- 88% of Bitcoin holders are in profit, signaling strong investor confidence, with minimal selling pressure despite recent gains.

- Exchange outflows and a steady MVRV ratio show accumulation is ongoing—buyers are stepping in while sellers sit back.

- Volatility is low, and historical patterns suggest BTC could be gearing up for a breakout above $96K if momentum holds.

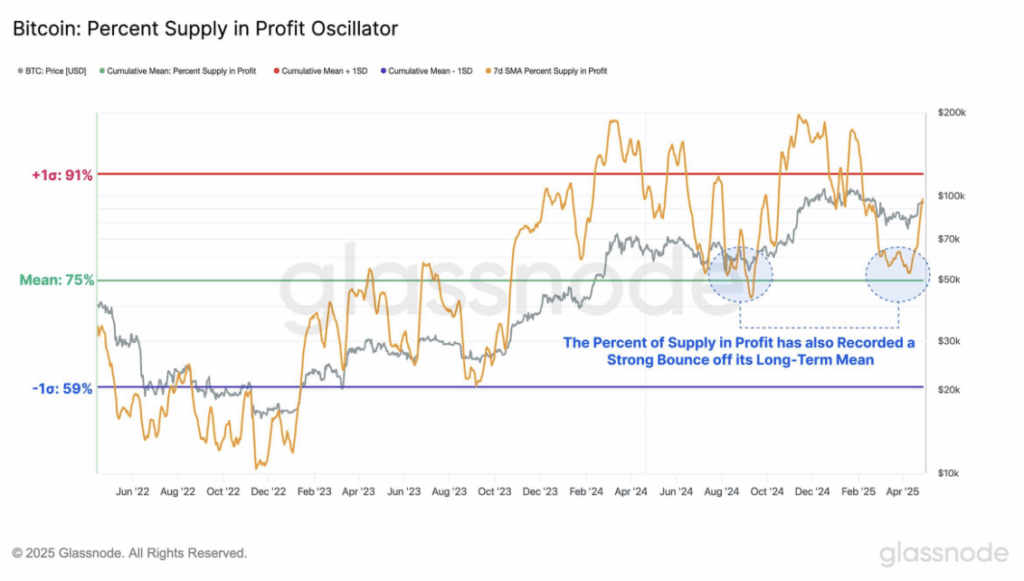

Bitcoin’s been on a quiet tear lately. Over the past two weeks, the big orange coin climbed from a local bottom around $83K to brushing up near $97K. Not a small move. That push has now left a huge chunk of BTC holders sitting on green bags. According to Glassnode, about 88% of the circulating supply was in profit as of press time. Yeah—almost 9 out of 10 coins are in the black.

That means anyone who bought in below $94K is feelin’ pretty good right now. But of course, that also puts the pressure on folks who grabbed BTC somewhere in the $95K–$100K zone—they’re the ones now holding bags that are just… barely red.

Panic Selling Slows as Confidence Builds

With most holders in profit, panic selling has cooled off. Glassnode’s data shows Bitcoin bouncing from its long-term mean profitability level of around 75%, which usually signals the end of major capitulation phases. Basically: people aren’t dumping like they were. There’s less fear. More chill. That’s usually a pretty solid sign for market health.

Back in late 2023 and early 2024, BTC bounced in a similar way from its $60K range. What happened next? A surge. And now we’re seeing something kinda similar with this $76K–$95K stretch, which could be setting up the next leg higher.

MVRV Ratio and Exchange Flows Say “HODL”

Another signal that’s flashing green: Bitcoin’s MVRV ratio just dropped back to its long-term average around 1.74. That might not sound exciting, but historically, this level tends to show a pause—a cooling off of wild profit margins. Which is not a bad thing. It often leads into a consolidation phase before prices run again.

At the same time, folks aren’t rushing to cash out. Bitcoin’s exchange netflows have been negative on most days lately. That means more BTC is being pulled off exchanges than sent in—classic “I’m holding this for a while” behavior. Even with BTC trading near $93K (which is a realized profit point for many), sellers aren’t showing up in droves. Instead? Buyers seem to be stepping in.

Volatility Drops: Calm Before the Breakout?

Now, let’s talk volatility—or lack of it. Bitcoin’s Average True Range (ATR) has dipped to just $2.4K. That’s pretty low. Lower volatility usually means the market is coiling… getting ready for something. Last time ATR hit levels this low was back in November 2024. Shortly after that, BTC rocketed to $108K.

So yeah, this current tight price action could be the calm before another push higher. If the market keeps absorbing profits and people stay patient, a breakout could be on deck. Maybe even above $96K, with an eye toward $98K next.

But hey, not every story ends in fireworks. If consolidation drags on too long, some holders might get antsy and start selling, which could drag BTC down to around $92,900.