- Solana’s breakout run against Ethereum is fading after a key wedge pattern broke down.

- Dropping memecoin activity on Solana is weakening one of its biggest growth drivers.

- Ethereum is gaining traction with scalable layer-2s and deeper real-world infrastructure.

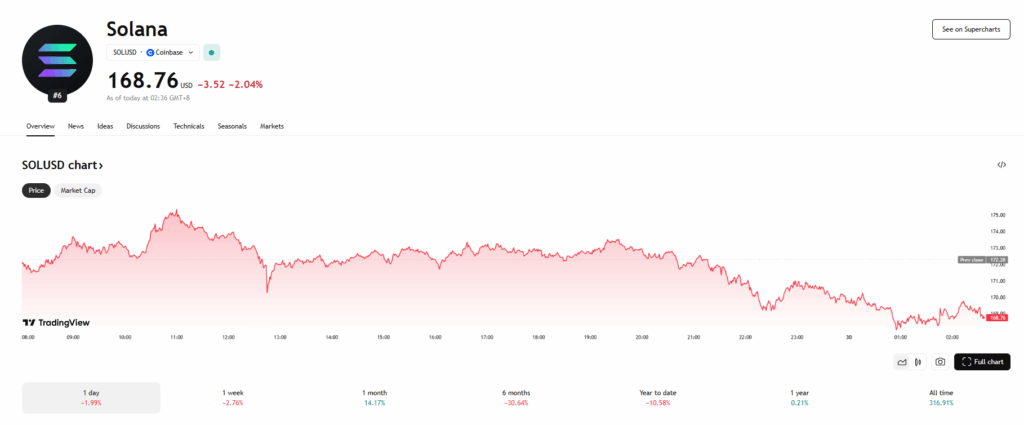

Solana’s been on a tear against Ethereum for quite a while, but that run could be cooling off fast. On the charts, the SOL/ETH pair just broke down from a rising wedge pattern—which, in trader speak, usually spells trouble. These setups tend to lead to sharp drops, and right now, that’s looking more likely than not.

As of May 29, the wedge is toast. The price slipped out the bottom, which technically means SOL could fall as much as 40% from where it’s sitting now. That puts a possible July target near 0.038 ETH. There is a bit of support floating around the 50-week EMA at 0.0628 ETH, but if SOL closes below that on the weekly… yeah, the bearish case gets louder.

Now, if SOL somehow flips and bounces back above that lower wedge line? That might buy some time. Or even cancel the whole bearish setup if it breaks out the top. But right now, things are looking more “uh-oh” than “all good.”

The Meme Hype’s Drying Up—and It Shows

Part of what had been fueling Solana’s momentum was its memecoin boom. Everyone and their cousin was using platforms like Pump.fun to drop meme tokens and rack up trading fees. But lately? That hype’s fading hard. Daily fees have cratered since early April—now sitting near year-lows, according to Dune Analytics.

Between late 2024 and early 2025, Pump.fun alone pushed Solana’s total fees above 3 million SOL. That retail-driven frenzy helped boost Solana’s value big time. But now that activity’s slumping, one of the network’s biggest growth engines is sputtering.

And it’s not just charts and fee graphs hinting at trouble. A new report from Standard Chartered dropped on May 27, warning that Solana could lag if it doesn’t break out of its memecoin bubble. Most of its current transactions still revolve around short-term hype, which might not be sustainable.

Ethereum’s Playing the Long Game

Meanwhile, Ethereum’s not sitting still. Standard Chartered points out that it’s gaining ground thanks to its expanding layer-2 ecosystem. These scaling solutions are offering low fees, serious infrastructure, and—most importantly—real-world utility that goes beyond trading memes.

So while Solana’s still fast and cheap, Ethereum’s building out its tech stack in a way that’s hard to ignore. If the memecoin craze keeps fading and Solana doesn’t pivot? That 40% drop in SOL/ETH might just be the start of something bigger.