- Long-term Cardano holders are starting to sell, signaling shaken confidence and adding downside pressure.

- Capital inflows remain weak, with CMF in the red, suggesting a lack of new buyer interest.

- ADA needs to hold above $0.60 to avoid further decline toward $0.57; a bounce could target $0.66 to $0.70 if sentiment improves.

Cardano (ADA) just gave up most of its recent gains, and, well… it’s got people spooked. The price drop has sparked a wave of selling, especially from long-term holders who, until recently, were hanging on tight. But now, it seems like even the loyalists are starting to fold, which isn’t a great sign.

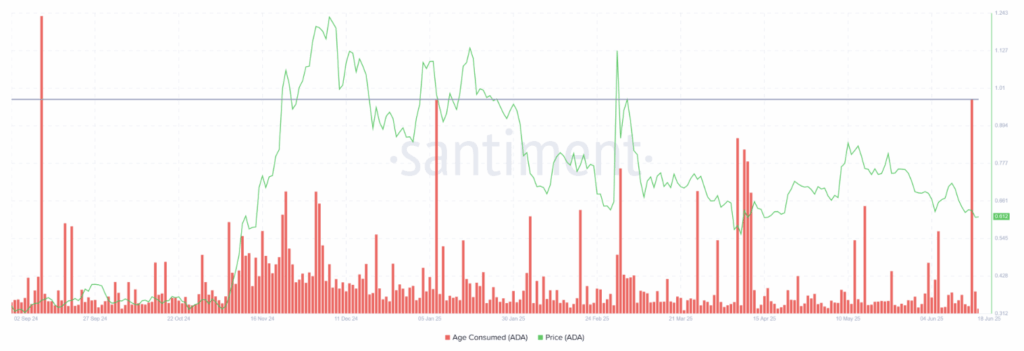

And it’s not just a few folks here and there. There’s been a serious spike in the “age consumed” metric—basically a tracker that lights up when older, dormant coins start moving. This jump is the biggest we’ve seen in nine months. Translation? The OG holders are unloading. And when long-term investors start selling like that, it usually means they’ve lost confidence, or they’re bracing for something worse.

Selling’s Picking Up, and Inflows Are Drying Up

This sudden LTH activity doesn’t just rattle nerves—it shakes the market. These kinds of holders tend to anchor price action. So when they sell, it adds serious weight to downward pressure. And right now, ADA needs all the help it can get.

Adding to the mess, investor inflows aren’t doing Cardano any favors either. The Chaikin Money Flow (CMF), which shows how much capital is flowing in or out of the asset, is stuck under zero. That basically means there’s more cash leaving than coming in. Not exactly the environment for a strong bounce back, especially when other traders are still hitting the sell button.

Can ADA Hold the Line?

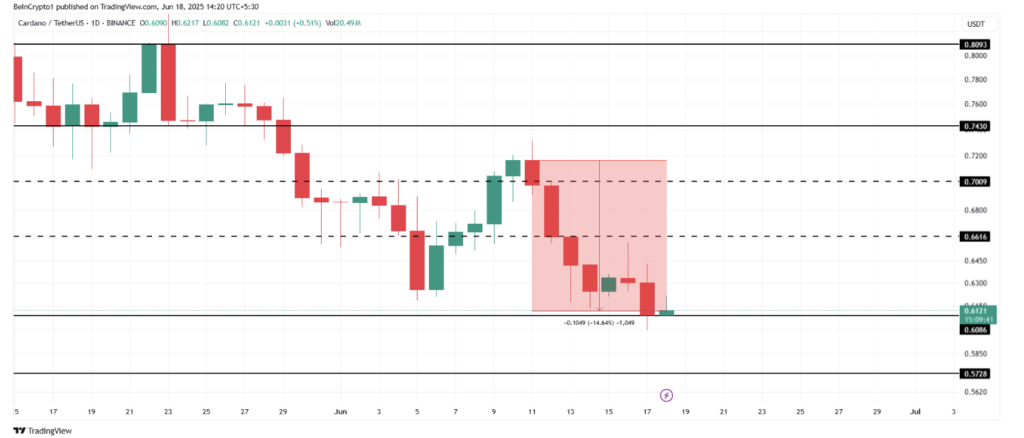

At the moment, ADA’s floating around $0.61—not too far above that $0.60 support zone. It’s already taken a 14.6% beating this week. And if this pressure keeps up, there’s a real risk it dips below that line and slides toward $0.57.

A drop like that could amplify losses, shake more holders out, and probably drag confidence even lower. That’s not to say a recovery is impossible, but it’d take some serious support kicking in. If ADA can cling to $0.60 and bounce from there, maybe it claws its way back to $0.66—or even $0.70 if sentiment cools and selling chills out.

Right now, though? That feels like a pretty big “if.”