- Bitcoin surged 11.1% in May while housing and auto markets showed serious signs of weakening.

- BTC ETFs drew $5.5 billion in inflows, over triple the amount seen by gold ETFs.

- ARK Invest sees the move as a strategic shift, not speculative mania, as investors seek safer ground.

Bitcoin’s climb to fresh all-time highs isn’t happening in a vacuum. According to a new report from ARK Invest, led by Cathie Wood, the rally is unfolding just as cracks begin to widen across key sectors of the U.S. economy.

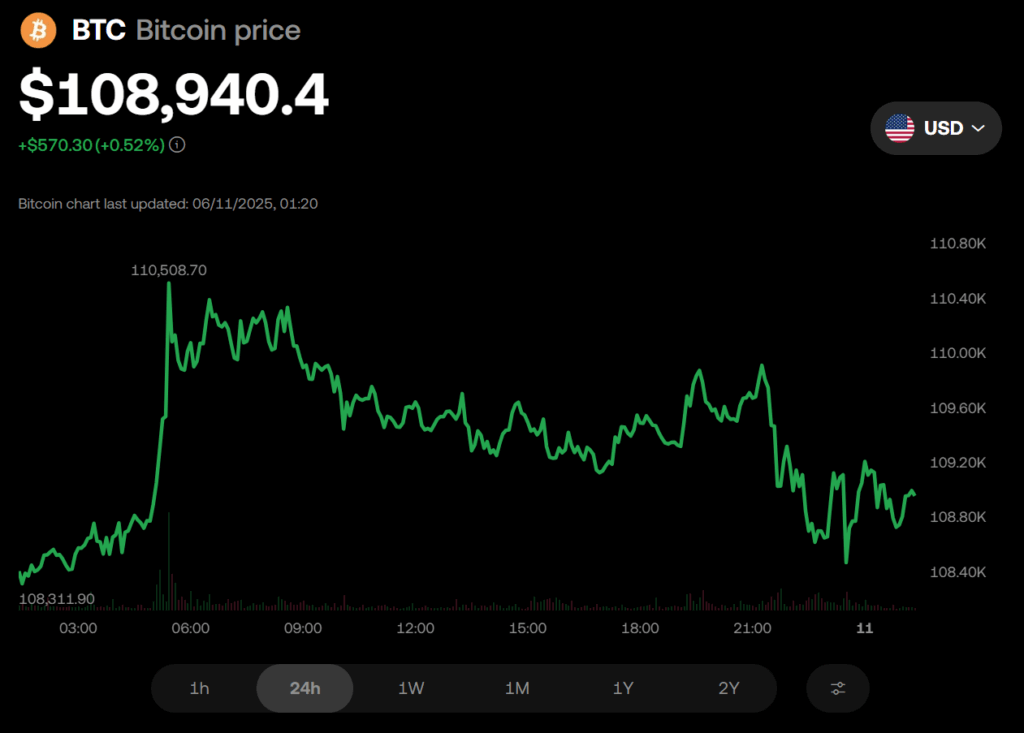

In May alone, BTC rose 11.1%, outpacing gold and smashing through important resistance zones. But what makes the move even more striking is when it’s happening — right as housing and auto markets, both bedrocks of consumer strength, start to wobble.

Economic Strain Meets Digital Ascent

ARK’s data shows home sellers now far outnumber buyers, a trend amplified by the Fed’s aggressive rate hikes since 2022. Housing affordability has plunged, and that’s beginning to drag prices lower in what’s still the biggest driver of household wealth. Meanwhile, U.S. auto sales — after booming earlier this year in a rush to beat tariffs — dropped hard in May, sliding from over 17 million units to just 15.6 million.

As traditional assets falter, bitcoin is quietly pulling in sidelined capital. Spot BTC ETFs saw inflows of $5.5 billion in May — that’s more than triple what gold ETFs brought in, which actually saw outflows. Clearly, something is shifting.

No Mania, Just Movement

Despite the rapid price action, ARK says we’re not in speculative bubble territory. On-chain data shows profit-taking remains modest, and unrealized gains are far below the euphoric highs seen in past cycles.

For many investors, this doesn’t look like wild speculation. It looks more like a quiet but calculated pivot — out of stressed sectors, into an asset they see as resilient in uncertain times.