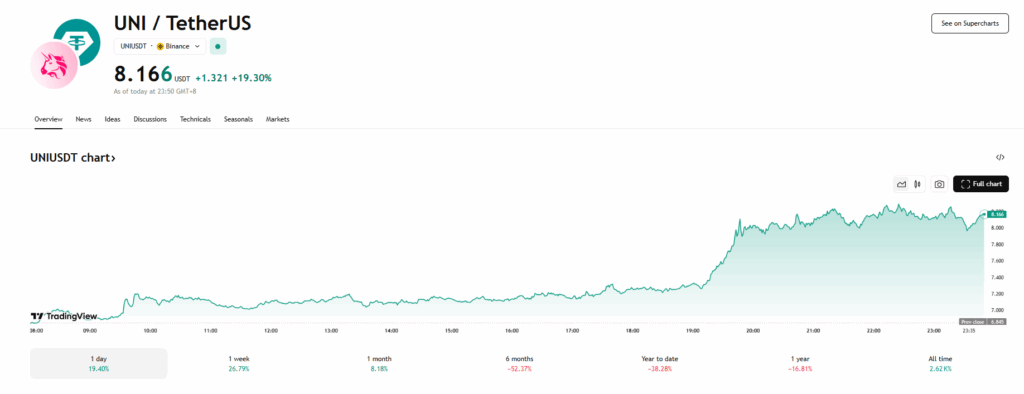

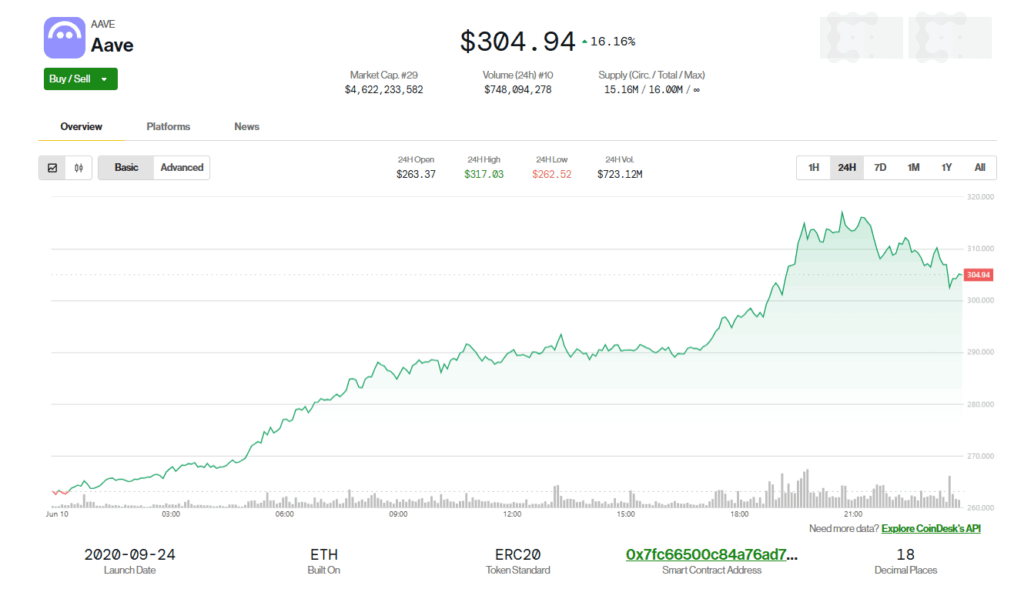

- UNI, AAVE, and SKY surged over 20% after SEC Chair Paul Atkins voiced strong support for DeFi and hinted at regulatory exemptions.

- Crypto leaders called June 9th “DeFi Day,” celebrating what could mark the beginning of a friendlier U.S. regulatory environment.

- Ethereum led the broader rally with an 8% gain, signaling growing confidence in DeFi’s future amid shifting policy sentiment.

UNI, AAVE, and SKY erupted with gains over 20% following unexpected—but very welcome—remarks from SEC Chair Paul Atkins during a roundtable held Monday. His suggestion that DeFi firms should be granted regulatory exemptions marks a massive shift in tone compared to the previously rigid stance taken by the SEC under Gary Gensler. Traders, developers, and investors alike took the comments as a green light—igniting a strong rally across the DeFi space.

Atkins’ Comments Signal Major Shift for Crypto Policy

Atkins didn’t mince words. He described the right to self-custody as a “foundational American value,” positioning decentralized finance as an extension of individual liberty in a digital age. While many expected cautious optimism, the intensity of his support caught the entire market off guard. “We didn’t expect his support to be quite so emphatic,” wrote analyst Noelle Acheson, who noted this was a clear deviation from the SEC’s previously hawkish tone.

Atkins went further, instructing regulators to examine how exemptions could be used to let DeFi innovators operate with fewer restrictions. The implications are huge: fewer roadblocks, more room to build, and potentially, a safer path forward for DeFi protocols trying to stay on the right side of the law.

The Industry Reacts: “DeFi Day” Takes Off

The response from the crypto world was almost euphoric. Binance founder CZ posted on X that June 9th “will be remembered as DeFi day,” while Arthur Cheong of DeFiance Capital echoed the sentiment, declaring that “The DeFi Renaissance continues.” DeFi-related tokens didn’t just outpace the broader market—they obliterated it. Ethereum jumped 8%, outshining even Bitcoin, as ETH remains the beating heart of decentralized applications.

Some market watchers are now speculating whether a wave of institutional capital might finally begin flowing into DeFi. With the SEC showing signs of cooperation rather than combat, the space might see its most significant growth phase yet. Traders are keeping a close eye on whether follow-up legislation or guidance emerges from these remarks.

ETH, BTC, and the Broader Market Ride the Wave

Bitcoin inched up by 1.5%, showing strength but clearly taking a backseat to DeFi momentum. The CoinDesk 20 Index rose 4.7% over 24 hours, fueled by investor enthusiasm and growing confidence that regulatory fears may start to ease. If Atkins’ tone holds through coming quarters, this could reshape the entire market outlook for DeFi-related tokens—and fast.