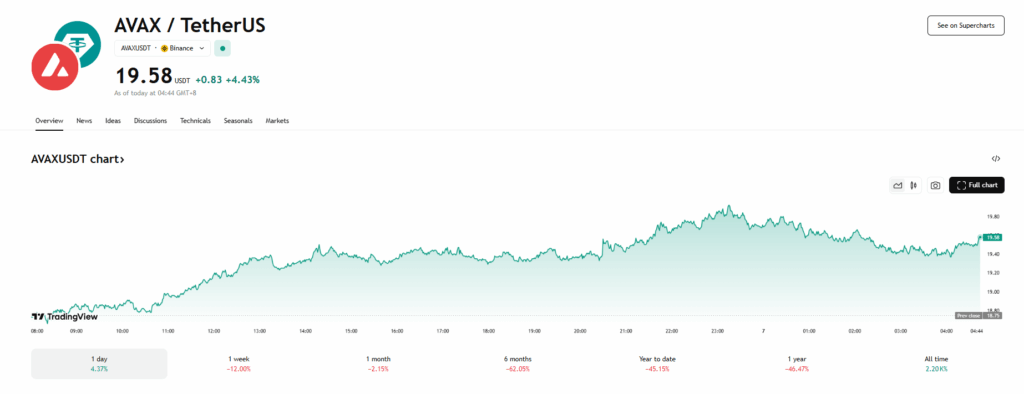

- AVAX rebounded 6% to $19.65 after dropping to $18.48, regaining over half of its losses during market turmoil.

- The token formed an ascending channel with resistance at $19.76 and consistent higher lows, signaling growing bullish momentum.

- Strong volume spikes and technical support zones suggest AVAX could soon retest the key $20 psychological level.

Avalanche’s AVAX token has bounced back after being swept up in the broader crypto sell-off triggered by the explosive feud between President Donald Trump and Tesla CEO Elon Musk. Following a steep drop to $18.48, AVAX rallied back to $19.65 by Friday night, reclaiming nearly 58% of its losses. Despite the chaotic backdrop, traders have shown clear accumulation behavior, helping the token form an ascending channel — a classic bullish setup.

Market Sentiment Recovers Despite Political Fallout

The crypto market took a hit after Musk accused Trump of appearing in the Epstein files and backed calls for his impeachment. But amid the sell-off, AVAX has shown resilience. The token has regained traction with a local high of $19.76 and consistent higher lows over the past 14 hours — signaling growing bullish sentiment. Meanwhile, the CoinDesk 20 Index slipped 0.85%, underscoring the wider volatility still lingering in the market.

Technical Indicators Signal Bullish Continuation

Analysts observed that AVAX saw a significant 8.14% dip before reversing course with strong support emerging between $18.48 and $18.88. Volume spikes, particularly at critical price levels, helped validate the reversal. The formation of an ascending channel points to a positive momentum shift, with $19.76 acting as resistance and $20 potentially within reach if the trend holds.

Where AVAX Could Go Next

AVAX’s current support sits firmly in the $19.53–$19.55 range, and recent hourly price action — including a 1% gain — supports the case for further upward movement. If bullish momentum continues, AVAX could test the psychological barrier at $20, with stronger market confidence helping extend the rally. However, a breakdown below $19.50 could trigger a retest of the $18.88 support.