- AVAX is consolidating near key support after a long decline from its 2021 all-time high, with a descending triangle forming — often a bullish breakout setup.

- Avalanche stands out for its fast, scalable tech, with a tri-chain architecture, low fees, 4,500+ TPS, and unique features like Subnets and AWS partnership.

- While short-term momentum is quiet, whale bags are packed and the next move may be triggered by broader market recovery or fresh DeFi momentum.

Avalanche — yep, AVAX — is still one of the heavyweights in the crypto space, sitting just shy of an $8 billion market cap. At the time of writing, it’s trading around $18.95, and folks are starting to wonder: is this just another quiet phase, or is AVAX winding up for a serious move?

Let’s take a step back and look at what’s actually going on with Avalanche — where it came from, how it stacks up against the competition, and where the price could be headed next.

How AVAX Got Here: From Whitepaper to DeFi Boom

The whole Avalanche thing started with a twist. Back in 2018, a mysterious group called Team Rocket dropped a whitepaper — not quite Bitcoin-level mysterious, but still kinda cool. Later, Cornell professor Emin Gün Sirer revealed that he and his team — including Kevin Sekniqi and Maofan “Ted” Yin — were behind it.

Fast forward to 2019, Ava Labs was born. A year later, the Denali testnet rolled out, giving devs a taste of what the network could do. Then came the mainnet in late 2020, and AVAX officially hit the stage. Trading, staking, dApps — the works.

But the real boost came in 2021, when Ava Labs launched Avalanche Rush — a $180M liquidity mining incentive program that pulled in DeFi giants like Aave and Curve. That was a big moment. It brought major visibility to DeFi, which had mostly been flying under the radar for retail investors. Suddenly, Avalanche wasn’t just another L1 — it was the place for fresh money, new projects, and serious buzz.

Subnets, AWS, and Architecture That Just Hits Different

Things didn’t stop there. Avalanche rolled out Subnets, letting devs basically build their own mini blockchains inside the ecosystem. Then in 2023, it scored a partnership with Amazon Web Services — a move that helped push crypto even further into mainstream tech.

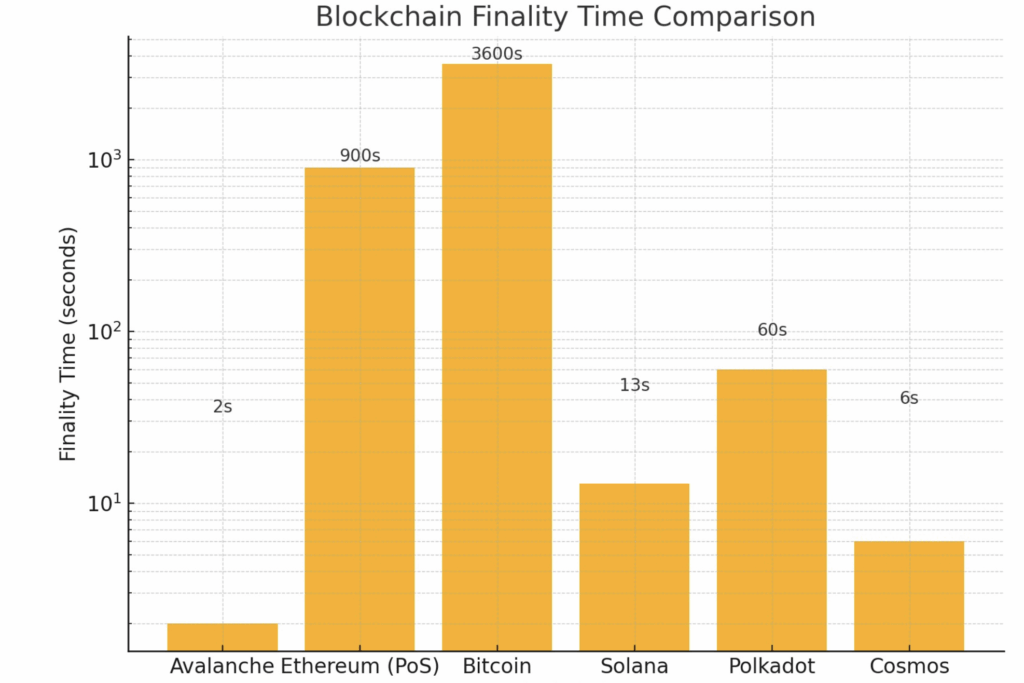

But let’s talk tech for a sec. Avalanche’s consensus design is one of the fastest and cleanest in the game — using a probabilistic, gossip-based system that lets it hit near-instant finality (think 1–2 seconds). Oh, and 4,500+ TPS, compared to Ethereum’s 30? Not even close.

AVAX uses a tri-chain setup:

- X-Chain for speedy asset transfers,

- C-Chain (which is EVM-compatible) for running dApps,

- and P-Chain for validators, staking, and those shiny subnets.

That whole design helps keep fees low — like, a fraction of a cent — and lets it scale like crazy. Basically, it’s built for big things.

AVAX Price Outlook — Setting Up for a Breakout?

Let’s talk numbers. AVAX hit its all-time high at $146 back in the hype-fueled DeFi run of late 2021. But yeah… we all know what came next. The 2022 bear market dragged it all the way down to around $18–$20.

After consolidating for what felt like forever, AVAX slowly climbed again — almost tripling off the lows. And right now, it’s resting at a major support zone on the weekly chart. Technically, it’s forming a descending triangle — and historically, those tend to break upward when pressure builds enough.

The next big resistance? Somewhere around $60. The RSI-14 also looks like it bottomed out, which supports the idea that AVAX might be prepping for a solid pump.

On shorter timeframes, not much has changed — we’re just waiting on a catalyst. Whether that’s market recovery, a new DeFi wave, or macro factors stabilizing… who knows. But when it happens, the bags will be packed — and early movers might just get the front-row seats.

Final Thoughts

Avalanche isn’t just chasing hype. It’s got the tech, the team, and the track record. From solving scalability issues to building one of the fastest ecosystems out there, AVAX still has a serious shot at climbing back into the top tier.

Until then? It’s consolidation mode — and maybe, just maybe, something big is around the corner.