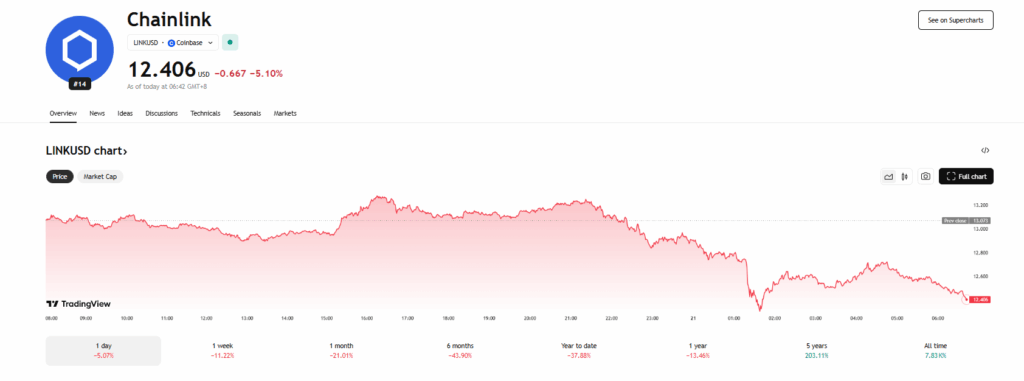

- LINK is down over 20% in 30 days, hovering near the $12.50 support level with bearish sentiment prevailing.

- $16.2 million in exchange outflows and concentrated long positions hint at potential accumulation.

- Forecasts suggest a mild short-term rebound, but broader momentum remains weak and uncertain.

Chainlink (LINK) has seen its price tumble over 20% in the past month, currently hovering around the $12.50 mark. This steep drop mirrors broader market weakness and stems from a mix of technical breakdowns, liquidations, and uncertain sentiment around Chainlink’s recent developments. LINK’s price remains pinned under a descending trendline, with traders debating whether the next move is a rebound or another 20% slide.

Accumulation Signals Provide Hope

Despite the bearish tone, some on-chain metrics suggest accumulation is underway. According to CoinGlass, $16.2 million worth of LINK has flowed out of exchanges in the past week. This trend indicates that investors may be taking advantage of the dip, reducing potential sell pressure. Long positions are heavily concentrated around the $12.55 zone, totaling over $9 million—another sign of bullish bets despite the bearish momentum.

Mixed Sentiment Among Analysts

Opinions on LINK’s trajectory remain split across the analyst community. While some warn that failing to hold the $12.50 support could be disastrous, others believe this zone offers strong upside potential. If LINK rebounds, a return to $14 could deliver big wins to those holding long positions. CoinCodex, meanwhile, projects a modest 3% increase to $13.20 by mid-July, but flags overall sentiment as bearish with the Fear & Greed Index at a neutral 54.

Next Move Could Be Pivotal

As LINK teeters at critical support, the coming days could define its short-term fate. A breakout above resistance might rekindle upward momentum, while a failure to hold the $12.50 level may open the door to further losses. For now, LINK remains on edge, with traders watching closely for signs of either recovery or deeper correction.