- Institutional Inflows Growing Fast: Bitwise forecasts up to $420 billion in Bitcoin inflows by 2026 from ETFs, public companies, states, and sovereign wealth funds—following a record $36.2B in 2024 alone.

- Major Players Still Warming Up: Despite strong demand, $35B remains sidelined due to compliance barriers from firms like Morgan Stanley and Goldman Sachs. That could unlock as ETFs gain trust.

- Bullish Allocation Scenarios: In a best-case setup, nation-states, companies, and wealth platforms could absorb over 4.2 million BTC, driven by inflation fears and Bitcoin’s growing status as digital gold.

Bitcoin’s sitting comfy above $108K, but that might just be the beginning. According to Bitwise, a major crypto asset manager, demand from institutional giants—like public companies, ETFs, sovereign wealth funds, and even entire countries—could bring massive inflows in the next couple of years. Think $120 billion by the end of 2025 and possibly $300 billion more in 2026. Yeah, it’s a big deal.

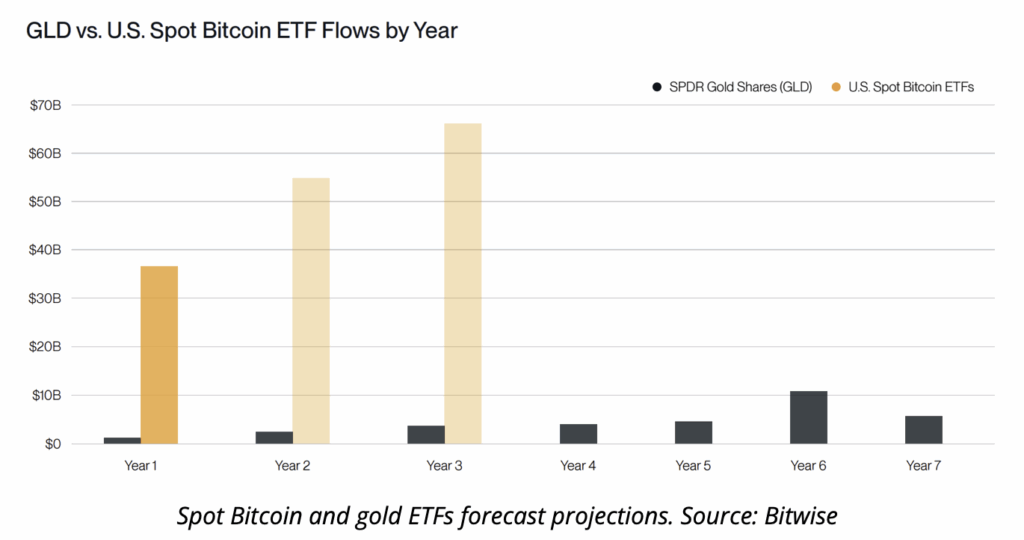

Bitwise’s report, cheekily titled “Forecasting Institutional Flows to Bitcoin in 2025/2026”, breaks it all down. Turns out Bitcoin ETFs brought in $36.2B in 2024 alone—smashing past early gold ETF records. In fact, BTC ETFs hit $125B in AUM faster than gold’s SPDR ever dreamed of. If that momentum keeps up, we could be looking at $100B/year inflows by 2027.

What’s Holding Some Back? Compliance.

Despite all this, around $35B worth of demand sat on the sidelines last year. Why? Firms like Morgan Stanley and Goldman Sachs—who manage a casual $60 trillion in assets—still need longer track records before they dive in. But as BTC ETFs mature and prove themselves, that capital may finally get off the bench.

Fidelity’s Jurrien Timmer sees BTC above $100K as a big “aha” moment, hinting it’s inching closer to replacing gold as the go-to store of value. He also pointed out Bitcoin’s Sharpe ratio is starting to look a lot like gold’s—meaning risk-adjusted returns are becoming neck and neck.

How Much BTC Could Institutions Really Buy?

Bitwise’s team laid out three possible scenarios—bearish, neutral, and bullish—for where institutional allocations might land.

- Bear Case: Even if nation-states only move 1% of their gold holdings into BTC, that’s still $32.3B flowing in. Add some US state treasuries buying BTC, wealth platforms dipping their toes, and companies stacking more coins, and the total hits around $150B.

- Base Case: A 5% gold-to-BTC shift by countries could pull in $161.7B, and that’s just the beginning. Add public companies, states, and wealth managers allocating more aggressively, and we’re talking $420B across 2025 and 2026—lining up with Bitwise’s headline forecast.

- Bull Case: If everything goes full send, countries move 10% of their gold, state adoption jumps to 70%, and asset managers throw 1% of their books into BTC. In total? Over $426B in inflows, potentially absorbing 15% of all existing Bitcoin.

Bitcoin’s Scarcity and the Future

Here’s the kicker: 94.6% of Bitcoin’s supply has already been mined—just under 20 million coins are out there. As big money keeps piling in, Bitcoin’s scarcity becomes even more obvious. Whether it’s inflation hedging, distrust in fiat, or just following the crowd, institutions clearly aren’t done with BTC.

With momentum building across sectors and borders, and most of the supply already spoken for, the case for long-term Bitcoin value is only getting louder. If even a fraction of these forecasts come true, we might be looking at a whole new era for crypto.