- Hoskinson proposes converting $100M in ADA to stablecoins and BTC to grow Cardano’s DeFi and treasury yield.

- Critics fear a negative price impact, but the plan is still under internal review with broader ecosystem input.

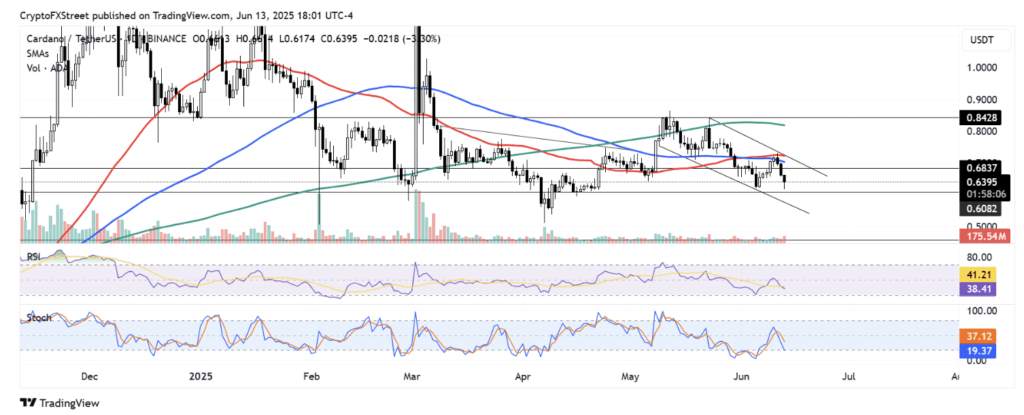

- ADA is testing $0.60 support as technical signals lean bearish following rejection at key resistance.

Cardano founder Charles Hoskinson stirred things up this week by suggesting a major shift in how the Cardano treasury operates. In a recent video, he proposed converting $100 million worth of ADA into Bitcoin and stablecoins to help boost stablecoin issuance on the network. According to him, Cardano’s current stablecoin ratio is “disproportionately low” at under 10%, compared to its $273 million total value locked (TVL).

Hoskinson believes using part of the treasury for yield-bearing assets could give Cardano a much-needed push. Drawing from examples like Norway’s and Abu Dhabi’s sovereign wealth funds, he pitched this as a long-term, sustainable play. Around $25M–$50M of the proposed funds could go toward Bitcoin, aimed at driving BTC-backed DeFi development. Critics have raised concerns about potential price drops, but Hoskinson downplayed that fear, noting that $100M isn’t enough to significantly impact ADA’s price.

Community and Market Reaction

Reactions have been mixed. While some see the plan as innovative, others are worried it could tank ADA’s value during an already fragile period. Hoskinson says the idea is still under review and hasn’t been finalized—he’s circulating a 40-page draft document among his team and DeFi app developers to gather feedback. He emphasized the role of Intersect, Cardano’s governance body, in making these kinds of strategic calls.

Criticism aside, the proposal is clearly designed to address a gap: Cardano’s stablecoin footprint is weak, and this initiative aims to change that fast. A treasury that earns yield, supports exchange listings, and promotes DeFi growth could shift the ecosystem’s trajectory—if the community gets on board.

ADA Price Faces Key Support Test

ADA’s price dipped 4%, partly due to Hoskinson’s announcement and partly from broader tensions in the Middle East. The token faced rejection near the top of a descending channel, with both the 50-day and 100-day SMAs adding pressure. Now, ADA is testing the $0.60 support zone.

If that level doesn’t hold, ADA could slide further toward the bottom of the channel. On the flip side, overcoming resistance around $0.84 would be needed to kickstart a rally. Technical indicators are leaning bearish: the RSI fell below its average, and the Stochastic Oscillator is nearing oversold territory. Traders should keep an eye on momentum shifts—things could move quickly from here.