- Bitcoin surged past $97K after breaking out of a tight range and showing strong bullish signals.

- Key support sits around $88K–$90K, with $92K seen as a possible re-entry zone for traders.

- ETF inflows, institutional buys, and weak U.S. economic data are fueling Bitcoin’s upward momentum.

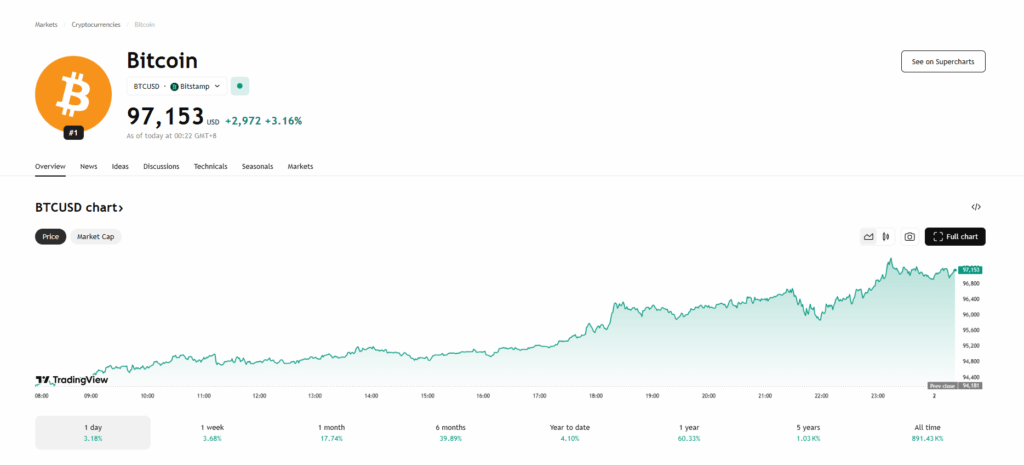

Bitcoin just ripped past $97,000 on Wednesday, peaking at $97,546 before cooling off a bit. After a few days stuck bouncing between $93K and $96K, traders finally pushed through that ceiling — and yeah, it’s looking bullish.

According to fresh data from crypto.news, total market cap touched $1.90 trillion, with 24-hour volume clocking in at just under $30 billion. Not bad for a market that looked pretty sleepy just a week ago.

From $74K to $97K — This Run’s Been Building for a While

This rally didn’t come out of nowhere. Back in mid-April, Bitcoin broke free from a long consolidation phase near $74,400 — and it’s been grinding upward ever since. Technicals are leaning bullish, with solid support hanging around the $88K to $90K zone.

If BTC dips back to around $92K, that might be a juicy re-entry spot for long traders… assuming volume holds up. But if it falls under $88K? That’s where things get dicey — could signal a broader correction ahead.

Why the Push Now? A Mix of Charts, ETFs & Macro Jitters

So what’s driving this move? A bit of everything.

- First, BTC dodged a death cross last month and printed some bullish patterns — double bottom, bullish flag breakout — that gave traders a reason to go long.

- Then there’s the $2.9 billion flowing into spot Bitcoin ETFs last month. Big names like Tether, SoftBank, and even Trump Media are tossing Bitcoin into their treasuries now.

- Add in some not-so-great U.S. economic news — weak jobs, falling consumer confidence — and boom, the Fed might cut rates sooner than expected.

- Oh, and let’s not forget Trump. Hints at a shift in his trade stance gave Bitcoin bulls another reason to lean in.

All in all, the mood’s upbeat — for now. But as always in crypto, it doesn’t take much for sentiment to flip. Keep an eye on those support levels… and maybe don’t FOMO at the top.