- Coinbase to join the S&P 500 on May 19, replacing Discover Financial amid its Capital One acquisition.

- Shares of Coinbase surged 8% after-hours, now holding a $53 billion market cap despite a sharp drop from 2021 highs.

- Coinbase reported $65.6 million in net income last quarter, meeting the S&P 500 inclusion criteria.

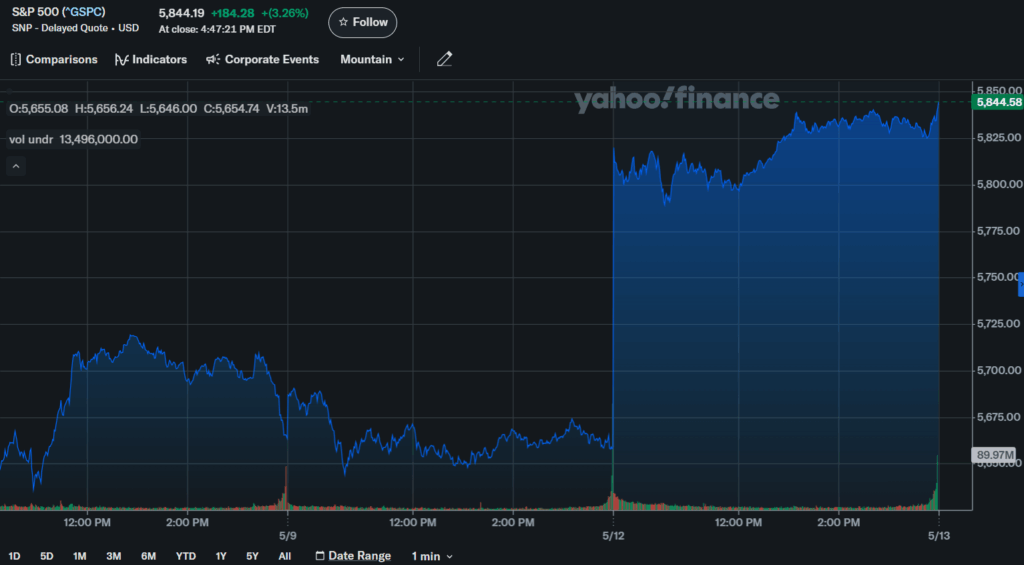

Coinbase is about to get a major boost – the crypto exchange is set to join the S&P 500, replacing Discover Financial Services, which is being acquired by Capital One. The change takes effect before trading on May 19, and news of the inclusion sent Coinbase shares up 8% in after-hours trading.

From Volatile Stock to S&P 500 Contender

Since going public through a direct listing in 2021, Coinbase has had its ups and downs. The stock hit a high of over $357 back in late 2021 but has since tumbled, closing at $207.22 on Monday with a $53 billion market cap. Despite the rollercoaster ride, Coinbase’s inclusion in the S&P 500 could drive further gains as index-tracking funds add the stock to their portfolios.

Financial Performance and Market Impact

To qualify for the S&P 500, a company needs to report a profit in its most recent quarter and over the past year. Coinbase just met that requirement – the exchange reported $65.6 million in net income last week, or 24 cents per share, down from $4.40 a share a year ago.

Revenue rose 24% to $2.03 billion. With institutional interest in crypto ETFs growing and Bitcoin surging, Coinbase could be positioning itself for even bigger moves ahead.