- AVAX is showing strong bullish signs, forming a double bottom near $18 with key resistance at $22—breaking it could send the price toward the $30 target.

- Technical indicators support a rally, with RSI bouncing from oversold levels and MACD flipping bullish, signaling momentum is building.

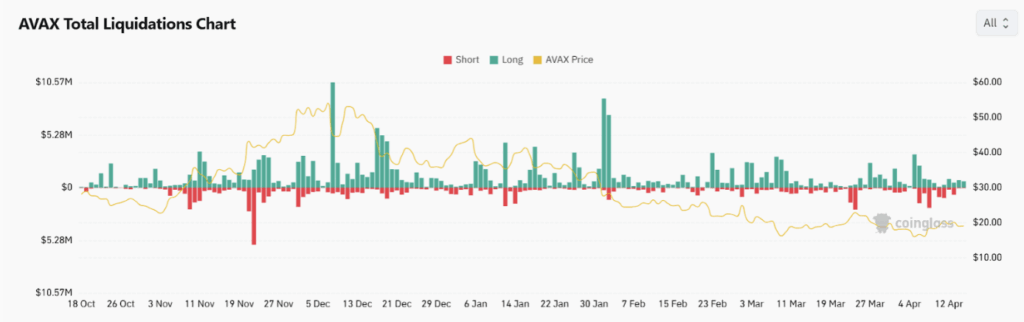

- Market sentiment and volume suggest volatility, as short liquidations rise and analysts eye targets between $30 and $40 if AVAX holds above support and breaks resistance.

Avalanche (AVAX) is starting to look spicy again. After weeks of choppy sideways movement and bearish vibes, it seems like the bulls might finally be waking up. On the daily chart, AVAX just printed a double bottom — a classic pattern that usually hints at a trend reversal. If this plays out like it’s supposed to, we could be looking at a push toward the $30 mark real soon.

Double Bottom Forming: Here’s Why That Matters

Zooming in on the daily timeframe, AVAX has bounced twice from around the $18 level, forming what technical folks call a “double bottom.” Basically, it’s a pattern that says, “Hey, maybe we’ve hit the bottom.”

After those two dips, AVAX popped above the neckline at roughly $19.60 — a solid first step for the bulls. Now, all eyes are on the next hurdle: $22. Break through that, and this thing might just have legs. The full pattern targets around $30, which would be a big move from where we are right now.

Technicals Are Starting to Flash Green

Let’s talk indicators.

The RSI is sitting around 30. That’s technically in oversold territory, and usually, it means a bounce is brewing. If RSI crosses back above 50, we might start seeing stronger bullish momentum.

And then there’s the MACD — it just flipped positive, and the MACD line is now above the signal line. Another good sign. Momentum is quietly building, and it’s starting to feel like the bulls have a bit more confidence.

$17 Support Is Holding Strong

One key level that’s been working overtime lately is $17. Every time AVAX has dipped toward it, buyers have swooped in to keep things afloat. That’s no coincidence. It shows there’s serious interest around that zone.

More interestingly, price action has been forming higher lows — another bullish signal. As long as AVAX stays above $17 and pushes past $22, this could easily turn into a proper trend reversal. And from there, well, $30 might not be far off.

Liquidations Hint at Incoming Volatility

Data from Coinglass shows that short liquidations are stacking up — usually a sign that traders are getting squeezed as price climbs past resistance. That’s often how rallies begin. Once short sellers start closing positions, they buy back into the market, adding even more pressure to the upside.

There’s also a ton of liquidity hanging around the $22–$30 range. If AVAX breaks into that zone and holds, more shorts could get wiped out, pushing the price even higher. Some traders are already eyeing targets around $35 to $40 if that domino effect plays out.

Analysts Still Bullish on the Macro Picture

According to AltCryptoGems, AVAX is “squeezing” around macro support, and there’s a possible inverse head-and-shoulders forming. That’s another textbook bullish pattern. If price breaks above $22 with conviction and strong volume, the next levels to watch are $23–$25 in the short term, with $30+ as a longer-term goal.

Final Take

AVAX has been in the shadows for a bit, but things are heating up again. Technical patterns look clean, support levels are holding, and volume’s starting to tick up. If it clears $22 soon, we might be looking at the beginning of a much bigger move.

Just keep your eyes on the chart — because when Avalanche moves, it moves fast.