- Approximately $50 billion in crypto market capitalization was lost within an hour.

- Bitcoin fell below $104,000, with major altcoins experiencing significant losses.

- Contributing factors include geopolitical tensions, massive liquidations, options expiry, inflation data, and ETF outflows.

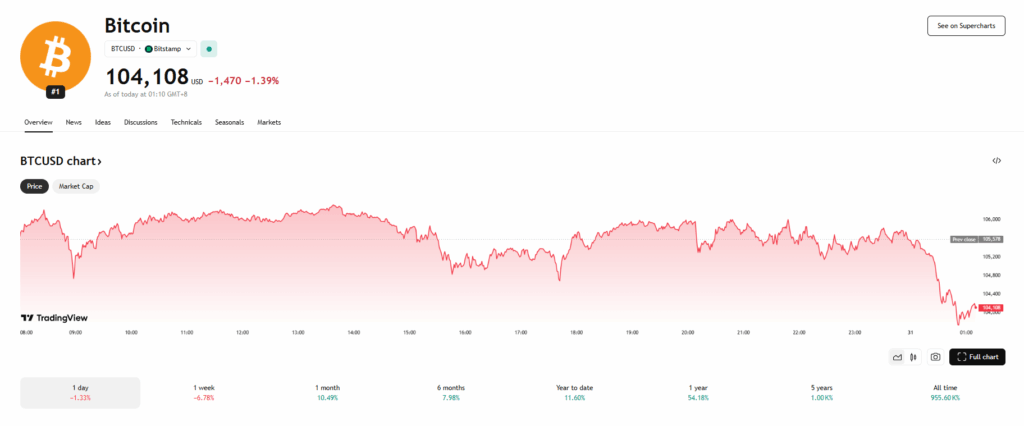

The cryptocurrency market experienced a sharp downturn today, with approximately $50 billion in market capitalization erased within an hour. Bitcoin (BTC) led the decline, dropping below the $104,000 mark, triggering significant losses across major altcoins.

Geopolitical and Economic Uncertainty

Renewed global tensions and macroeconomic concerns have unsettled investors. Bitcoin’s value dipped below $106,000, reaching an intraday low of $104,684, as the total crypto market capitalization fell by 2.12% to $3.34 trillion.

Massive Liquidations

The market downturn triggered widespread liquidations, with over $750 million in positions closed within 24 hours. Notably, $380 million was liquidated in just four hours, affecting over 196,000 traders. The largest single liquidation was a BTCUSDT order valued at $12.74 million on the OKX exchange.

Options Expiry and Inflation Data

The expiration of $11.6 billion in Bitcoin and Ethereum options added to market volatility. Additionally, traders are reacting to the release of the U.S. Personal Consumption Expenditures (PCE) inflation data, which is expected to show a slight increase, further influencing market sentiment.

ETF Outflows

The spot Bitcoin ETF market saw a net outflow of $346.8 million, marking the first outflow in nearly ten trading days. While BlackRock’s IBIT ETF recorded inflows of $125.1 million, other major ETFs like Fidelity’s FBTC and Grayscale’s GBTC experienced significant outflows.

Market Outlook

Despite the sharp decline, some analysts view this correction as a healthy pullback in an otherwise bullish market. The upcoming Federal Reserve meeting and potential interest rate decisions will be closely watched by investors. Market participants are advised to exercise caution and stay informed as the situation develops.