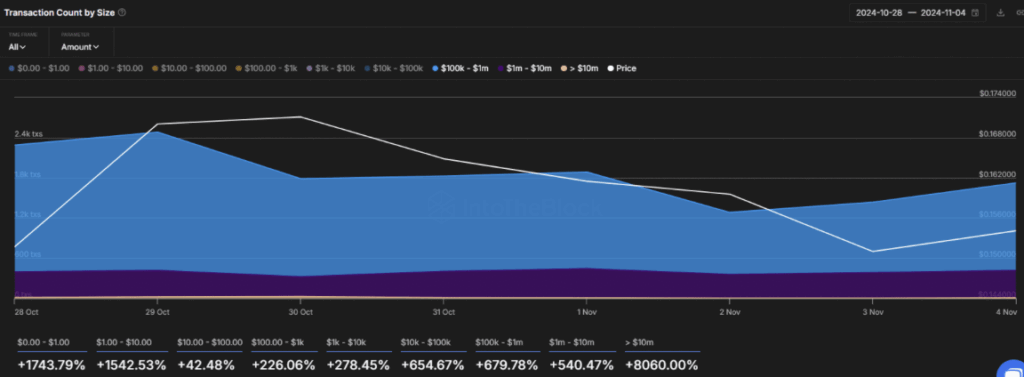

IntoTheBlock data shows whale transactions worth between $1M and $10M skyrocketed by 540.47% — and it gets crazier — transactions over $10M exploded by 8060%.

That’s not a typo. Eight thousand percent. Wild.

It’s not just the whales moving big bags either.

- Large transaction volumes over the last 24 hours surged by 41.12%.

- Daily active addresses jumped 34.91% too.

Put it all together and it’s pretty clear: whales and institutions are paying very close attention to DOGE right now.

Might they know something regular folks don’t? Maybe. Might they just be loading up ahead of a bigger move? Also very possible.

Price Momentum: Bulls Still in the Game

At press time, DOGE was trading near $0.179, slipping about 1.45% over the last 24 hours. Trading volume? It dropped around 43%, suggesting less action from retailers and smaller investors.

Still — despite the cooldown — traders aren’t giving up hope.

Over on Binance, the DOGEUSDT long/short ratio sat at 2.15, signaling strong bullish sentiment. According to Coinglass:

- 68.28% of top traders were holding long positions.

- Only 31.72% were shorting it.

Even with price moving sideways, most traders are betting up, not down.

Key Levels to Watch Next

AMBCrypto’s analysis says DOGE has been trapped in a tight little range between $0.175 and $0.185 for the past five days — building energy for whatever’s coming next.

Here’s the simple breakdown:

- Bullish Scenario: If DOGE breaks above $0.185 and closes strong, it could rally another 10%, aiming for around $0.205.

- Bearish Scenario: If it breaks down below $0.175, it might tumble about 7.5%, finding support near $0.162.

Pretty clear make-or-break setup brewing here.

Final Thoughts: Calm Before the Storm?

Right now, Dogecoin’s sitting at a crossroads.

Whales are moving. Traders are bullish. Retail’s kinda quiet.

If DOGE can bust out of this tight range soon? Things could get real interesting real fast.