- BNB Chain daily transactions jumped over 275%, showing major on-chain growth despite flat price.

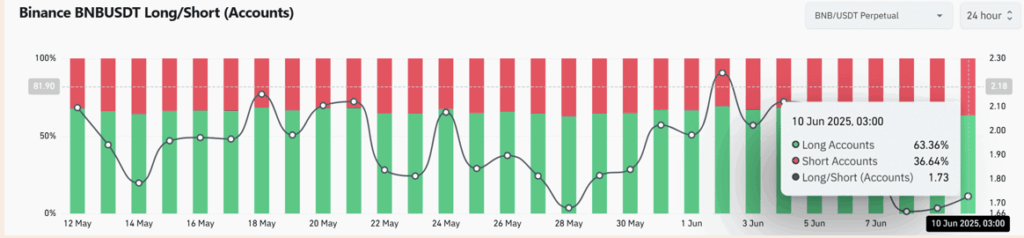

- Derivatives data reveals high trader interest, though bulls are showing a bit more caution near resistance.

- A breakout above $675–$695 could trigger a sharp move, but until then, price may stay rangebound.

BNB Chain’s lighting up the charts lately. Daily transactions have exploded—from a modest 4 million to over 15 million in just a short stretch. That’s not just a bump. It’s a 275%+ leap and screams that user activity and ecosystem utility are heating up fast. Even though BNB’s price hasn’t exactly gone vertical yet, this on-chain demand is quietly laying down the framework for a serious move.

We’re not just talking hype here—this uptick suggests a meaningful shift in how people are actually using BNB. Real-world apps, DeFi tools, maybe even gaming. The foundation’s being built whether the price catches up immediately or not.

Outflows? Yep—but Don’t Panic

Right now, BNB’s showing a spot net outflow of about $229K. That might spook a few folks, especially traders quick on the sell button. But let’s be real—it’s a blip. Short-term traders are likely just cashing in some gains, nothing deeper.

If you zoom out a bit, netflows in May and June show a steady rhythm of inflows and outflows. That’s market rotation, not a full-on retreat. And with on-chain activity climbing, it’s hard to paint this as anything but normal.

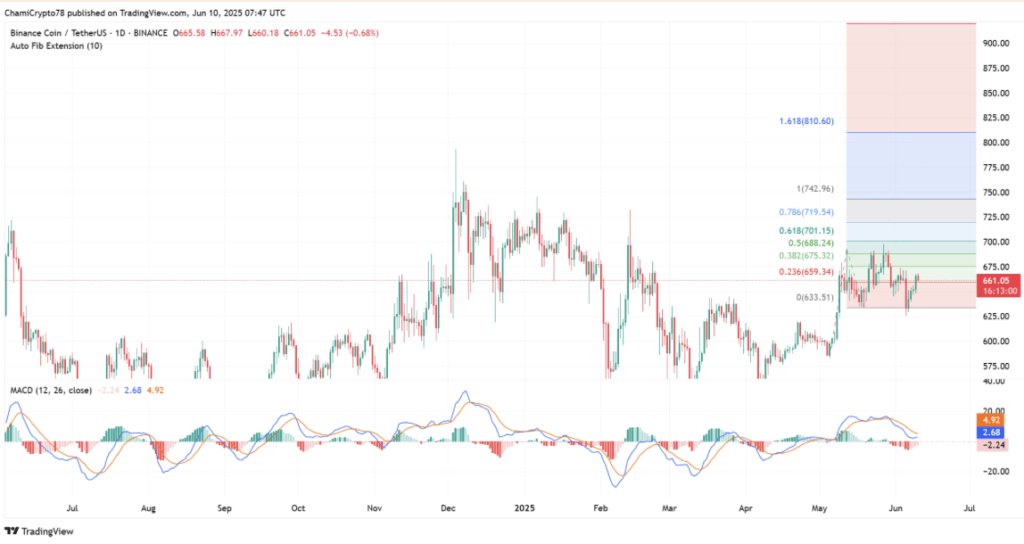

Fibonacci Resistance is Stubborn, But…

BNB’s bouncing around the $661 mark right now, bumping its head on that 0.236 Fibonacci level at $659. It’s been struggling to get past that familiar $675 ceiling, with further resistance lined up at $688 and $701.

Even with all the strong on-chain stuff going on, sellers are still holding firm in that zone. But here’s the kicker—BNB’s holding above $633 pretty well. If it clears $675 and stays above it, that could flip the switch and send price into a whole new zone.

Derivatives Go Wild: Traders Gear Up for Volatility

BNB’s derivatives scene? Buzzing. Volume’s shot up 70%, now at $594.9M, while Options volume more than doubled. Open Interest hit $736.75M and climbing. That’s traders betting something big is brewing.

Longs are still out in front—63.36% of positions are bullish, but that ratio was higher earlier this month. So yeah, bulls still have the wheel, but they’re not flooring it anymore. Could be profit-taking, or maybe just waiting for a clearer green light.

It All Comes Down to This Range…

Look at the liquidation heatmap and it’s pretty obvious—$675 to $695 is where the real action sits. Break above that, and BNB could rip as trapped liquidity gets released. Below $650? Things get quieter, fewer liquidations waiting to happen.

So all eyes are glued to that range. Can BNB break it? Maybe. But until it does, expect more sideways dance moves. Still, with everything going on under the hood—on-chain growth, trader interest, and ecosystem buzz—the odds are tilting bullish.