- BONK surged 73% from its April 22 low, backed by a breakout from a multi-month downtrend, rising trading volume, and strong open interest growth in futures markets.

- Social buzz and funding rates are soaring, reflecting growing retail and trader excitement, with analysts eyeing potential upside targets of $0.00002410 and $0.000040.

- If momentum continues, BONK could rally further, but short-term pullbacks may occur due to overbought conditions as RSI sits near 71.

Bonk (BONK) — yep, that spicy little Solana memecoin — is heating up again. After dipping to around $0.00001247 on April 22, the dog-themed token has surged back to $0.00001929 (give or take), marking a massive 73% rebound in just under a week. At its peak on April 28, it even hit $0.00002167 before cooling off a bit.

According to CoinGecko, BONK is up around 3% in the last 24 hours and a juicy 60% on the weekly, currently sitting with a market cap of $1.5 billion — though it briefly flirted with $1.7B during the weekend pump.

Broad Memecoin Comeback

It’s not just BONK. The entire memecoin sector is in rally mode, with coins like DOGE and SHIB posting moderate gains, and newcomers like TRUMP and BRETT going full send — up 73% and 83% on the week, respectively.

In total, memecoin market cap jumped 17.5%, hitting $55.5 billion, while trading volume exploded to nearly $8 billion, per CoinMarketCap. Yep, looks like retail’s feeling risky again.

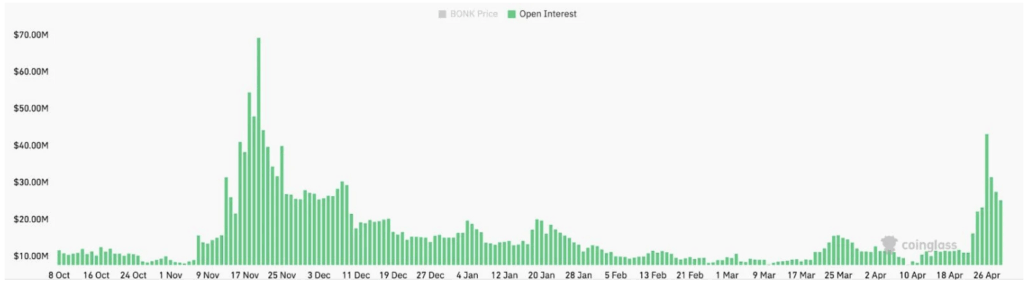

Open Interest Spikes

One big metric that stands out? Open interest on BONK futures shot up 290%, from $11M to $43.2M between April 22 and April 26. It has since cooled to $28M, but that’s still way above previous levels.

Rising OI means traders are loading up on positions — and in this case, mostly longs, as indicated by funding rates pushing higher. In simple terms? Traders are betting BONK goes higher.

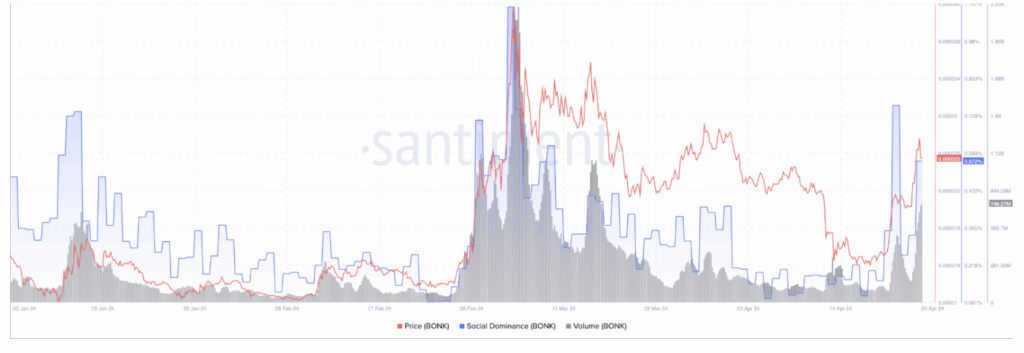

Social Buzz Is Off the Charts

According to Santiment, BONK’s social dominance spiked from 0.091% to 0.572% in under a week. That’s a lot of chatter. When a coin trends this hard, retail FOMO isn’t far behind — and that’s exactly what’s playing out.

Breaking Out: What’s Next for BONK?

So technically speaking, BONK’s looking pretty good. On April 13, it broke out of a long-term downtrend, busting through both the 50-day and 100-day EMAs like butter.

Now, all eyes are on the 200-day SMA at $0.00002410 — that’s the next big resistance. If BONK can push through there with solid volume, the next target could be $0.000040, the high from mid-January. That’s more than 100% from current prices.

The RSI is sitting around 71, which means BONK is technically overbought, but that’s not necessarily bad — sometimes overbought just means momentum is strong. Still, don’t be shocked if there’s a tiny pullback first before another leg up.

Traders Chime In

- “$BONK’s descending trendline got cleared… expecting 2x in the coming days,” said World of Charts on X.

- Crypto Joe, another well-followed trader, spotted BONK breaking out of a bullish pennant on the 30-minute chart, eyeing $0.00002690 as a short-term target.

Final Take

BONK’s breakout isn’t just a lucky bounce — it’s backed by rising volume, growing trader activity, social buzz, and technical strength. As long as this momentum holds, BONK could be lining up for another massive move.

But hey, it’s still a memecoin… so strap in. 🐶💥