- Bitcoin dipped to $103,300 ahead of the Fed’s interest rate decision and amid geopolitical unease.

- Long-term holders are still HODLing, but mid-term traders locked in nearly $1B in profits this week.

- $102K–$104K could be the bounce zone, but a break below $98K might trigger a sharper drop.

Bitcoin’s having a bit of a wobble. After holding steady for a while, the price dropped to around $103,300, down from the $104K+ range. This little slide comes right before the upcoming FOMC meeting, where everyone’s expecting to hear whether the Fed will tweak interest rates again. Toss in the rising tensions between Israel and Iran, and you’ve got a cocktail of caution brewing across both crypto and traditional markets.

But it’s not just macro stuff weighing on Bitcoin. According to Bitcoin Vector—a Swissblock-backed market tracker—there’s seasonal weakness setting in, and on-chain growth’s been kind of… meh. Demand from spot buyers has cooled off a bit too. Over $434 million in leveraged BTC futures got liquidated in just 24 hours, which suggests traders aren’t in the mood to gamble big right now.

U.S. Demand Steady, But Not Enough

One bright spot? U.S. investors are still showing up. The Coinbase Premium Index, which compares BTC prices on Coinbase versus Binance, has stayed positive for most of June. That’s usually a sign that American buyers are stepping in. But even with that steady demand, price action’s been underwhelming. The overall mood feels hesitant.

And then there’s profit-taking. Glassnode says folks who’ve been holding BTC for 6–12 months cashed out a hefty $904 million in profits on Monday alone. That’s 83% of all realized gains for the day. It’s a shift—longer-term holders had been leading that charge, but now it’s mid-term folks locking in wins. That doesn’t scream panic, but it does show a rotation in who’s moving the market.

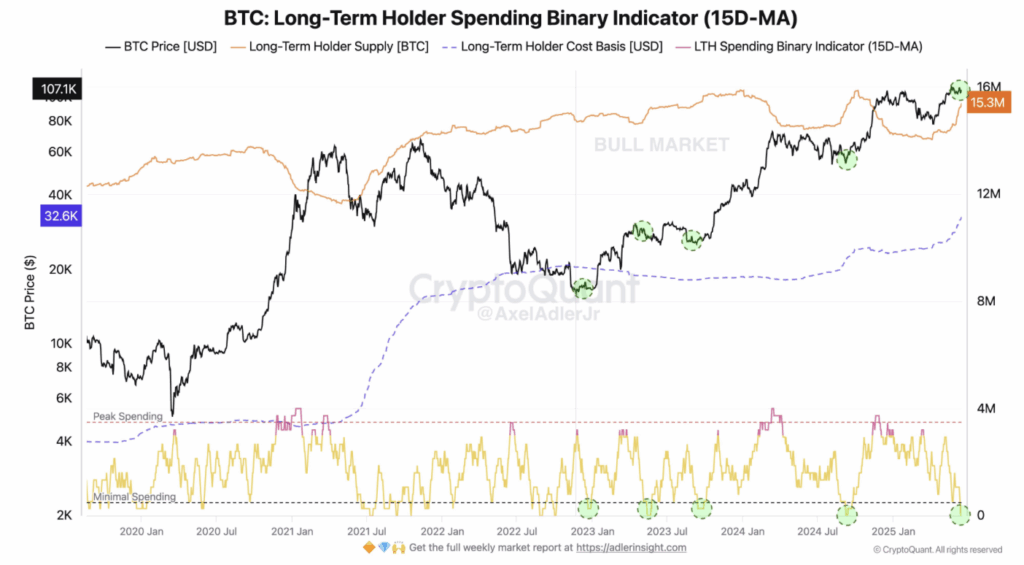

Still, long-term holders aren’t selling. Axel Adler Jr. pointed out that LTHs are just sitting tight, which—if history’s any guide—is a good sign. Their behavior usually sets the tone for the bigger picture, and right now, they’re not flinching.

A Bounce at $102K? Could Be

From a technical view, there’s a solid chance Bitcoin’s heading into a short-term bounce zone. The $102K to $104K range is dense with liquidity and aligns with a key historical order block. The Bollinger Bands are getting tight too—usually a setup for a volatility spike. The middle band, sitting around $106K, has acted like dynamic resistance before, especially during that chop zone in early June.

If BTC can reclaim $106,748 and close above it, that could kick off a move back to $112K. But if it fails and falls under $100K, we might be staring at a drop toward $98K.

According to data from Alphractal, the $98,300 zone is the magic number. That’s where short-term holders still hold profits. If Bitcoin dips hard below that level, the market tone could shift from cautiously bullish to fully defensive. As Alphractal put it, “As long as Bitcoin stays above the STH Realized Price, we can still consider the market bullish. But losing $98K hard? That’s where things could get messy.”