- A trader sold ETH at $1,570 and re-bought at $2,670, missing out on over $2.6 million in gains.

- Ethereum’s market cap hit $321B, surpassing Coca-Cola and closing in on Bank of America.

- ETH led crypto investment inflows last week with $205M, boosted by the Pectra upgrade and new leadership.

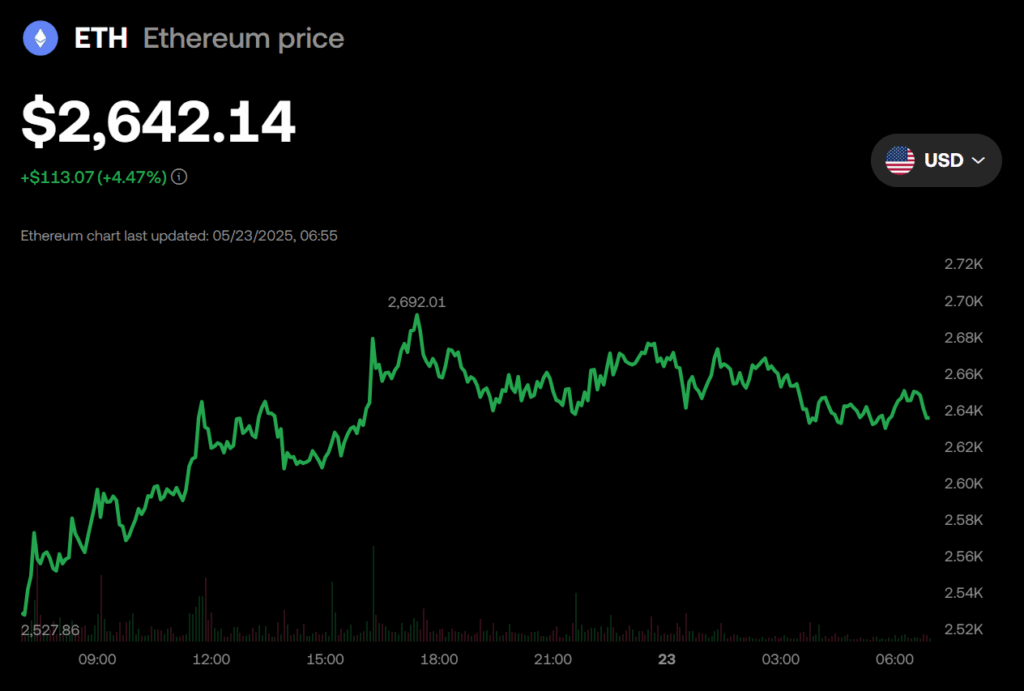

Oof. That’s gotta sting. A crypto trader just bought 1,425 ETH for $3.8 million at around $2,670 per coin, jumping back into Ethereum after its sharp rally. The kicker? Just a month ago, this same wallet sold 2,522 ETH for nearly the same amount—$3.9 million—when ETH was trading around $1,570. Ouch.

Lookonchain, the blockchain sleuths, flagged the wallet activity on May 22. Their takeaway? “Think twice before selling your bags.” Yeah… no kidding.

If the trader had simply held instead of selling and rebuying, their original stash would be worth about $6.7 million right now. Instead, they’ve lost more than 1,000 ETH—roughly $2.67 million—just trying to time the market.

Ethereum Blows Past Coca-Cola in Market Cap

As ETH pushed higher, it didn’t just break personal records—it started climbing global ranks. Ethereum now boasts a market cap of $321 billion, according to 8marketcap. That puts it ahead of giants like Coca-Cola, Alibaba, and AbbVie, and it’s creeping up on Bank of America. ETH is currently the 38th most valuable asset in the world. No big deal, right?

A big chunk of this momentum came from the Pectra upgrade, which launched successfully and delivered some long-awaited improvements. Scalability? Check. Smarter wallets? Check. Easier validator UX? Yep. All this has fueled hopes that Ethereum’s mainnet adoption will pick up steam in the months ahead.

ETH Dominates Crypto Inflows With $205M in a Week

ETH hasn’t just been making waves in price action—it’s crushing it in the investment product space too.

A recent CoinShares report (May 19) showed that U.S.-based crypto investment products brought in a whopping $785 million in a single week. ETH led the charge, pulling in $205 million—that’s 26% of the entire pie. Year-to-date? ETH ETPs are now sitting on over $575 million in inflows.

Analysts are crediting the surge to the Pectra upgrade hype and the appointment of Tomasz Stańczak as a co-executive director at the Ethereum Foundation. New leadership and fresh tech? Yeah, that tends to excite investors.

So while some traders are fumbling the bag trying to time the market, others are doubling down—and they might just be on the right side of this rally.