- DFDV secured a $5 billion credit line to expand its Solana holdings and validator operations.

- The firm already holds over 609,000 SOL tokens, worth about $96 million.

- Shares surged 12% on the news, following a recently withdrawn $1B share sale plan.

DeFi Development (DFDV), a Nasdaq-listed company, has entered into a $5 billion equity line of credit agreement with RK Capital Management. The deal gives DFDV the option to sell shares at its discretion, provided it fulfills conditions like filing a resale registration with the U.S. Securities and Exchange Commission. The company plans to file the necessary paperwork soon.

Strategic Focus on Solana Treasury Growth

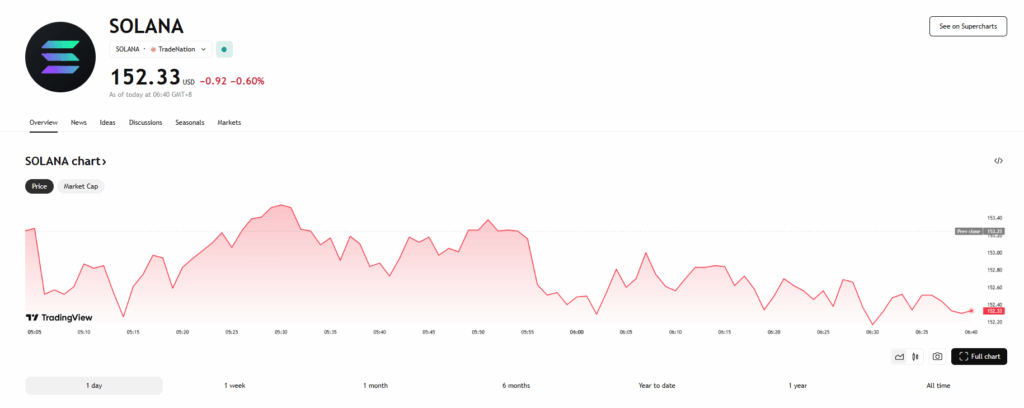

The firm, which transitioned from real estate tech to crypto, is doubling down on its Solana (SOL) strategy. CEO Joseph Onorati described the move as a “clean, strategic path” to scale the business, emphasizing a focus on increasing SOL per share and compounding validator yield. As of May 16, DeFi Development held over 609,000 SOL, valued at approximately $96 million.

Market Reaction and Previous Funding Moves

Following the announcement, DFDV shares rose by 12% during Thursday’s U.S. trading session. The equity credit line comes shortly after the company withdrew a previous $1 billion share sale filing, which it plans to refile. DeFi Development is part of a growing trend of public companies adopting crypto treasury strategies by raising funds through equity and debt to accumulate digital assets.