- Bitcoin transactions hit a low not seen since Oct 2023, with only 256,000 confirmed on June 1, despite BTC trading near its all-time high.

- Low-fee transactions are sneaking in, including a 0.1 sat/vB transfer by Mempool founder Mononaut, mined via MARA’s Slipstream pipeline.

- Debate erupts over Bitcoin’s direction, as 31 Core developers defend low-fee, non-standard transactions for decentralization, while critics like Samson Mow warn it opens the door to spam.

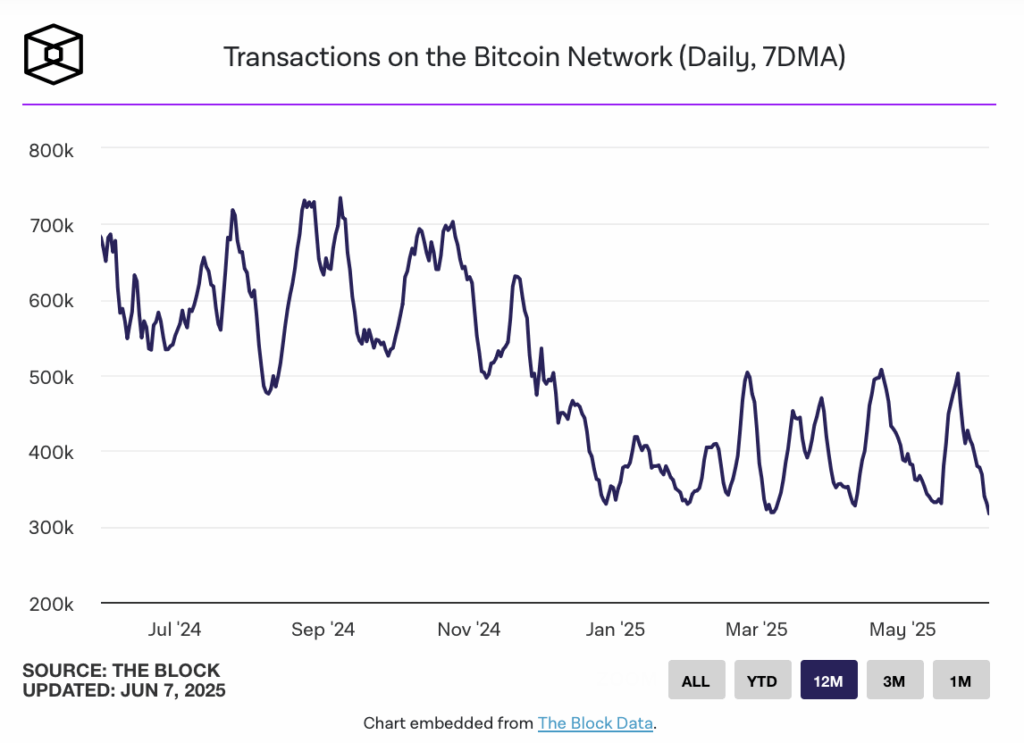

It’s a bit of a strange scene over on the Bitcoin blockchain lately. Despite BTC hovering near its all-time high, activity on the network has cooled off quite a bit—actually, it’s dropped to levels not seen since way back in October 2023. Yeah, kind of odd, right?

According to data from The Block, the seven-day average for Bitcoin transactions slid down to roughly 317,000 by Friday. That’s the lowest it’s been since October last year, when things dipped even further to around 269,000. And on June 1st? Only 256,000 transactions made it into blocks, per YChart data. Not exactly what you’d expect with prices flirting with peak territory.

Now here’s where it gets interesting. Amid all that slowdown, some very low-fee transactions are managing to sneak their way into blocks. One example? A transaction from Mempool founder Mononaut was mined at just 0.1 sat/vB. He even joked about it on X, calling it a “bespoke handcrafted artisanal transaction,” which—let’s be honest—sounds more like a hipster coffee than a Bitcoin transfer. It only cost 11 sats, about a penny, and just… sat in the mempool for a month until it found a home.

A Debate Over Fees and Freedom

With activity drying up, miners have started eyeing transactions that fall below the usual 1 sat/vB relay floor set by Bitcoin Core. Mononaut’s transaction, for instance, was mined by MARA (formerly Marathon Digital), who runs a low-fee transaction route called Slipstream that’s geared for this sort of thing.

But not everyone’s cheering.

On June 6, a group of 31 Bitcoin Core devs published an open letter basically saying: “Hey, let people send weird or low-fee transactions. That’s Bitcoin doing its thing.” They argued that filtering out “non-standard” stuff undercuts Bitcoin’s whole censorship-resistant design—even if the content isn’t financial or universally approved.

Their stance was clear: censoring data—even silly or spammy stuff—goes against Bitcoin’s core ideals. But, of course, not everyone agrees.

Community Split on Direction

Some big names in the Bitcoin world weren’t exactly thrilled. Jan3 founder Samson Mow, for one, clapped back on X, accusing devs of quietly opening the door to spam and now trying to justify it with a shoulder shrug. “Too bad,” isn’t exactly flying with everyone.

All of this underscores a bigger tension in the Bitcoin world right now—between those who want to keep things pure and streamlined, and others who say the network’s very strength lies in letting people do what they want with it. For better or worse.

With activity slowing and debates heating up, the next few weeks could help shape how Bitcoin handles low-fee transactions—and whether it leans more toward open playground or tight fortress.