- BNB Climbs with Ecosystem Growth: Binance Coin rose to $660, riding a wave of activity on the BNB Smart Chain. DEX trading volume hit over $100B in the last 30 days, surpassing both Ethereum and Solana.

- PancakeSwap Leads the Charge: Most of the recent surge came from PancakeSwap, which alone handled $92B in volume. Upcoming upgrades like Maxwell are expected to improve speed and scalability even further.

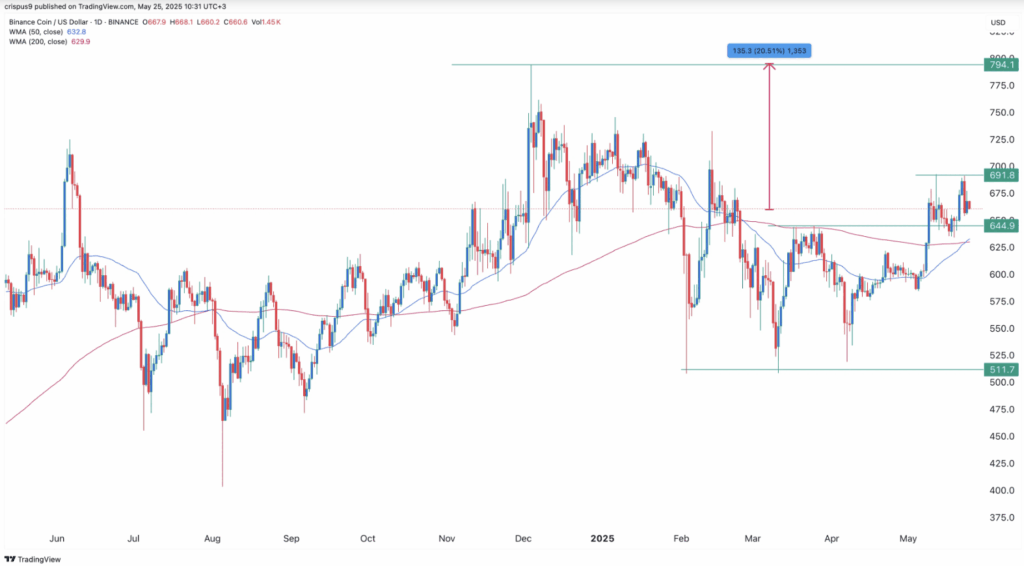

- Bullish Technical Signals: BNB formed a golden cross and a triple-bottom pattern. If it breaks resistance at $690, it could rally toward $795. Long-term charts show a cup-and-handle setup, hinting at more upside ahead.

Binance Coin (BNB) crept up to around $660 on Sunday, clocking in a 13% gain from its lowest dip this month. Still, it’s hovering just under May’s peak at $692—so it hasn’t quite broken free yet.

But here’s what’s interesting: the real action isn’t just in price—it’s in the ecosystem. The BNB Smart Chain has been firing on all cylinders lately. Over the past month, DEX protocols on the chain processed more than $100 billion in volume. That’s not just solid—it’s enough to knock Ethereum and Solana down a peg. ETH and SOL only saw $67B and $97B respectively in that same stretch.

PancakeSwap Takes the Crown

Most of this surge came in just the last week. DEX volume on BSC rocketed 133% to hit over $55 billion in seven days. PancakeSwap, BSC’s golden goose, is behind a big chunk of that—handling $50B in trades last week and $92B in 30 days. It even passed the $1.62B milestone in cumulative volume.

Other DEX players on BSC—like Uniswap (yes, they’re cross-chain now), THENA, Dodo, and SquadSwap—have also seen their volumes swell lately. Safe to say, it’s been a busy few weeks across the board.

Upgrades Are Making BSC Faster and Meaner

This uptick in usage follows two major upgrades: Pascal and Lorentz. Pascal helped BSC talk better with Ethereum, while Lorentz sliced block time in half—from 3 seconds to just 1.5. Not bad, right?

Next up? The Maxwell upgrade. That one’s expected to make BSC even faster and potentially give it a leg up on both Ethereum and Solana. No hard date yet, but devs say it’s coming in June.

A Closer Look at BNB’s Chart

BNB has been showing some promising signs on the technical side too. The token hit lows near $510 back in Feb and March, then pulled the same move again in April—forming a classic triple-bottom setup with a neckline at $645.

Even more encouraging? BNB just printed a golden cross on the daily chart—where the 50-day Weighted Moving Average (WMA) jumped above the 200-day WMA. That’s usually a bullish long-term signal, often seen before big rallies.

If BNB manages to crack resistance at $690, that opens the door for a run to $795—which was the December high and would mean a 20% climb from where we are now.

Long-Term Picture: Bullish Vibes

Looking ahead, things still lean bullish. Some analysts have been pointing to a cup-and-handle formation on the weekly chart—a setup that historically leads to significant breakouts. If the momentum sticks and the Maxwell upgrade delivers, BNB might just have more room to run than most expect.