- Bitcoin ETFs saw over $1.3B in inflows despite Middle East tensions, showing strong investor appetite.

- BTC quickly recovered from a brief dip and now trades near $105K, just 6% off its all-time high.

- Ongoing global instability and a weakening U.S. dollar are boosting Bitcoin’s appeal as a hedge asset.

Bitcoin’s been holding its ground near $105K lately—even with all the chaos happening in the world right now. That alone is pretty telling. Investors don’t seem too spooked, which might be a signal of growing confidence in BTC as a hedge or maybe just… resilience.

ETF Inflows Keep Rolling In

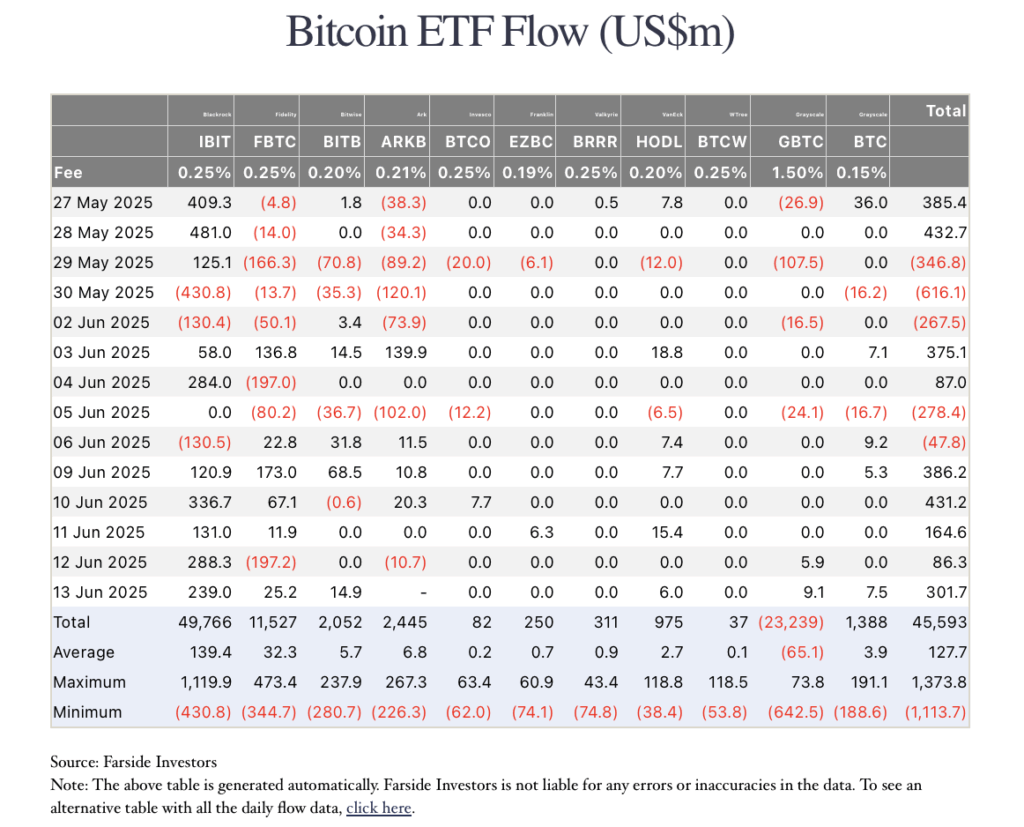

Despite tensions flaring between Israel and Iran, Bitcoin exchange-traded funds (ETFs) have seen five straight days of inflows. According to data from Farside Investors, things kicked off Monday, June 9, with $386 million pouring in. And by Friday, another $301 million had joined the mix—totaling over $1.3 billion in just five days. That’s a lot of cash flowing in, especially in a shaky macro environment.

Interestingly, the Bitcoin price barely flinched when news of the airstrikes hit. It dropped around 3% at first, but quickly bounced back. Nic Puckrin from Coin Bureau pointed out that the U.S. dollar index (DXY) falling below 100 for the first time in three years is a much bigger deal long-term. BTC tends to move in the opposite direction of the dollar—and the dollar looks like it’s heading south.

Strait of Hormuz: A Real Risk Factor?

While Bitcoin’s been pretty stable, there’s still risk hanging in the air. Analysts are watching the Strait of Hormuz, which sees about 20% of the world’s oil flow through it. If Iran decides to shut that down, energy prices could explode, and that might ripple across every market—including crypto. A full-blown regional war is another wildcard no one wants to see unfold.

Bitcoin’s Resilience Has Analysts Buzzing

Even after dipping to around $103K—triggering $422 million in long liquidations—BTC snapped right back to trade above $105K. That’s less than 6% off its all-time high of $112K from May 22. This sort of price stability under pressure has analysts thinking we might be looking at the start of another big leg up.

With inflation still a worry, trust in traditional systems cracking, and debt levels sky-high, Bitcoin is starting to feel like more than just a speculative play. Its fixed supply and growing mainstream access through ETFs are helping it carve out a more serious role in portfolios.