- $LINK is at a key decision point, retesting the $12.25 support level after falling below a year-long trendline — failure to hold could lead to a drop toward $10 or even $7.50.

- New Pi Network partnership and declining exchange reserves suggest long-term bullish potential, though short-term momentum and trading volume remain weak.

- Whales are reducing their holdings slightly, while retail investors are stepping in — but overall network activity has dropped sharply, limiting immediate upside.

Chainlink ($LINK) is currently stuck in what feels like a make-or-break moment. After slipping below a year-long ascending trendline, the price is now back to retest that same zone — and honestly, this could go either way.

Yeah, there was a small bounce, but nothing too exciting. The $12.25 level? That’s the real battleground right now. If bulls can’t hold it, things might head south, fast — think $10, maybe even $7.50 if it really breaks down.

Technically Speaking… Mixed Signals

On the charts, there was a little action. LINK managed to poke its head above a descending trendline, which should be bullish, right? Kinda. The follow-through has been weak though, and momentum still feels shaky. No fireworks just yet.

At the time of writing, LINK is trading around $12.67 — up just a smidge (0.41%) in the last 24 hours. If bulls want to push a real reversal, they’ve gotta keep it above $12.25, plain and simple.

Partnerships, Reserves, and Quiet Bulls

Now, on the fundamentals side — there’s some good news. Chainlink just teamed up with Pi Network to level up decentralized apps using real-time data. Pretty cool if you ask me. Long-term? That’s solid stuff. Short-term? The market’s barely blinked.

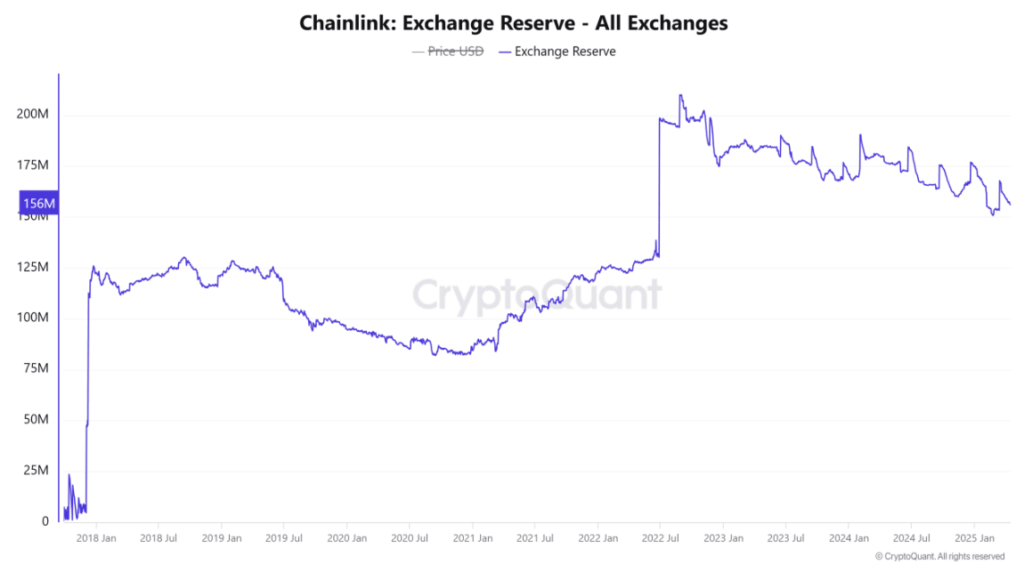

Meanwhile, exchange reserves dipped by 0.2% in the past 24 hours. Doesn’t sound like much, but it means people aren’t rushing to dump their tokens — which usually hints at accumulation brewing under the surface. If that trend keeps up and demand ticks up even a bit, we might actually see LINK stretch its legs.

Whales Are Pulling Back, Retail’s Stepping In

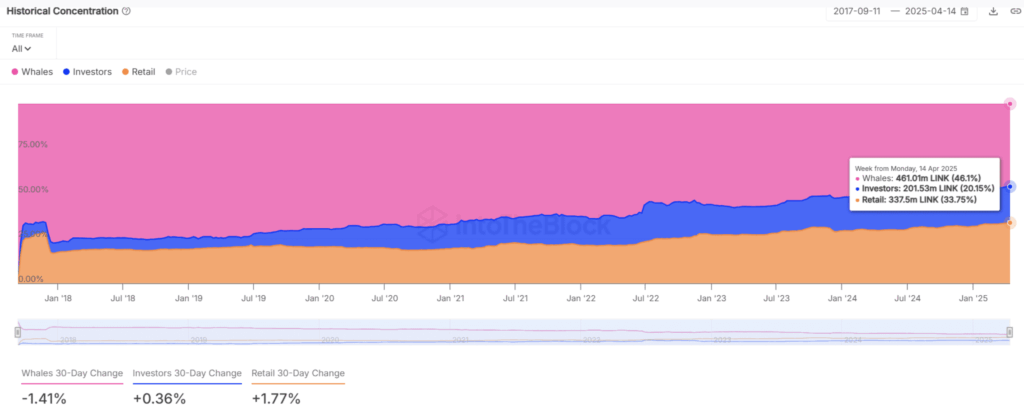

Zooming out a bit, whale wallets still control nearly half of LINK’s supply — 46.1%, to be exact. But here’s the twist: whales trimmed their holdings by about 1.41% over the last month. Retail investors, on the other hand, nudged their share up by 1.77%. Not a massive shift, but interesting.

That said, on-chain activity has taken a bit of a nap. New addresses are down 44%, active addresses nearly 50%, and zero-balance addresses? Down over 56%. That’s a lot of people just sitting on their hands, waiting to see what happens next.

Final Thoughts

Chainlink’s sitting on the fence — no doubt about it. On one hand, you’ve got solid fundamentals brewing (that Pi Network deal, lower reserves, retail stepping in). On the other, network activity’s drying up and whales seem to be easing off.

$12.25 is the line in the sand. Hold it, and there’s a chance bulls can build some momentum. Lose it, and we might see LINK dive back toward double digits.

All eyes on the next move. Because from here… it’s either bounce, or break.