- Bitcoin drops to $102,388 after hitting $105,819 amid profit-taking ahead of the CPI report.

- Strategy buys 13,390 BTC, pushing its holdings to 568,840 BTC, as institutional interest persists.

- Glassnode data shows rising profit-taking and weakening momentum buyers, hinting at potential consolidation.

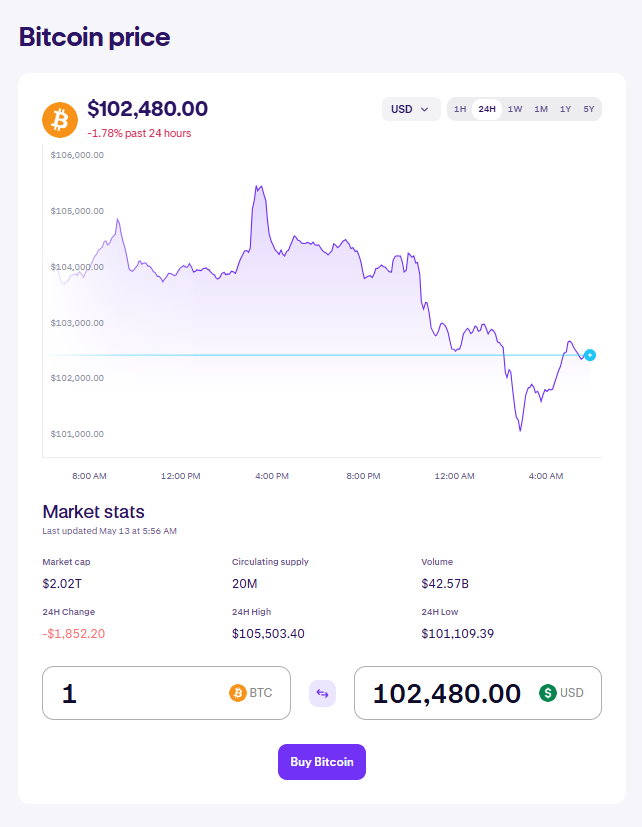

Bitcoin’s rollercoaster ride continues. On May 12, BTC hit an intraday high of $105,819 but quickly slipped back down to $102,388 – a pretty abrupt drop considering all the bullish news flying around. The US-China trade deal talks in Switzerland seemed to have sparked optimism, with US equities rallying and the Dow shooting up 1,000 points. Trump, as usual, was quick to claim victory, flooding Truth Social with celebratory posts. But despite the hype, Bitcoin couldn’t hold onto those gains.

Mixed Signals Amidst Big Bitcoin Buys

Meanwhile, big players are still piling into Bitcoin. Strategy CEO Michael Saylor made waves by announcing the purchase of 13,390 BTC, pushing the firm’s stash to a jaw-dropping 568,840 BTC. Elsewhere, shares of KindlyMD, a healthcare firm, skyrocketed 600% after merging with Nakamoto Holdings – a Bitcoin investment outfit linked to David Bailey, Trump’s crypto advisor. April saw a similar trend, with multiple firms announcing Bitcoin buys as treasury assets, signaling that institutional interest hasn’t cooled off.

Profit-Taking and CPI Fears Weigh on BTC

Despite the bullish narrative, on-chain data from Glassnode hints that Bitcoin could be in for some consolidation. The firm pointed out that while first-time buyer interest is strong, momentum buyers are fading, and profit-taking is on the rise. Spot markets and perpetual futures both saw increased selling pressure, with some traders likely cashing out ahead of the May 13 Consumer Price Index (CPI) inflation report.

Market Moves and What’s Next

Looking ahead, the CPI print could be a key market mover. If inflation surprises to the upside, it might dent risk appetite, pulling Bitcoin lower. On the other hand, a softer reading could reignite bullish momentum, especially with Bitcoin’s recent surge in spot ETF inflows. The US Dollar Index is rallying, stock markets are up, but Bitcoin’s inability to stay above $105,000 raises questions about whether the recent gains are sustainable or just another head fake in an increasingly choppy market.

Short-Term Correction or Deeper Pullback?

All in all, Bitcoin’s recent pullback appears to be more of a technical correction than a full-fledged reversal. But with CPI data on the horizon and profit-taking increasing, the short-term outlook remains murky. Spot buying has been a big driver of the recent rally, but whether that appetite continues depends on how the broader market reacts to the latest economic data. For now, Bitcoin sits at a crossroads, with $104,000 acting as the key battleground level.