- Circle’s $CRCL stock more than tripled post-IPO, triggering multiple volatility halts.

- The USDC issuer raised $1.1 billion and now trades on the NYSE.

- Market enthusiasm signals rising belief in stablecoins over government-issued digital currencies.

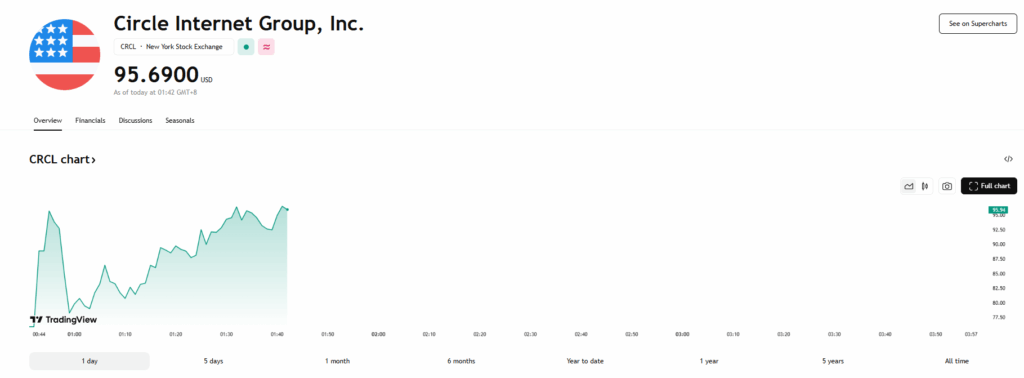

Circle Internet Group, the firm behind the USDC stablecoin, made its debut on the New York Stock Exchange—and things got wild real fast. The stock, trading under the ticker $CRCL, more than tripled its IPO price of $31 within the first hour. That insane momentum triggered multiple Limit Up-Limit Down (LULD) trading halts, signaling extreme volatility similar to last year’s GameStop frenzy when Roaring Kitty made headlines again.

The buzz wasn’t exactly a surprise. Circle has been eyeing a public listing since 2021 but only sealed the deal this week, pulling in $1.1 billion. Word spread fast that the IPO was oversubscribed, and now all eyes are on what Circle’s public run might mean for crypto’s push into mainstream finance. CEO Jeremy Allaire called the move a “powerful milestone” and said it marks the world’s readiness to embrace an internet-based financial system.

A Milestone for Stablecoins in Traditional Finance

Circle’s IPO isn’t just a company going public—it’s a statement that stablecoins, especially USDC, are staking a real claim in modern finance. With a market cap hovering around $61 billion (and growing), USDC continues to be used as a proxy for how many tokens are floating around. Unlike traditional assets, stablecoins are minted on purchase and burned on redemption, giving that market cap serious weight.

Unity Wallet’s COO James Toledano noted the significance of Circle’s upsized IPO, calling it proof that institutional players believe stablecoins will become a cornerstone of financial infrastructure. The allure? Fast settlement, programmable money, and fewer banking headaches—making them attractive tools for both fintech and traditional players.

The Battle Between Market and State-Controlled Digital Money

As stablecoins like USDC gain traction, the spotlight now turns to the ongoing standoff between privately issued digital dollars and central bank digital currencies (CBDCs). The latter, Toledano pointed out, haven’t exactly won hearts and minds. Meanwhile, Circle is charging ahead, and its momentum underscores the appetite for market-led financial innovation over government-run alternatives.

Circle’s IPO success not only cements its position but could also accelerate the race for dominance in the digital currency world. Whether it’s for faster payments or programmable global commerce, it’s clear the financial system is shifting—and Circle just fired a major starting gun.