- Cardano (ADA) is approaching a breakout point, trading within a symmetrical triangle pattern and showing signs of a possible 27% move either way.

- Retail investors are stepping in as whales slightly reduce holdings, with on-chain activity like new and active addresses also rising—indicating growing user interest and engagement.

- Short-term trading volume is up, showing market confidence, but options data reflects long-term caution, leaving ADA’s breakout direction uncertain for now.

Cardano (ADA) looks like it’s getting ready to spring. At the time of writing, the price sat around $0.6461, climbing 2.61% in just 24 hours. But more than the short-term gain, it’s the shape of the chart that’s catching attention. ADA’s been squeezing into a symmetrical triangle — the kind that usually doesn’t end quietly.

According to AMBCrypto’s latest analysis, this tightening range and dropping volatility could be setting up ADA for a solid move — possibly up to 27% in either direction. Yeah, it’s one of those “buckle up” moments.

Squeeze Play: The Setup Looks Tense

ADA’s current setup shows price action bouncing between two converging lines: one dragging down from January’s highs, the other pressing up from a longer-term base. Support is holding firm near $0.5618, while resistance looms around $0.7545 to $0.7581.

What’s interesting is that ADA just reclaimed both its 9-day and 21-day moving averages — currently sitting at $0.6252 and $0.6263. That kind of reclaim, especially in a tight range like this, is often a quiet precursor to a louder move.

If bulls break through the top line? We could be eyeing $0.81. But if bears win and we fall through the base — a trip back down to the $0.46 range isn’t off the table.

Whales Are Easing Off — Retail Steps In

Ownership trends are changing too. Over the last month, big holders (the whales) trimmed their ADA bags by 1.68%. Meanwhile, smaller investors added 1.6% to their stacks, and retail addresses rose by 0.72%.

This kind of redistribution from whales to retail often suggests growing grassroots interest. And historically, retail-driven surges can pack a punch once momentum kicks in.

Network Buzz Picking Up

Cardano’s network activity also saw a noticeable boost. New addresses jumped 4.79% over the last week, and active addresses spiked nearly 12%. Even zero-balance addresses — a quirky but useful stat — climbed by 12.26%. That points to more movement, more churn, and more hands in the mix.

In short: things are getting busy on-chain, which typically adds fuel to whatever price move comes next.

Derivatives Data Is… Kinda Conflicted

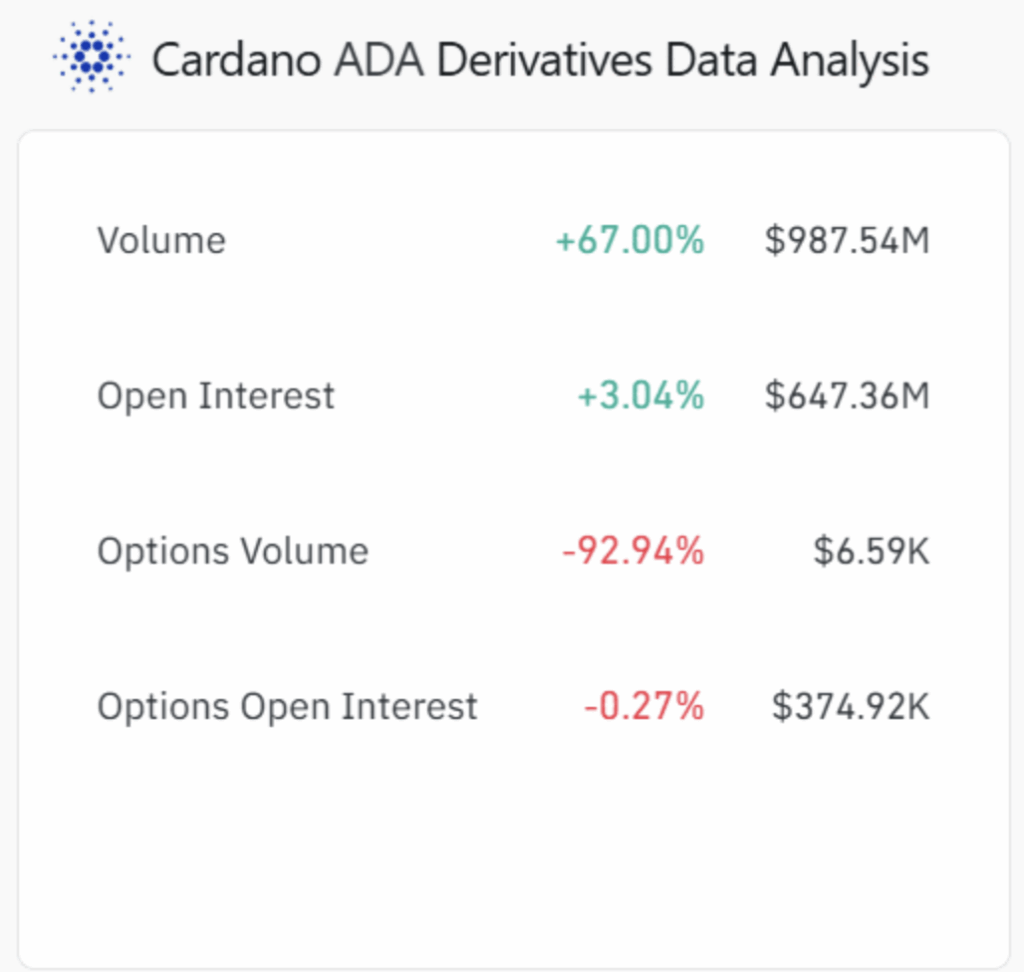

Now, zooming into the derivatives markets — it’s a bit of a mixed bag. Volume in ADA futures shot up 67%, touching nearly $987.5 million. Open Interest ticked up by 3.04%, which usually signals increasing speculation.

But in the options corner? Not so hot. Volume absolutely tanked by almost 93%, and Open Interest nudged down by 0.27%. That tells us traders are hesitating when it comes to long-term bets — maybe waiting to see which way this triangle breaks before they jump in deeper.

The Big Question: Boom or Bust?

ADA is coiling. There’s no sugarcoating it — this thing’s close to a major move. Between the rising retail activity, renewed network energy, and bullish near-term volume, the setup looks ripe.

But… that drop in options action signals caution too. So it really comes down to this: can ADA punch through resistance and ride retail momentum? Or does it crack under pressure and tumble toward deeper support?

Whichever way it goes, it won’t be quiet.