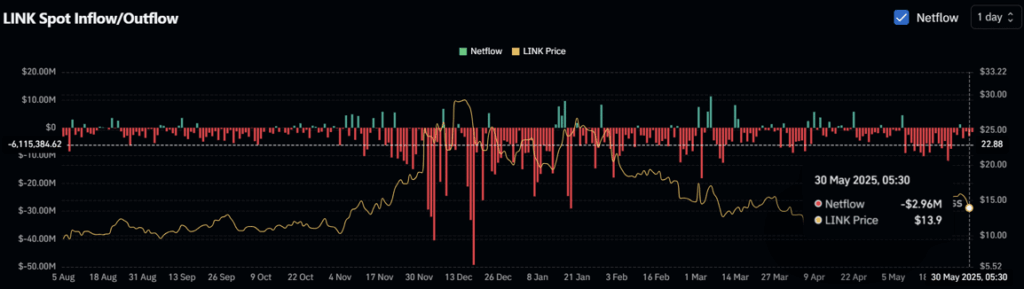

- Major Whale Activity Detected: Nearly 1.8 million LINK tokens (worth $25.5M) were moved from BitGet to a private wallet, suggesting accumulation. Additionally, over $4.49M in LINK has flowed out of exchanges in the past 48 hours, often a bullish signal.

- Price Tests Key Support Level: LINK has dropped 6% in 24 hours, landing near $13.71. Despite this, trading volume is up 7%. The $13.40 support level is crucial—holding it could lead to a 15% rebound, while losing it risks a further dip to $10.40.

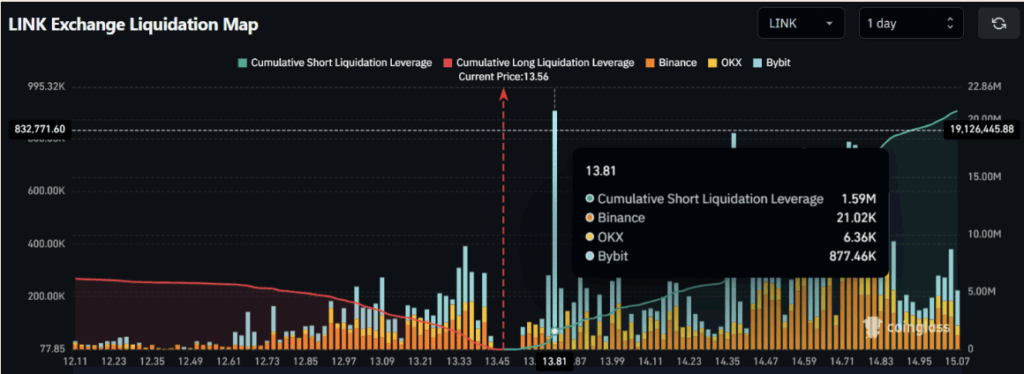

- Traders Lean Bearish, But Reversal Possible: Liquidation data shows more interest in short positions near $13.81. However, if accumulation continues and sentiment shifts, LINK could bounce back strongly in the near term.

After taking hits for four straight days, Chainlink (LINK) has now stumbled right into a critical price zone—one that could either bounce it back up or send it sliding even lower. But here’s the twist: while the price has been sinking, some whales and traders are quietly loading up, maybe betting on a comeback.

Nearly 1.8 Million LINK Just Left BitGet

On May 31st, Whale Alert posted something that definitely got folks talking. About 1.78 million LINK tokens—roughly $25.5 million worth—were moved from BitGet to an unknown wallet. That kind of move usually screams “whale activity” and often signals accumulation, especially when prices are falling. And it’s not just that one transaction. According to CoinGlass, exchanges have been seeing a steady outflow of LINK, with more than $4.49 million worth taken off platforms in the past 48 hours. That’s often a bullish sign, showing holders may be planning to keep their tokens tucked away.

Price Dips, But Volume Climbs

Right now, LINK’s hovering around $13.71 after dropping another 6% in just a day. Kinda rough, yeah—but here’s where it gets interesting. Even with the price falling, trading volume has actually jumped 7%, which means more people are jumping in—possibly betting on a reversal. LINK’s now parked right at $13.40, a level that historically triggered a nice bounce. If enough people keep accumulating and the selling chills out, LINK could very well turn around and shoot up 15% to hit $15.40. But if this support breaks? Well, things could get uglier.

Eyes on the Liquidation Map

Now for the liquidation game—traders are watching two big levels. On the low end, $13.35 is holding $1.14 million in long positions. On the flip side, up at $13.81, there’s $1.59 million worth of shorts stacked up. That tells us sentiment’s still kinda bearish for now, with more bets piling up against a price rise. If LINK fails to hold the $13 level and closes a daily candle below it, we might be looking at a deeper drop—possibly all the way to $10.40.

So yeah, LINK’s at a crossroads. If whales and investors are right, we could see a rebound soon. If not? Strap in for more red.