- Bitcoin surged to $95,490 as markets await Trump’s 100-day speech, with investors pulling over $4 billion in BTC off exchanges in the past week, signaling strong bullish sentiment.

- Trump’s policies, including a potential Bitcoin strategic reserve and renewed tariff threats, are creating both opportunities and risks, with Bitcoin benefiting from growing safe-haven demand as stocks face pressure.

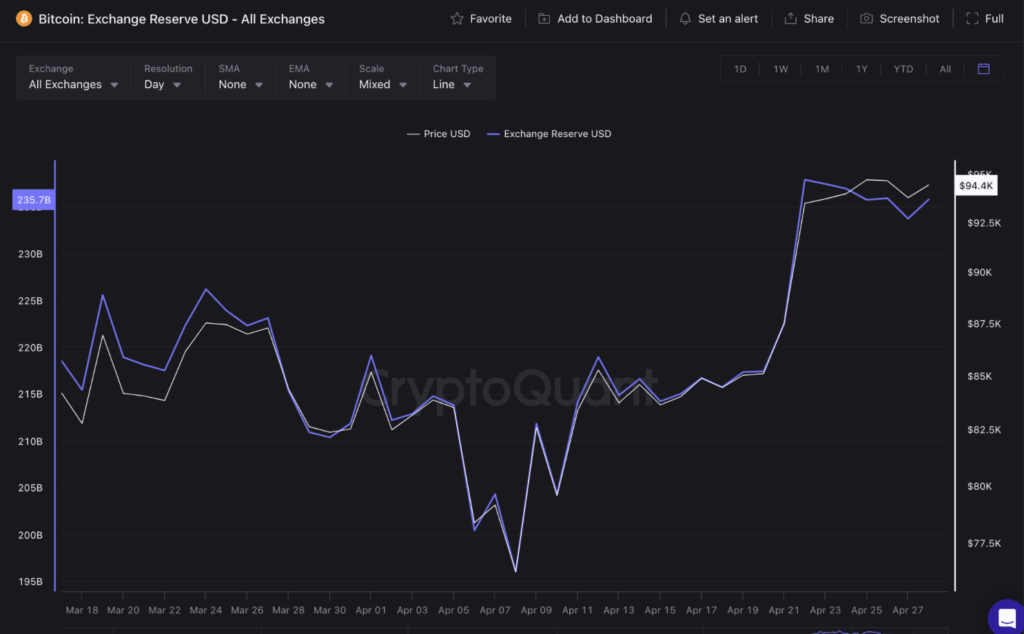

- On-chain data shows a sharp decline in Bitcoin exchange reserves, strengthening the case for a potential breakout toward $100,000 if market momentum and supply squeeze continue.

Bitcoin (BTC) made a strong move Monday, bouncing back up to $95,490 just as the market gears up for Trump’s 100-day address.

With crypto-specific policy announcements looming, investors are starting to position themselves — and the on-chain data is starting to tell a story.

Bitcoin Climbs Past $95K — What’s Driving It?

Bitcoin posted a 0.8% gain over the last 24 hours, touching $95,490.92, according to CoinGecko. During Monday’s session, BTC bounced between $92,953 and $95,490, keeping its recent momentum alive.

Weekly numbers are still looking solid too, with Bitcoin up 8.9% compared to last Monday, and roughly 15% higherover the last 30 days.

Crypto markets are holding their breath, waiting to hear if Trump will finally provide clarity on the rumored Bitcoin strategic reserve proposal.

Meanwhile, over $4 billion in Bitcoin has been pulled off exchanges just in the past week — right after Trump’s controversial push for interest rate cuts. Investors are clearly moving their coins to cold storage, usually a bullish signal for price.

Trump’s 100 Days: So Far, So Crypto

Bitcoin’s rally isn’t happening in a vacuum — it’s mirroring moves in U.S. equities, especially big tech stocks, as markets anticipate what Trump’s speech could bring.

If Trump officially endorses a Bitcoin reserve, analysts say it could spark a parabolic surge toward $100,000.

On the flip side, if the focus swings too hard toward tariffs or harsh budget cuts, that could spook broader markets and cap Bitcoin’s short-term upside.

Inflation has been trending down too, sliding from 9.1% in 2022 to 2.4% in March 2025, according to TradingEconomics. Trump’s been quick to take credit for that, but economists warn that his pro-tariff policies could easily reignite inflation pressures.

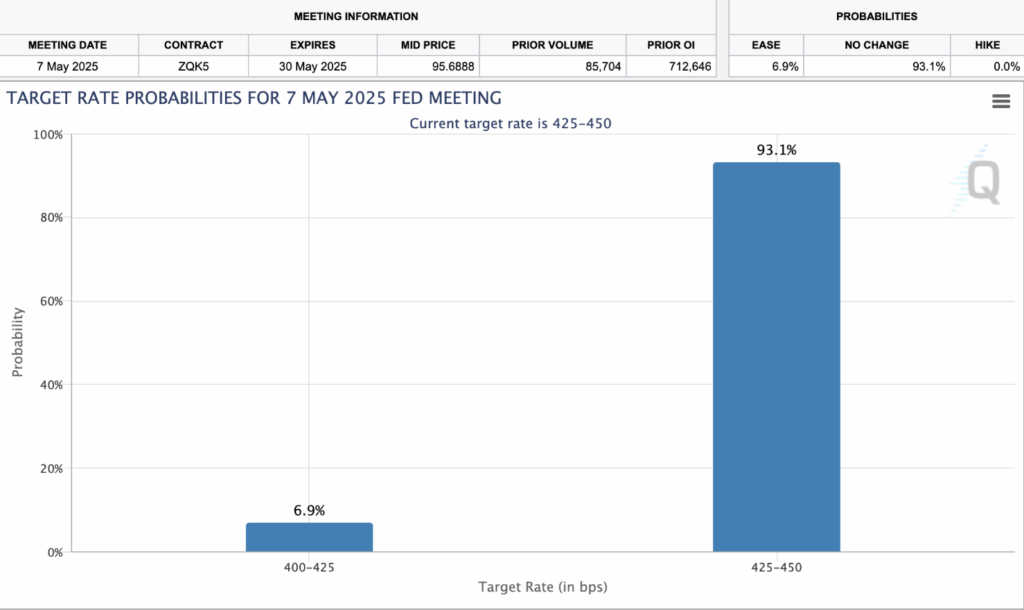

Fed Rate Cut? Not So Fast

Even with Trump pushing hard for a rate cut — and even threatening to replace Fed Chair Jerome Powell — the CME FedWatch Tool shows a 90.1% chance the Fed holds rates steady at the upcoming May 7 meeting.

In short: the market’s hearing Trump’s demands but not quite buying it yet.

Tariff Talk Weighs on Stocks, Boosts Bitcoin

Trump’s constant tariff chatter has been hammering U.S. stocks — especially big tech, often called the “Magnificent 7.”

All that uncertainty seems to be benefiting Bitcoin, which is increasingly being seen as a safe-haven asset, kinda like digital gold.

For perspective, Bitcoin is up 5.6% year-to-date, while the Nasdaq, S&P 500, and Dow Jones are all down 5% over the same period.

Investors fleeing from shaky TradFi markets are starting to find comfort in Bitcoin’s relative strength.

Looking Ahead: Is $100K Within Reach?

Geopolitical tensions and market jitters during Trump’s first 100 days have given Bitcoin a nice tailwind.

BTC’s ability to hold firm above $90,000 — despite all the noise — is a big deal. It signals resilience and keeps hopes alive for a breakout toward $100K.

On-chain data from CryptoQuant shows it too:

- Bitcoin exchange reserves have dropped by over $4 billion since April 22.

- Deposits fell from $237.8 billion to $233.8 billion in just one week.

That’s a major supply squeeze happening under the surface.

If demand stays hot and available supply keeps shrinking, Bitcoin’s breakout toward six-figure territory could happen sooner than a lot of people expect.