- Bitcoin briefly overtook Alphabet in market value, hitting $1.87 trillion before slipping back.

- A surge in U.S. Bitcoin ETF inflows and trade optimism helped fuel BTC’s rally past $94,000.

- Despite its growth, Bitcoin still trails far behind giants like global real estate and gold in total value.

For a short—yet symbolic—moment, Bitcoin slid into the number five spot among the world’s most valuable assets, overtaking Google’s parent company, Alphabet. Yep, it actually happened… if only for a little while.

According to the folks over at CompaniesMarketCap, Bitcoin’s total market value touched around $1.87 trillion, slightly nudging past Alphabet’s $1.859 trillion mark. It didn’t last long, but it made waves in crypto circles regardless.

Naturally, analysts and traders were quick to chime in, calling it another milestone that shows just how far Bitcoin’s come. Andre Dragosch from Bitwise Europe dropped a quote that kinda sums it up:

“It’s becoming harder and harder for asset managers to ignore BTC.”

Hard to argue there. Even though Alphabet has since snatched its spot back and Bitcoin’s cap cooled to $1.856 trillion, the flip turned heads—and that alone says a lot.

BTC Still Outpaces Big Names Like Amazon and Meta

Even with the minor dip, Bitcoin’s still sitting ahead of heavy hitters like silver, Amazon, Meta, and Saudi Aramco. Of course, it’s got a long road before catching up to the real giants. For context: global real estate? Valued at about $635 trillion. Gold? Around $23 trillion. So yeah, Bitcoin’s still the rookie in the room compared to the big leagues.

What’s Fueling the Fire?

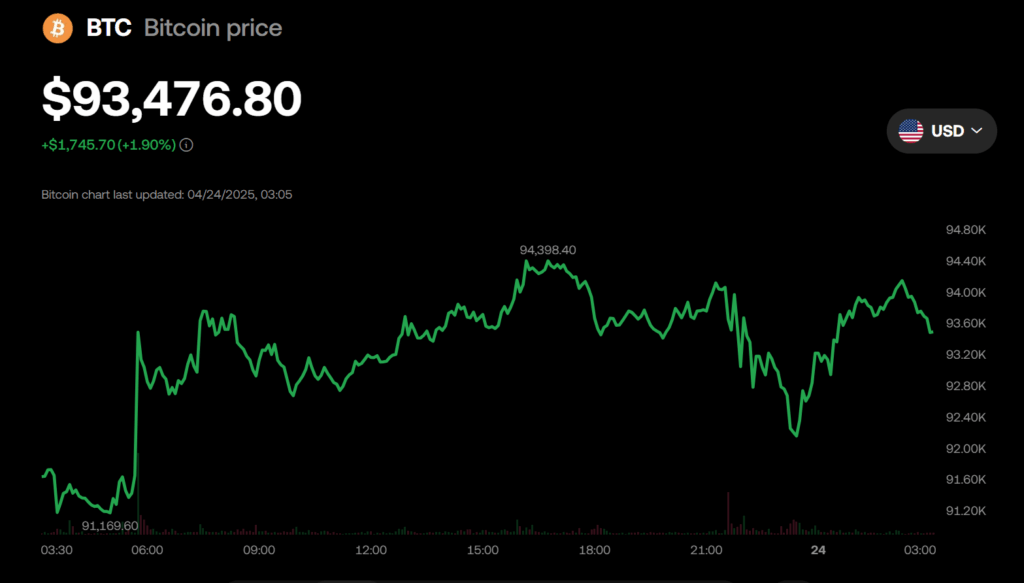

This recent surge didn’t come outta nowhere. BTC blasted past $94,000 after what was honestly a pretty quiet stretch. But then macro factors kicked in—namely, some political shifts and a fresh wave of investor optimism.

One big spark? A statement from U.S. Treasury Secretary Bessent on April 22 hinting at easing tensions with China. That kind of news tends to light up the risk asset crowd, and crypto is no exception.

To top it off, U.S. Bitcoin spot ETFs logged a mind-blowing $912.7 million in inflows—yep, in a single day. That’s the highest daily haul since President Trump made his way back into the White House. Clearly, institutions are paying attention again.

Bloomberg Intelligence also dropped a note that Bitcoin’s calmer price swings (especially after that tariff drama on April 2) might push more companies to stash some BTC on their balance sheets. Seems like we’re inching closer to that “Bitcoin-as-corporate-reserve” reality.