- Cardano’s facing heated allegations over a $600M ADA transfer, but Charles Hoskinson denies wrongdoing and has launched an independent audit to clear the air.

- Despite the FUD, ADA’s price is holding steady with surging volume, and analysts see a bullish setup forming if the Chang upgrade rolls out clean.

- Cardano isn’t retreating—it’s doubling down with transparency, big governance updates, and a long-term vision that’s still very much intact.

Cardano’s back in the spotlight again, but this time, not for a tech upgrade or new partnership. Nope—it’s for all the wrong reasons. A wave of FUD (fear, uncertainty, doubt) has been sweeping through the community lately, and it’s aimed directly at Charles Hoskinson, the man who’s been the face of Cardano since the beginning. From Reddit threads to Twitter storms, it’s been nonstop drama—accusations of financial misconduct, centralization concerns, and internal tension bubbling to the surface.

So, what’s really going on here? Is this legit concern, or just another overhyped hit piece from bored speculators? Well, like most things in crypto, it’s a bit messy and way more nuanced than a 240-character tweet can explain. That’s what we’re here for. Because when it comes to crypto narratives, they can be powerful—but they can also be weaponized. And if you’re holding ADA or even just watching from the sidelines, it’s worth understanding what’s fact, what’s rumor, and what might actually matter in the long run.

The biggest claim floating around? That Charles allegedly redirected over $600 million worth of ADA during a past hard fork. Sounds crazy, right? But that’s the headline that’s got people worked up. Let’s get into what’s actually being said—and more importantly, what’s being done about it.

Understanding the Allegations — The $600M ADA Controversy Explained

Alright, here’s the meat of the drama. The controversy kicked off with allegations that during the 2021 Allegra hard fork, Charles Hoskinson used something called a “genesis key” to manipulate the Cardano ledger. The claim? That he quietly rerouted 318 million ADA—about $600 million at the time—from unclaimed pre-sale wallets into Cardano’s reserves. The person behind the accusation is an NFT artist named Masato Alexander, and the story caught fire fast.

Now, before jumping to conclusions, here’s Hoskinson’s side. He flat-out denied the whole thing. According to him, most of the ADA from the original 2017 sale was already claimed by investors over a seven-year period. The leftover tokens? He says they were donated to Intersect, a governance group working on decentralization for Cardano. Nothing shady, no personal gain—just cleaning up the unclaimed leftovers and giving them back to the community ecosystem.

Still, as these things go, a denial isn’t always enough to calm the mob. So Hoskinson took it a step further: he announced a full-blown independent audit. The idea is to dig through every bit of ADA movement around the Allegra hard fork, put everything on-chain, and settle the debate with facts—not just tweets.

Regardless of how it plays out, this whole situation highlights something big—trust and transparency still matter. In crypto, especially in projects that preach decentralization, clarity is currency. And right now, that’s exactly what this audit aims to provide.

Charles Hoskinson’s Response and the Path Forward

Now, instead of ducking the controversy or tossing out vague PR statements, Charles Hoskinson went all in. He didn’t just say “it’s fake news.” He publicly committed to a deep, transparent audit of Input Output Global (IOG)—the company behind Cardano—and the entire token movement that’s under scrutiny. And he didn’t hire some no-name firm to do it. The audit is being conducted by major players like BDO International, McDermott Will & Emery, and a blockchain analytics group to verify everything on-chain.

This is more than just PR cleanup. It’s Charles standing up and saying, “Here’s everything—take a look.” That kind of move isn’t cheap, fast, or easy. But it’s necessary if Cardano wants to squash the doubt and move forward. Transparency here isn’t just a buzzword—it’s a strategy.

Charles also got personal. In his response, he said he was “deeply hurt” by the way the community reacted—especially how quickly people turned on him. That hit home for a lot of long-time ADA holders who’ve stuck with Cardano through thick and thin. Whether you love or hate the guy, Hoskinson has been a consistent voice in crypto, and this kind of public scrutiny shows just how high the stakes are.

Now the countdown begins. Once the audit results come in, it’s either vindication—or fallout. But the way Charles and IOG are handling it? That’s what long-term investors want to see. Not retreat. Not silence. But action, transparency, and accountability. And that might just turn this FUD storm into a proving moment for Cardano’s leadership.

ADA Holds Strong Amid FUD—What the Market Is Really Saying

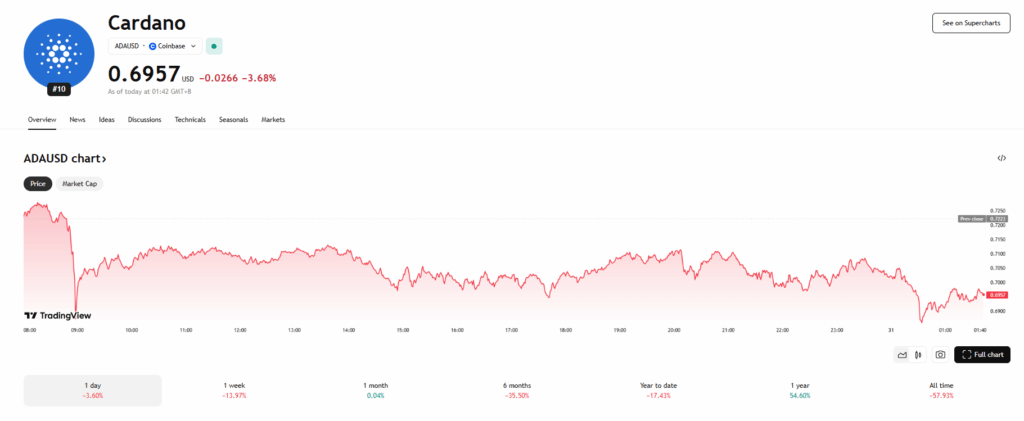

Now, here’s where things get a little weird—in a good way. Despite all the noise, the price of ADA hasn’t exactly tanked. In fact, it’s been pretty solid. As of mid-May 2025, ADA is hovering between $0.82 and $0.86, with strong support around $0.77. That’s not just holding the line—it’s pushing back against the narrative that Cardano is “collapsing” under pressure.

Even more interesting? Trading volume spiked big—up more than 50%, pushing toward $900 million in daily volume. That means more people are buying, selling, and—most importantly—watching ADA right now. When markets move on fear, prices usually nosedive. But when they hold steady or rise? That’s a sign people see through the smoke.

Analysts are already projecting bullish targets. One forecast sees ADA hitting $1.79 by year’s end, especially if the Chang hard fork rolls out smoothly. That upgrade’s a big one—it enhances Cardano’s governance, gives the community more say, and tightens the chain’s decentralization model. If it lands as expected, we could see a big shift in sentiment.

So while the Twitter noise says “Cardano’s in trouble,” the chart says something else. And in crypto? Price often tells the real story.

Don’t Fall for the FUD: Cardano’s Still Building

FUD is just part of crypto—always has been. And every major chain has faced its own version. Ethereum had its DAO hack. Solana’s been roasted for outages. Bitcoin’s been banned more times than we can count. Cardano? It’s just the latest in the spotlight. But what separates the winners from the rest is how they respond when the pressure’s on.

Right now, Cardano isn’t running—it’s leaning in. The audit is happening. The team’s still shipping. And the market? It’s holding firm. So if you’re panicking, maybe take a step back. Look at the facts. This isn’t the end—it might just be a turning point.

The truth is, strong projects don’t fold during controversy—they evolve. And with big upgrades, new governance tools, and growing institutional attention, Cardano’s still playing the long game. This drama? It’ll pass. But what’s being built? That’s what really matters.