- BNB is trading flat near $655 with low volatility and mixed technicals, signaling consolidation.

- RSI and MACD suggest bearish pressure, but breakout potential exists above $671 if volume returns.

- Price forecasts for 2025 vary widely, ranging from $613 to $1,434 — so traders are focusing on risk-managed entries.

BNB’s stuck in a bit of a holding pattern, hovering around $655.35 with a small 0.89% gain in the last day. The trading volume’s up slightly too, clocking in at $1.44 billion — but nothing wild. For the week, it’s pretty much flat, gaining just 0.55%. Basically, the coin’s been bouncing between tight ranges, showing it’s in no rush to break out… at least not yet.

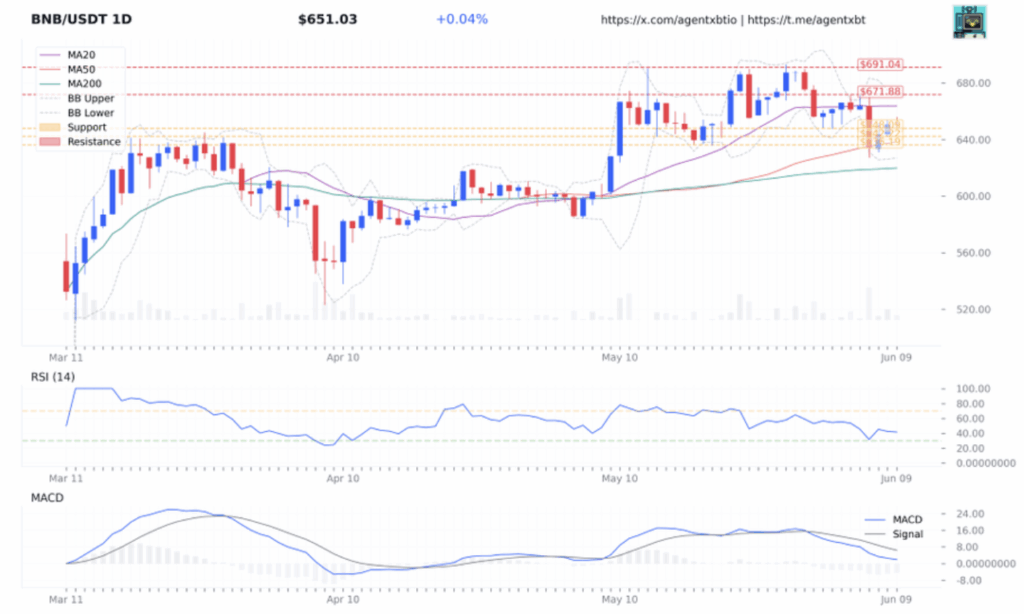

Looking at the charts, BNB’s consolidating near $651 with super-low volatility. The Bollinger Band Width is sitting at 6.69%, which usually means something’s brewing — either up or down. Momentum’s slipping, volume’s dipping, and the ADX is high but flattening. Traders are starting to sense that whatever strong trend was there might be cooling off.

Bearish Hints Creep In, but Breakout Watch Is On

Technicals aren’t painting the rosiest picture. The RSI’s at 41.58 — not quite oversold, but it’s heading in that direction. Meanwhile, the MACD’s still dragging below its signal line, showing weak buying pressure. On the bigger timeframes, momentum’s fading, and unless some buyers step up, prices could slip further.

That said, when price gets this quiet, it’s usually the calm before the storm. Support is sitting at $648, resistance at $660–$671. If BNB drops under $642, it could unravel fast. But if it clears $671 with conviction? Well, then bulls might finally have their moment. For now, traders are being super cautious, leaning short under $660 and only going long on solid momentum above $671.

Mixed Signals for 2025: Skyrocket or Snooze?

Looking ahead, forecasts for BNB are all over the place. DigitalCoinPrice is dreaming big — calling for a rally to $1,434.17 by the end of 2025, smashing past the previous highs. But Changelly’s taking the safer route, projecting a max price of $613.16, which, yeah, would be a step back from where we are now.

So what’s the move? Don’t rush it. Most analysts are saying to wait for a confirmed break above $660 or a proper dip below $642 before going in heavy. Until that happens, this is a textbook wait-and-see setup. Timing, patience, and tight stop losses are your friends in this kind of market.